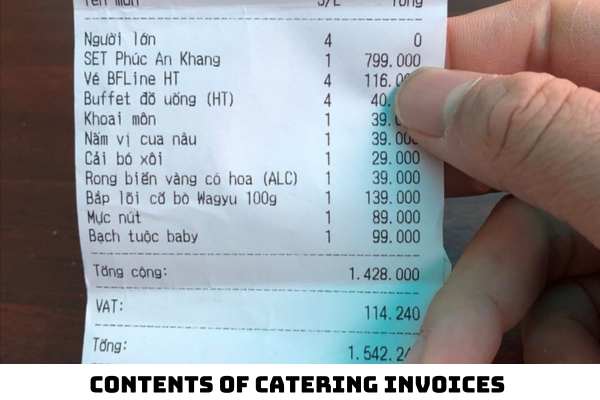

Vietnam: Is it required to detail dishes and relevant tax rates on catering invoices?

Is it required to detail dishes and relevant tax rates on catering invoices in Vietnam?

Pursuant to Clause 6 Article 10 of Decree 123/2020/ND-CP stipulating the contents of invoices in Vietnam as follows:

Contents of invoices

…

6. The name, unit, quantity, unit price, amount payable exclusive of VAT, VAT rate, total VAT amount calculated by each VAT rate, total VAT payable and total amount payable inclusive of VAT:

a) Name, unit, quantity, unit price:

- Name of good/service: written on the invoice in Vietnamese language. If the goods fall into different categories, their names shall contain the categories (e.g. Samsung phone, Nokia phone, etc.).

Accordingly, the catering invoices must show the name of goods and/or services.

If the goods fall into different categories, their names shall contain the categories.

At the same time, when calculating the total payment, VAT must be included.

Specifically, in this matter, the General Department of Taxation in Vietnam has given the opinion that the seller will determine the goods and services provided to determine the contents on the invoice as prescribed in Article 10 of Decree 123/2020/ND-CP, not required to detail each dish if it is not related to the determination of tax liability ( Excise tax rate, VAT rate,...).

In other words, when dishes or products are eligible for VAT or Excise tax, it is required to detail the tax rate, name of goods, and services on the invoice.

What are the available invoice types in Vietnam under the current regulations?

Pursuant to the provisions of Article 8 of Decree 123/2020/ND-CP, the available invoice types in Vietnam under the current regulations include:

Invoice types

Invoices prescribed herein are classified into the following types:

1. Value-added tax (VAT) invoice is an invoice which may be used by organizations making VAT declaration by employing the credit-invoice method for the following activities:

a) Domestic sale of goods or provision of services;

b) Provision of international transport services;

c) Export of goods to free trade zones and other cases considered as export of goods;

d) Export of goods or provision of services in a foreign market.

2. Sales invoice is an invoice which may be used by the following organizations and individuals:

a) Organizations or individuals that declare and calculate VAT by employing direct method for the following activities:

- Domestic sale of goods or provision of services;

- Provision of international transport services;

- Export of goods to free trade zones and other cases considered as export of goods;

- Export of goods or provision of services in a foreign market.

b) Organizations or individuals in free trade zones that sell goods or provide services to the domestic market, sell goods or provide services to other organizations/individuals in free trade zones, or sell goods or provide services to a foreign market. In such cases, invoices must bear the phrase “Dành cho tổ chức, cá nhân trong khu phi thuế quan” ("For organizations/individuals in free trade zones”).

3. Public property electronic sales invoice is used when selling the following types of property:

a) Public property at authorities, organizations or units (including state owned houses);

b) Infrastructure property;

c) Public property that is managed by enterprises as assigned by the Government, excluding state capital invested in enterprises;

d) Property of state-funded projects;

dd) Property under the established all-people ownership;

e) Public property appropriated under decisions issued by competent regulatory authorities or officials;

g) Raw materials and supplies obtained from the disposal of public property.

4. Electronic sales invoice on national reserve goods is used when a state reserves agency or unit sells national reserve goods in accordance with regulations and laws.

5. Other invoices, including:

a) Stamps, tickets and cards in the form and containing contents prescribed herein;

b) Air freight receipts; receipts of international transport charges; receipts of banking service charges, except the cases prescribed in Point a of this Clause where a record whose format and contents are made according to international practices and regulations of relevant laws.

6. Records printed, issued, used and managed in the same manner as invoices, including delivery and internal transfer note, and delivery notes for goods sent to sales agents.

7. The Ministry of Finance shall provide specific guidance on templates of invoices used by the entities prescribed in Article 2 hereof for reference purposes.

Thus, there are currently the following invoice types:

- Value-added tax (VAT) invoice

- Sales invoice

- Public property electronic sales invoice

- Electronic sales invoice on national reserve good

- Other invoice types, including:

+ Stamps, tickets, and cards;

+ Air freight receipts; receipts of international transport charges; receipts of banking service charges.

- CRecords printed, issued, used and managed in the same manner as invoices, including delivery and internal transfer notes, and delivery notes for goods sent to sales agents.

What is the time for issuing catering invoices in Vietnam under the current regulations?

Pursuant to Clauses 2 and g, Clause 4, Article 9 of Decree 123/2020/ND-CP, the time for issuing catering invoices in Vietnam is specified as follows:

- Catering invoices shall be issued upon completion of the provision of services, whether the payment of the invoiced amount is made or not.

- In case a service is provided with payments collected in advance or during the provision of that service, an invoice shall be issued when each payment is collected.

In addition, for food service establishments that sell foods and drinks directly to consumers through their stores but all business operations are recorded at their head offices (the head office directly enters into contracts for sale of goods/provision of services; each store shall issue sales invoices to clients through its POS cash register in the name of the head office), at the end of a business day, the business establishment shall, based on bill data, issue e-invoices for goods or foods and drinks sold during the day.

LawNet