Vietnam: Officially deploying credit package for social housing, workers' houses, renovation and rebuilding of old apartments? What is the loan interest rate?

- Who can get loans and what are the loan principles in the loan program for social housing, workers' houses, renovation and reconstruction of old apartments?

- What is the program's preferential interest rate? How long does the offer last?

- How must commercial banks periodically report to the State Bank of Vietnam on the progress of the Program implementation?

Who can get loans and what are the loan principles in the loan program for social housing, workers' houses, renovation and reconstruction of old apartments?

In Official Dispatch No. 2308/NHNN-TD in 2023, the State Bank of Vietnam sent commercial banks, SBV branches in provinces and cities to guiding a number of contents and requirements for the implementation of the loan program for social housing, worker housing, renovating and rebuilding old apartments according to the Government's Resolution No. 33/NQ-CP in 2023.

According to that, in Resolution No. 33/NQ-CP in 2023 on certain solutions to resolve difficulties and promote the real estate market to develop safely, healthily, and sustainably, the Government assigned the State Bank of Vietnam:

“Preside over the implementation of a credit program of about VND 120,000 billion to direct commercial banks, of which the main ones are 04 state-owned commercial banks (Agribank, BIDV, Vietcombank, Vietinbank) for investors and buyers of social housing projects, workers' houses, projects on renovation and rebuilding of old apartment buildings with interest rates during the preferential period 1.5-2% lower than the average medium and long-term VND lending rates of state-owned commercial banks (including Agribank, BIDV, Vietcombank, Vietinbank) in the market and eligible non-state commercial banks with specific credit packages from time to time”.

In order to perform the assigned tasks on the basis of the unified opinions and participation documents of 04 state-owned commercial banks, the SBV guides a number of contents and requests commercial banks and SBV branches in provinces and cities to urgently develop implementation of the Program.

Thus, the borrowers of the Program are mentioned in subsection 1.1, Section 1 of Official Dispatch No. 2308/NHNN-TD in 2023 as follows:

Borrowers (hereinafter referred to as customers) are legal entities and individuals investing in projects and buy houses in social housing projects, worker housing, renovation and reconstruction projects of old apartment buildings on the list of projects announced by the Ministry of Construction in accordance with regulations, including:

- Client is the Investor who invests in the project (hereinafter referred to as the Investor).

- The customer is a buyer of a house in the project (hereinafter referred to as a home buyer).

The lending principles are clearly stated in subsection 1.2, Section 1 of Official Dispatch No. 2308/NHNN-TD in 2023 as follows:

- Customers must meet the conditions to be entitled to support policies on social housing, worker housing and renovating and rebuilding old apartment buildings in accordance with the law and guiding documents of the Ministry of Construction; meet the loan conditions as prescribed by law.

- Each homebuyer is only allowed to participate in a loan as prescribed in this Program once to buy 01 apartment in a project on the list of projects announced by the Ministry of Construction according to regulations, each project of the Investor. Only participate in borrowing capital as prescribed in this Program once.

In addition, the disbursement period of the Program is until the disbursement revenue reaches VND 120,000 billion but not later than December 31, 2030.

What is the program's preferential interest rate? How long does the offer last?

About the offer period:

In subsection 1.4, Section 1 of Official Dispatch No. 2308/NHNN-TD in 2023 stipulating as follows:

- For the Investor: apply the lending interest rate for a preferential period of 3 years from the date of disbursement but not exceeding the loan term in the original loan agreement.

- For Home Buyers: the loan interest rate will be applied for a preferential period of 5 years from the date of disbursement but not exceeding the loan term in the original loan agreement.

About loan interest:

In subsection 1.5, Section 1 of Official Dispatch No. 2308/NHNN-TD in 2023, there are specific regulations on preferential interest rates when participating in loans as follows:

Loan interest rate during the preferential period:

- The lending interest rate applied until the end of June 30, 2023 for the Investor is 8.7%/year;

- The lending interest rate applied until the end of June 30, 2023 for Homebuyers is 8.2%/year;

From July 1, 2023, every 6 months, the State Bank will announce the lending interest rates during the preferential period for commercial banks participating in the Program.

In addition, the lending interest rate at the end of the preferential period: The commercial bank and the customer can agree, agree, and ensure compliance with the provisions of law and are clearly defined or specified how it is determined in the loan agreement signed between the bank and the customer.

In addition, the SBV also requested Agribank, BIDV, Vietcombank and Vietinbank to urgently implement the credit program of about VND 120,000 billion from April 1, 2023 and issue unified guidance throughout the system on the implementation of the Program.

Other commercial banks participating in the Program need to follow the instructions in this official letter and report in writing to the SBV participating in the Program, and at the same time send a written registration to exploit information about the Program to the Vietnam National Credit Information Center (CIC).

Vietnam: Officially deploying credit package for social housing, workers' houses, renovation and rebuilding of old apartments? What is the loan interest rate?

How must commercial banks periodically report to the State Bank of Vietnam on the progress of the Program implementation?

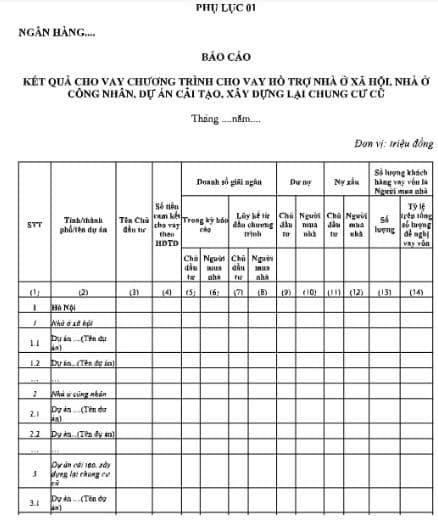

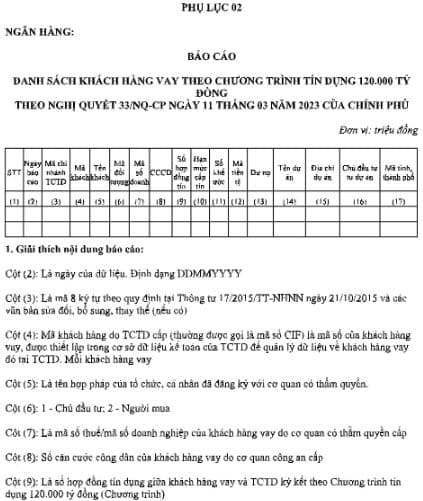

In Section 4 of Official Dispatch No. 2308/NHNN-TD in 2023, the State Bank of Vietnam requires commercial banks to periodically report to the SBV on the results of the Program implementation; promptly report to the State Bank of difficulties and problems arising in the lending process under this Program according to Appendix 01; and periodically report to the Vietnam National Credit Information Center according to Appendix 02.

Specifically:

(1) Appendix 01 issued together with Official Dispatch No. 2308/NHNN-TD in 2023 stipulating the form of report on loan results for loan programs to support social housing, worker housing, renovation and construction projects rebuild the old apartment as follows:

See details of the sample report on loan results for the loan program to support social housing, worker housing, renovation and reconstruction projects of old apartments: Click here

- Reporting time: No later than the 10th of the following month.

(2) Appendix 02 issued together with Official Dispatch No. 2308/NHNN-TD in 2023 stipulates the sample list of borrowers under the credit program of VND 120,000 billion under Resolution No. 33/NQ-CP in 2023 as follows:

See detailed sample list of borrowers under the credit program of VND 120,000 billion under Resolution No. 33/NQ-CP in 2023: Click here.

- Reporting deadline: Periodically report on the 25th and 10th of every month

LawNet