Vietnam: In 2023, what is the latest tax declaration form? What are the instructions for preparing a tax declaration in 2023?

In 2023, what is the latest tax declaration form in Vietnam?

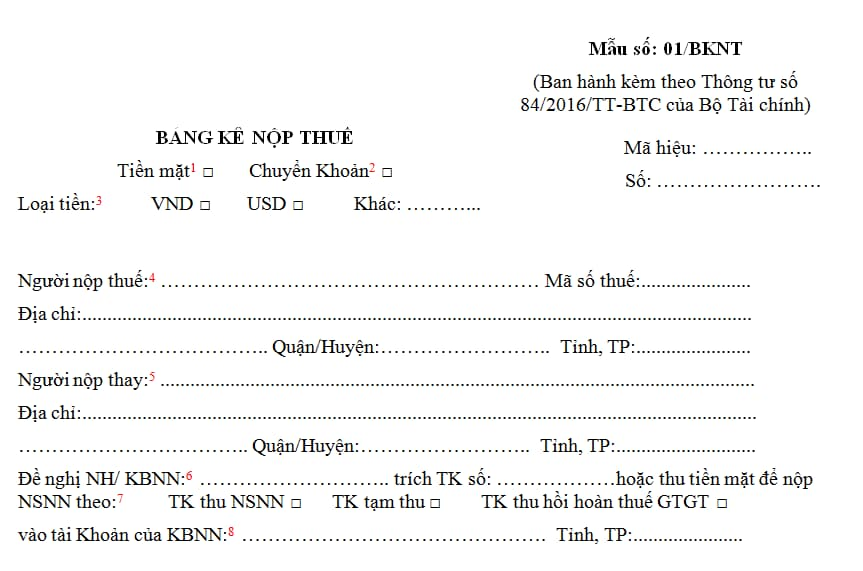

The latest tax declaration form in Vietnam shall comply with Form No. 01/BKNT issued together with Circular 84/2016/TT-BTC:

Instructions for preparing tax declaration

[6] - Payment by fund transfer: Insert name of the bank and account number of the taxpayer.

- Payment in cash: Only insert name of the bank/State Treasury where the taxpayer conducts the transaction without the account number.

[7] The taxpayer shall choose the box “State revenue account” or the box “VAT refund withdrawal account”

[8] State Treasury account: Insert name of the receiving State Treasury agency.

[9] The taxpayer checks one of the boxes corresponding to the issuing authority including “State Audit Agency”, “Government Inspectorate”, “Financial Inspectorate”, “Other competent authority”.

[10] The taxpayer registers the collecting authority’ name in accordance with the budget payment.

[11] - With respect to each revenue according to decision/notification of the competent authority, the taxpayer shall indicate the number and symbol of the decision/notification (for example 123/QD-CT, 67/TB-CCT).

[12] The taxpayer inserts each revenue according corresponding to the following format:

- Irregular payment (whenever taxable income arises) DD/MM/YYYY (insert date of filing tax return);

- Monthly payment: 00/MM/YYYY;

- Quarterly payment: 00/Qx/YYYY;

- Period-based payment: 00/Kx/YYYY;

- Annual payment: 00/CN/YYYY;

- Annual statement payment: 00/QT/YYYY;

- Payment upon decision/notification: DD/MM/YYYY (insert date of decision/notification).

- If a collecting entity pays a sum of tax collected from the taxpayer to the State budget, it must insert the date of list of receipts in the column “Tax period”.

[13] - The taxpayer shall fill additional information, according to characteristics of each kind of property, in the box “State budget revenues” as follows: address of house, land plot; mean of transport, trademark, type, color, chassis number, and engine number of plane, boat, car, or motorcycle.

State budget revenues shall be clearly indicated as follows:

- VAT on domestic businesses.

- VAT on lottery.

- Corporate income tax on agreement-based oil and gas operation.

- Special excise tax on tobacco manufacturing.

- Special excise tax on imported cars for domestic sale.

- Personal income tax on wages.

- Personal income tax on capital investment.

[14] The sum of money in number and words: Indicate the sum of paid money equivalent to the chosen currency, VND, USD or another foreign currency.

[15] - Regarding fund transfer by organizations or enterprises: Bear signature and full name of the chief accountant (if any); bear signature, full name and seal of the head of the entity (being the account holder of the account for tax payment purpose).

What are the cases of using the tax declaration made in Form No. 01/BKNT in Vietnam?

Pursuant to Article 9 of Circular 84/2016/TT-BTC as follows:

Making tax payment receipts at counters of coordinating banks, collecting banks, State Treasury agencies

1. If paying tax at a counter of a coordinating bank or a collecting bank, or paying tax in cash at a counter of a State Treasury agency, the taxpayer shall make a tax declaration (using Form No. 01/BKNT issued herewith) as follows:

a) Payment method: Check the box “in cash” or “fund transfer”.

b) Payment currency:

- Check the box “VND” if the taxpayer must pay a sum of tax or domestic revenue in VND.

- Check the box “USD” or another kind of currency if the taxpayer must pay a sum of tax or domestic revenue in US Dollar or other foreign currency as prescribed in law and regulations.

c) Taxpayer’s details: Insert name, TIN, address of the taxpayer according to the tax registration information or enterprise registration information.

...

Thus, If paying tax at a counter of a coordinating bank or a collecting bank, or paying tax in cash at a counter of a State Treasury agency, the taxpayer shall make a tax declaration using Form No. 01/BKNT issued together with Circular 84/2016/TT-BTC.

What are the regulations on processing collection and payment information at tax authorities in Vietnam?

According to Article 16 of Circular 84/2016/TT-BTC as follows:

- The tax authority shall receive collection and payment information from the State Treasury agency, inspect the digital signature and details in the list of deposit slips, and insert them to the tax management system for keeping records of revenues and payments of taxpayers.

- The tax authority shall trace and deal with differences and amend information about revenues with the State Treasury agency and taxpayers as prescribed in Article 17 of Circular 84/2016/TT-BTC.

- Every 15th or on the consecutive working day of the 15th (if it is a day off prescribed in the law on labor), the tax authority shall notify payments in the preceding month recorded in the tax management system to the taxpayer via the e-Tax account issue by General Department of Taxation.

LawNet