Vietnam: Guidance on customs documentation for imported goods? How to write a customs declaration form for imported goods in 2022?

What does the customs dossier for imported goods include in Vietnam?

Pursuant to Clause 2, Article 16 of Circular 38/2015/TT-BTC (amended and supplemented in Section 5 of Circular 39/2018/TT-BTC) stipulates a set of customs dossiers for imported goods:

2. A customs dossier of imports consists of:

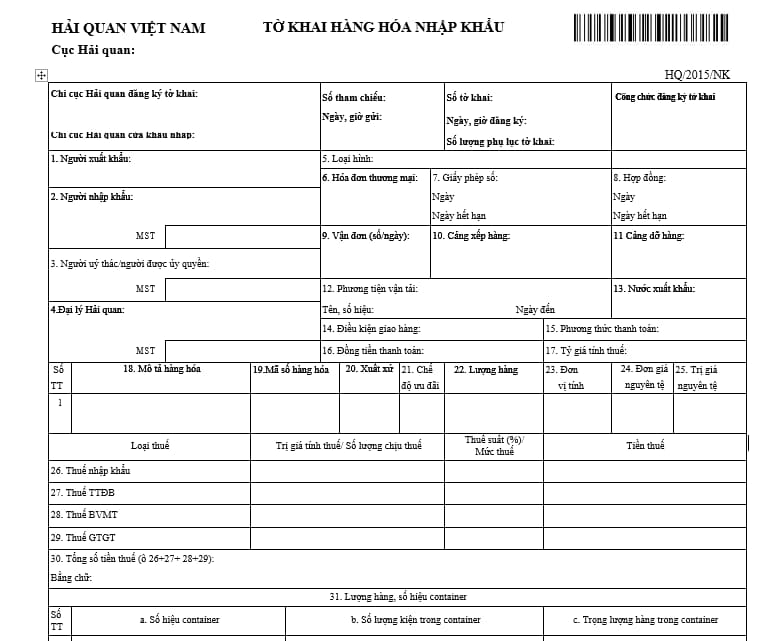

a) A customs declaration according to form No. 01 in Appendix II hereof.

If a physical customs declaration is made according to Clause 2 Article 25 of Decree No. 08/2015/ND-CP, which is amended by Clause 12 Article 1 of Decree No. 59/2018/ND-CP, the declarant shall complete and submit 02 original copies of form No. HQ/2015/NK in Appendix IV hereof;

b) Commercial invoices or equivalent documents if the buyer has to pay the seller: 01 photocopy.

If the owner of the goods buys the goods from a seller in Vietnam and is instructed by the seller to receive goods overseas, the customs authority shall accept the invoice issued by the seller in Vietnam to the owner of the goods.

The declarant is not required to submit the commercial invoice in the following cases:

b.1) Goods are imported to execute a processing contract with a foreign trader;

b.2) Goods are imported without invoices and the buyer is not required to pay the seller. In this case, the declarant shall declare the customs value in accordance with Circular No. 39/2015/TT-BTC dated March 25, 2015 of the Minister of Finance.

c) The bill of lading or equivalent transport documents if goods are transported by sea, air, railroad, or multi-modal transport as prescribed by law (unless goods are imported through a land checkpoint, goods traded between a free trade zone and the domestic market, imports carried in the luggage upon entry): 01 photocopy.

With regard to imports serving petroleum exploration and extraction transported on service ships (not commercial ships), the cargo manifest shall be submitted instead of the bill of lading;

c) A statement of imported raw timber (if any) as prescribed by the Ministry of Agriculture and Rural Development: 01 original copy;

dd) The export license or a document permitting the export issued by a competent authority if required by foreign trade law; The quota-based import license or a notification of tariff quota:

dd.1) If partial shipments are not permitted: 01 original copy;

dd.2) If partial shipments are permitted: 01 original copy for the first consignment;

e) Inspection certificate: 01 original copy.

If applicable law permits submission of photocopies or does not specify whether the original copy or photocopy has to be submitted, the declarant may submit a photocopy.

If the inspection certificate is used multiple times during its effective period, the declarant shall only submit it 01 time to the Sub-department of Customs where procedures for import of the first consignment are followed;

g) The certificate of eligibility to import prescribed by investment law: 01 photocopy while following procedures for import of the first consignment;

h) Value declaration: the declarant shall make the value declaration using the set form and send the electronic declaration to the e-customs system or submit 02 original copies to the customs authority (in case of submission of physical customs declaration). Cases in which a value declaration is required and the value declaration form are provided in Circular No. 39/2015/TT-BTC ;

i) Documents certifying goods origins specified in Circulars of the Minister of Finance on determination of origins of exports and imports;

k) A list of machinery and equipment in case of combine machines or machine sets of Chapters 84, 85 and 90 of Vietnam’s nomenclature of exports and imports or unassembled or disassembled machinery and equipment: 01 photocopy with presentation of the original copy for comparison in accordance with Circular No. 14/2015/TT-BTC in case of partial shipments;

l) Entrustment contract: 01 photocopy if an import license, inspection certificate or certificate of eligibility to import is required for import entrustment as prescribed by investment law and the trustee uses the license or certificate of the trustor;

m) A contract to sell goods to a school or research institute or a contract to supply goods or services that are imported to serve teaching or scientific experiments and apply 5% VAT according to the Law on Value-added tax: 01 photocopy.

The declarant is not required to submit the documents mentioned in Point dd, Point e, Point g and Point i of this Clause if they are sent electronically through the National Single-window Information Portal by the inspecting authority or regulatory authority or through the Association of Southeast Asian Nations Single-window Information Portal by a competent authority of the exporting country or through another portal conformable with international treaties to which Vietnam is a signatory.

Vietnam: Guidance on customs documentation for imported goods? How to write a customs declaration form for imported goods in 2022?

Customs declaration form for imported goods in 2022 in Vietnam?

Download the customs declaration form for imported goods: Here.

Instructions for recording the customs declaration in the customs dossier for imported goods in Vietnam?

- Box 01: Fill in the full name, address, telephone number, fax number and code (if any) of the overseas seller selling goods to a Vietnamese trader.

- Box 02: Fill in the full name, address, telephone number, fax number and tax identification number of the importer; ID card or passport (if individual).

- Box 03: Entrustor / authorized person

The customs declarant shall write the full name, address, telephone number, fax number and tax code of the trader entrusting to the exporter or the full name, address, telephone number, fax number and tax code of the exporter. authorized person to declare customs; ID card or passport (if the authorized person is an individual).

- Box 04: Customs agent

The customs declarant shall write the full name, address, telephone number, fax number and tax code of the customs agent; Number and date of customs agent contract.

- Box 05: Specify the corresponding type of export.

- Box 06: Enter the number, date, month and year of the commercial invoice (if any).

- Box 07: Enter the license number, date, month and year of the specialized management agency's license for imported goods and the date, month and year of the license's expiration (if any).

- Box 08: Enter the number of days, months and years of signing the contract and the expiration date (if any) of the contract or contract appendix (if any).

- Box 09: Enter the number, date, month and year of the bill of lading or a valid transport document issued by the carrier to replace the bill of lading (if any).

- Box 10: Write the name of the port, the place (agreed in the commercial contract or written on the bill of lading) where the goods are loaded onto the means of transport to be transported to Vietnam.

- Box 11: Enter the name of the port/border gate where the goods are unloaded from the means of transport.

In case the port/port of discharge is different from the place where the goods are delivered to the customs declarant, write the port of discharge/delivery place.

- Box 12: Enter the ship's name, flight number, train number, number and arrival date of means of transport carrying goods imported from abroad to Vietnam by sea or road transport. air, rail, road.

- Box 13: Enter the name of the country or territory from which the goods are shipped to Vietnam (where the goods were sold last to Vietnam).

Note that ISO 3166 is applied country code, do not write the name of the country or territory through which the goods are transshipped.

- Box 14: Specify the delivery conditions agreed upon by the buyer and seller in the commercial contract.

- Box 15: Specify the payment method agreed in the commercial contract;

- Box 16: Enter the code of the currency used for payment (original currency) as agreed in the commercial contract. Apply currency codes in accordance with ISO 4217.

- Box 17: Enter the exchange rate between the original currency unit and the Vietnamese currency applied for tax calculation (according to current regulations at the time of customs declaration registration) in Vietnam dong.

- Box number 18:

Specify the name of goods, specifications of goods according to the commercial contract or other documents related to the shipment.

+ In case the consignment has 02 or more items, the way to write this criterion is as follows:

On the customs declaration, it is written: “according to the declaration appendix”.

On the declaration appendix: clearly state the name, quality specification of each item.

+ For a shipment with a code number applied but in a shipment with many details and many sides, the common name of the shipment should be written on the declaration, and a detailed list is allowed (not required to be declared in the appendix).

- Box 19: Enter the classification code according to the List of exported and imported goods of Vietnam.

In case the consignment has 2 or more items, the way to write this entry is as follows:

+ On the customs declaration: nothing is written.

+ On the appendix of the declaration: specify the code of each item.

- Box 20: Enter the name of the country or territory where the goods are manufactured (manufactured). The country code specified in ISO 3166 applies.

In case the consignment has 02 or more items, the same way of writing in box 19.

- Box 21: Enter the name of the C/O form issued for the shipment under the Free Trade Agreements to which Vietnam is a member.

- Box 22: Enter the quantity, volume or weight of each item in the consignment under the customs declaration being declared in accordance with the unit in box 23.

In case the consignment has 02 or more items, the same way to write in box 19.

- Box 23: Enter the name of the unit of calculation of each item as specified in the List of exported or imported goods or the actual transaction.

In case the consignment has 02 or more items, the same way to write in box 19.

- Box 24: Write the price of a unit of goods (in the unit in box 23) in the currency stated in box 16, based on the agreement in the commercial contract, invoice, L/C or other documents relating to the shipment.

In a commercial contract by the mode of deferred payment and the purchase and sale prices stated in the contract, including the interest payable, the unit price is determined by the purchase and sale price minus (-) the interest payable under the commercial contract. commercial.

In case the consignment has 02 or more items, the same way to write in box 20.

- Box 25: Enter the original currency value of each imported item, which is the result of multiplying (x) between "Amount of goods (box 22) and "Unit price of original currency (box 24)".

In case the consignment has 02 or more items, the way to write in this box is as follows:

+ On the customs declaration: write the total value of the original currency of the declared items on the declaration appendix.

+ On the declaration appendix: Write the original currency value for each item.

- Box number 26:

+ Taxable value: Enter the dutiable value of each item in Vietnam dong.

+ Tax rate (%): Enter the tax rate corresponding to the code identified in box 19 according to the applicable Tariff.

+ Enter the payable import tax amount of each item.

In case the consignment has 2 or more items, the way to write in this box is as follows:

+ On the customs declaration, write the total amount of import tax payable in the corresponding "tax" box.

+ The appendix of the declaration must clearly state the taxable value, tax rate, and payable import tax amount for each item

- Box number 27:

+ The dutiable value of excise tax is the sum of the dutiable value of import tax and the payable import tax of each item.

+ Tax rate %: Enter the excise tax rate corresponding to the goods code for which the goods code is determined in box 19 according to the SCT Schedule.

+ Tax: Enter the payable SCT amount of each item

In case the consignment has 02 or more items, the method of recording is similar to cell number 26.

- Box number 28:

+ The quantity subject to environmental protection tax of imported goods is the quantity of goods according to the units specified in the Environmental Protection tax rate table.

+ The environmental protection tax rate of imported goods shall comply with the provisions of the environmental protection tax rate table.

+ Tax: Enter the amount of environmental protection tax payable for each item.

In case the consignment has 2 or more items, the method of recording is similar to cell number 26.

- Box number 29:

+ The dutiable value of value-added tax is the import tax price at the border gate plus import tax (if any) plus excise tax (if any) plus environmental protection tax (if any).

Import prices at border gates are determined according to regulations on taxable prices of imported goods.

+ Tax rate %: Enter the VAT rate corresponding to the goods code identified in box 19 according to the VAT Schedule.

+ Tax: Enter the payable VAT amount of each item.

In case the consignment has 2 or more items, the recording method is similar to box 26.

- Box 30: Total tax amount (box 26 + 27 + 28 + 29), the customs declarant records the total amount of import tax, SCT, environmental protection and VAT; text.

- Box number 31:

In case there are 4 or more containers, the person who specifically records information on the appendix of the customs declaration shall not write it on the declaration.

- Box 32: List the accompanying documents of the import declaration.

- Box 33: Enter the date/month/year of declaration, sign for certification, write full name, title and stamp on the declaration.

Above is a guide to customs documents for imported goods and how to write a customs declaration form for imports in 2022.

LawNet