Vietnam: Is Circular 111/2013/TT-BTC on guidance for implementing the Law on Personal Income Tax still in effect? In 2024, what are the instructions for calculating PIT on incomes from salaries and remunerations?

Is Circular 111/2013/TT-BTC on guidance for implementing the Law on Personal Income Tax in Vietnam still in effect?

Currently, Circular 111/2013/TT-BTC on guidance for implementing the Law on Personal Income Tax and the Government's Decree No. 65/2013/ND-CP is still in effect.

However, Circular 111/2013/TT-BTC has been amended by the following documents:

- Circular 119/2014/TT-BTC on amendments to Circular No. 156/2013/TT-BTC, Circular No.111/2013/TT-BTC, Circular No. 219/2013/TT-BTC, Circular No. 08/2013/TT-BTC, Circular No. 85/2011/TT-BTC, Circular No. 39/2014/TT-BTC and Circular No. 78/2014/TT-BTC to simplify tax formalities.

- Circular 79/2022/TT-BTC on amendments to some legislative documents promulgated by Ministry of Finance

- Resolution 954/2020/UBTVQH14 on changes to personal income tax exemptions

- Circular 80/2021/TT-BTC on elaboration of some Articles of the Law on Tax Administration and the Government’s Decree No. 126/2020/ND-CP on elaboration of some Articles of the Law on Tax Administration

- Circular 25/2018/TT-BTC on guidelines for the Government’s Decree No. 146/2017/ND-CP on amendments to some articles of the Circular No.78/2014/TT-BTC and Circular No.111/2013/TT-BTC

- Circular 92/2015/TT-BTC providing guidelines for vat and personal income tax incurred by residents doing business, amendments to some articles on personal income tax of the Law No. 71/2014/QH13 on the amendments to tax Laws and the Government's Decree No. 12/2015/NĐ-CP on guidelines for the Law on the amendments to tax Laws and Decrees on taxation

Who are PIT payers in Vietnam?

Under Article 2 of the Law on Personal Income Tax 2007 on PIT payers in Vietnam as follows:

Taxpayers

1. Personal income taxpayers include residents who earn taxable incomes specified in Article 3 of this Law inside and outside the Vietnamese territory and non-residents who earn taxable incomes specified in Article 3 of this Law inside the Vietnamese territory.

2. Resident means a person who satisfies one of the following conditions:

a/ Being present in Vietnam for 183 days or more in a calendar year or 12 consecutive months counting from the first date of their presence in Vietnam;

b/ Having a place of habitual residence in Vietnam, which is a registered place of permanent residence or a rented house for dwelling in Vietnam under a term rent contract.

3. Non-resident means a person who does not satisfy any of the conditions specified in Clause 2 of this Article.

Thus, PIT payers in Vietnam include:

(1) Personal income taxpayers include residents who earn taxable incomes specified in Article 3 of this Law inside and outside the Vietnamese territory and non-residents who earn taxable incomes inside the Vietnamese territory.

(2) Resident means a person who satisfies one of the following conditions:

- Being present in Vietnam for 183 days or more in a calendar year or 12 consecutive months counting from the first date of their presence in Vietnam;

- Having a place of habitual residence in Vietnam, which is a registered place of permanent residence or a rented house for dwelling in Vietnam under a term rent contract.

(3) Non-resident means a person who does not satisfy any of the conditions specified in Clause 2, Article 2 of the Law on Personal Income Tax 2007.

In 2024, what are the instructions for calculating PIT on incomes from salaries and remunerations in Vietnam?

The method for calculating PIT on incomes from salaries and remunerations in Vietnam will vary based on whether the PIT payer is a resident individual or a non-resident individual.

The instructions for calculating PIT on incomes from salaries and remunerations in Vietnam are specified as follows:

(1) For resident individuals:

Case 1: Resident individuals conclude an employment contract for 03 months or more:

Under the provisions of Article 7 and Article 8 of Circular 111/2013/TT-BTC, PIT on incomes from salaries and remunerations of resident individuals is determined according to the following formula:

PIT on incomes from salaries and remunerations = Assessable income x Tax rate |

Where:

Assessable income = Taxable Income - Personal deductions

Taxable Income = Total Income - Exemptions

Taxable income from salaries and remunerations is determined by the total amount of income from salaries and remunerations received by taxpayers in the tax period, including:

- Wages, remunerations, and the other amounts paid as wages or remunerations in cash or not in cash.

- Allowances and benefits, except for:

+ Allowances and benefits according to regulations of law on incentives for contributors.

+ Benefits for national defense and security;.

- Benefits for dangerous or harmful works.

- Benefits for employees in disadvantaged areas.

- Irregular allowances for difficulties, occupational accident benefits, occupational illness benefits, lump-sum allowances for childbirth or adoption, maternity leave benefits, post-maternity recovery benefits, benefits for the reduction in workability, lump-sum pension, monthly widow’s pension and other benefits according to the Law on Social insurance.

- Severance pay, redundancy pay according to the Labor Code

- Benefits for beneficiaries of social security and other allowances and subsidies that are not like salaries and remunerations according to Government regulations.

- Insurance premiums, including premiums for social insurance, health insurance, unemployment insurance, and professional liability insurance, which is compulsory for some professions; contributions to the voluntary pension fund

- Personal deductions:

The current personal deductions shall follow Resolution 954/2020/UBTVQH14 as follows:

- Deduction for the taxpayer: 11 million VND/month (132 million VND/year);

- Deduction for each dependant: 4,4 million VND/dependent/month.

- Deductible charitable donations:

The charitable donations shall be deducted from the taxable income from business and wages before calculating the tax incurred by a resident taxpayer. To be specific:

- Donations to the establishments that take care of disadvantaged children, the disabled, and the homeless elderly people;

- The contributions to charitable, humanitarian and study encouragement funds.

Personal income tax rate:

The rate of personal income tax is specified in Clause 2 Article 7 of Circular 111/2013/TT-BTC as follows:

Level | Assessable income/year (million VND) | Assessable income/month (million VND) | Tax rate (%) |

1 | Up to 60 | Up to 5 | 5 |

2 | Over 60 to 120 | Over 5 to 10 | 10 |

3 | Over 120 to 216 | Over 10 to 18 | 15 |

4 | Over 216 to 384 | Over 18 to 32 | 20 |

5 | Over 384 to 624 | Over 32 to 52 | 25 |

6 | Over 624 to 960 | Over 52 to 80 | 30 |

7 | Over 960 | Over 80 | 35 |

Case 2: Resident individuals do not conclude an employment contract or conclude an employment contract for less than 03 months

Under Point i, Clause 1, Article 25 of Circular 111/2013/TT-BTC, resident individuals, who conclude an employment contract for less than 03 months or do not conclude an employment contract but have a total income of VND 02 million/payment or more, must withhold tax at the rate of 10% on income (always deduct before paying).

That is, individuals who do not conclude an employment contract or conclude an employment contract for less than 03 months but have income from salaries and remunerations of VND 02 million or more must pay tax at the rate of 10%, except for the case of making a commitment according to Form 08/CK-TNCN if eligible.

The amount of tax payable is calculated as follows:

Personal income tax payable = 10% x Total income before payment |

(2) For non-resident individuals:

According to Article 18 of Circular 111/2013/TT-BTC, PIT on incomes from salaries and remunerations of non-resident individuals is determined as follows:

PIT on incomes from salaries and remunerations = Taxable income from salaries and remunerations x PIT rate of 20% |

The taxable income from wages earned by a non-resident individual who works both in Vietnam and overseas without being able to separate the income earned in Vietnam shall be calculated as follows:

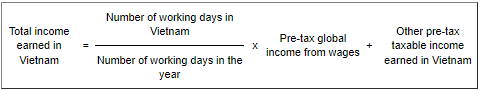

- Where the foreigner is not present in Vietnam:

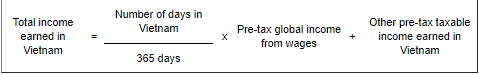

- Where the foreigner is present in Vietnam:

LawNet