Vietnam: Instructions for making a corporate income tax declaration for separate transfer of real estate according to the latest form No. 02/TNDN?

- Which form is used in the corporate income tax declaration for calculating tax according to the percentage of revenue?

- Instructions for making a corporate income tax declaration for separate transfer of real estate according to the latest form No. 02/TNDN?

- Is it mandatory to separately declare CIT for transfer of real estate in Vietnam?

Which form is used in the corporate income tax declaration for calculating tax according to the percentage of revenue?

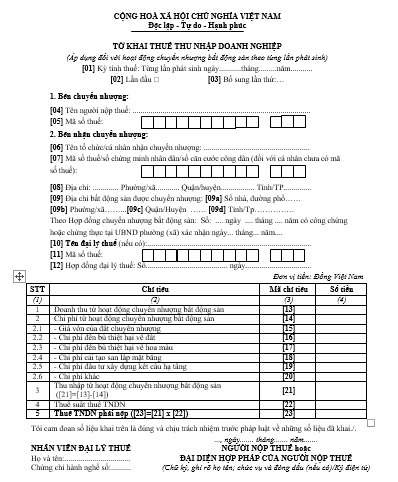

The corporate income tax declaration applicable to real estate transfer upon each arising time, made according to form No. 02/TNDN issued together with Circular No. 80/2021/TT-BTC, has the following form:

Download the tax declaration form No. 02/TNDN: Click here.

Vietnam: Instructions for making a corporate income tax declaration for separate transfer of real estate according to the latest form No. 02/TNDN?

Instructions for making a corporate income tax declaration for separate transfer of real estate according to the latest form No. 02/TNDN?

According to the website of the General Department of Taxation, instructions for making a corporate income tax declaration for separate transfer of real estate, according to form No. 02/TNDN as follows:

Target [01]: The taxpayer declares the date the tax liability arises in accordance with the law on corporate income tax.

Indicators [02], [03]: Check “First time”. In case the taxpayer discovers that the first-time tax declaration dossier submitted to the tax agency contains errors or omissions, an additional declaration shall be made according to the ordinal number of each supplement.

If taxpayers make an electronic tax declaration, from the time the Etax System issues a Notice of Acceptance of Tax Declarations for the "First Time" Tax Declaration, the subsequent Tax Declarations of the same tax period are the "Additional" declarations. . The taxpayer must submit the "Additional" Declaration in accordance with the regulations on additional declarations.

Targets [04], [05]: Declare the information "Taxpayer's name and tax code" according to the taxpayer's business registration or tax registration information.

If taxpayers make an electronic tax declaration, after filling in the "Tax ID number" information completely and correctly, the Etax system automatically displays information about "Taxpayer's name".

Target [06]: The taxpayer writes the name of the organization/individual receiving the real estate transfer.

Target [07]: The taxpayer writes the tax code/identity identification number/citizen identification number (for individuals without a tax code) of the organization/individual receiving the real estate transfer.

Target [08]: The taxpayer writes the address of the organization/individual receiving the transfer

Targets [09], [09a], [09b], [09c], [09d]: The taxpayer writes the address of the transferred real estate.

Targets [10], [11], [12]: The taxpayer must enter the tax agent's name, tax agent tax identification number, and tax agency contract information in case the taxpayer declares tax through a tax agent. The tax agent must have "Active" tax registration status and the Contract must be valid at the time of tax declaration.

If taxpayers make an electronic tax declaration, the Etax system automatically supports displaying information about tax agents, tax agency contracts registered with tax agencies for taxpayers to choose in case taxpayers have many tax agents and contracts. .

Target [13]: The taxpayer declares the enterprise income taxable revenue from real estate transfer as determined in accordance with the CIT law.

Indicators [14], [15], [16], [17], [18], [19], [20]: The taxpayer declares the total expenses for calculating corporate income tax from real estate transfer , in which details of each expense are determined according to the CIT law. Indicator [14] = [15] + [16] + [17] + [18] + [19] + [20].

Target [21]: The taxpayer declares income from real estate transfer according to the formula [21]=[13]-[14].

Target [22]: The taxpayer declares the corporate income tax rate for income from real estate transfer according to the time of income generation (from January 1, 2016 to now, the tax rate is 20%).

Target [23]: taxpayers declare payable corporate income tax according to the formula [23]=[21] x [22].

Is it mandatory to separately declare CIT for transfer of real estate in Vietnam?

Pursuant to Point e, Clause 4, Article 8 of Decree No. 126/2020/ND-CP stipulating taxes declared monthly, quarterly, annually, separately; tax finalization as follows:

Taxes declared monthly, quarterly, annually, separately; tax finalization

...

4. The following taxes and other amounts shall be declared separately:

...

dd) Irregular VAT and corporate income tax incurred by payable by taxpayers paying tax directly on value added and revenue as prescribed by VAT and corporate income tax laws. In case these taxes are incurred multiple times within a month, they may be declared monthly.

e) Corporate income tax on real estate transfer incurred by taxpayers paying tax directly on revenue under corporate income tax laws.

g) Personal income tax directly declared by the income earners or declared and paid by the income payers on behalf of the income earners on income from real estate transfer, capital transfer, capital investment, copyright, franchising, winning overseas prizes; inheritance, gifts.

h) Taxes and amounts payable by property lessors, household businesses and individual businesses that do not have fixed business locations and regular business operations.

i) Registration fees (including those previously exempted under registration fee laws).

...

Thus, the separate declaration of CIT for transfer of real estate in Vietnam is only incurred by taxpayers paying tax directly on revenue.

LawNet