Vietnam: Form of salary payment table and employee's income for enterprises and business households is regulated?

- How are the form of salary payment table and employee income for business households regulated in Vietnam?

- Instructions for making a table of payments of wages and incomes of employees for business households in Vietnam?

- How are the form of the salary payment table and employee incomes for enterprises regulated in Vietnam?

- Instructions for making a table of payments of wages and incomes of employees for enterprises in Vietnam?

How are the form of salary payment table and employee income for business households regulated in Vietnam?

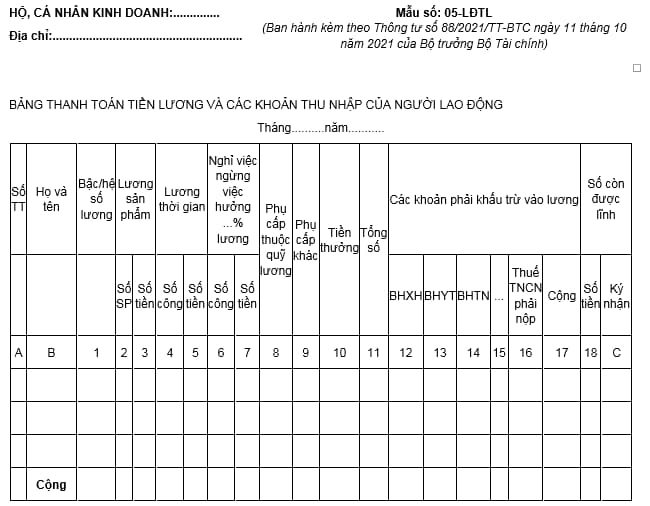

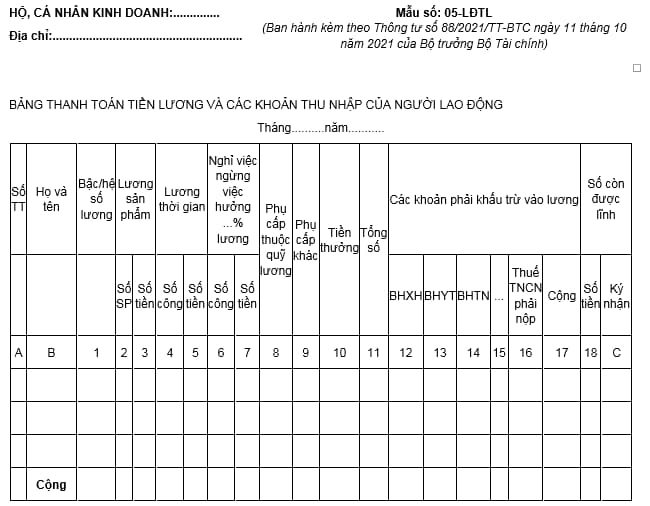

For the Form of payment table of wages and incomes of employees for business households, currently specified in Form No. 05-LĐTL issued together with Circular 88/2021 / TT-BTC as follows:

Download the Form of payment table of wages and incomes of employees for business households: Here.

Vietnam: Form of salary payment table and employee's income for enterprises and business households is regulated?

Instructions for making a table of payments of wages and incomes of employees for business households in Vietnam?

Pursuant to Section 2, Appendix 1 issued together with Circular 88/2021 / TT-BTC, there are instructions on making a table of payment of wages and incomes of employees for business households as follows:

The payment table of wages and incomes of employees is made monthly. The basis for making a table of payment of wages and incomes of employees is the tracking information, statistics on the number of workers or the number of products / work completed, the unit price of time salary / unit price of product wages,...

Columns A and B: Write the order number, full name of the employee entitled to salary.

Column 1: Write down the salary tier or salary coefficient of the employee.

Column 2.3: Record the number of products and the amount calculated by product salary.

Column 4.5: Record the number of credits and the amount calculated according to the time salary.

Column 6.7: Record the number of wages and amounts calculated according to the salary of time or stop or leave work entitled to % of salary.

Column 8: Record salary fund allowances.

Column 9: Write down other allowances that are included in the employee's income but not in the salary and bonus fund.

Column 10: Write down the total amount of bonuses that employees are entitled to.

Column 11: Record the total amount of salary and allowances and bonuses that employees are entitled to.

Column 12,13,14,15,16,17: Record payroll deductions of employees, including social insurance (social insurance), health insurance (health insurance), unemployment insurance (unemployment insurance).... personal income tax payable (PIT) and the total amount of salary deductions for the month. Where column 17 is the sum of payroll deductions, column 17 = column 12+ column 13+ column 14+ column 15+ column 16.

Column 18: Record the amount of salary, bonus and income that business households and individuals still have to pay employees (Column 18 = Column 11 – Column 17).

Column C: Employees sign when receiving wages.

At the end of each month, based on relevant documents, the business household/individual shall make a payment table of wages and incomes of the employee to transfer to the representative of the business household/business individual for approval, then make a check and pay the salary.

The payment table of wages and incomes of employees is stored at business households and business individuals. Each time the employee receives a salary, the employee must directly sign the column "Sign the receipt" or the recipient must sign on behalf (the recipient of the household must specify his full name).

In case the business household/individual pays the employee's salary through the bank deposit account, the employee is not required to sign the "Signature" column.

Business households and individuals can base on the characteristics of salary payment and income of employees at business households and business individuals to be able to add columns, remove columns or rearrange columns from columns 1 to 10, columns 12 to 16 of the salary payment table template and employees' incomes accordingly. with the reality of business households, and business individuals.

How are the form of the salary payment table and employee incomes for enterprises regulated in Vietnam?

For the Form of payment of wages and incomes of employees for enterprises, currently specified in Form No. 02-LDTL Appendix 3 issued together with Circular 200/2014 / TT-BTC as follows:

Download the Employee Payroll and Income Payment Sheet template for business: Here.

Note: This Circular provides accounting guidance to enterprises in all fields and economic sectors. Small and medium enterprises that are performing accounting under the Accounting Regime applicable to small and medium enterprises may apply the provisions of this Circular to account in accordance with their business characteristics and management requirements.

Instructions for making a table of payments of wages and incomes of employees for enterprises in Vietnam?

Pursuant to Appendix 3 issued together with Circular 200/2014 / TT-BTC, there are instructions on making a table of payment of wages and incomes of employees for enterprises as follows:

The salary payment table is drawn up monthly. The basis for making a salary payment table is related documents such as: Timesheet, product confirmation slip or completed work ...

Columns A and B: Write the order number, full name of the employee entitled to salary.

Column 1,2: Record salary level, salary coefficient of employees.

Column 3.4: Write the product number and the amount calculated by product salary.

Column 5.6: Record the number of credits and the amount calculated according to the time salary.

Column 7.8: Record the number of employees and the amount calculated according to the time salary or stop or quit work to enjoy % of salary.

Column 9: Record salary fund allowances.

Column 10: Write down other allowances that are included in the employee's income but not in the salary and bonus fund.

Column 11: Record the total amount of wages and allowances to which employees are entitled.

Column 12: Write down the amount of each person's first period advance.

Columns 13,14,15,16: Record the deductions from the employee's salary and calculate the total amount to be deducted during the month.

Column 17.18: Record the amount still received for period II.

Column C: Employees sign when receiving salary period II.

At the end of each month, based on relevant documents, the salary accountant shall prepare a salary payment table and transfer it to the chief accountant for review and submit it to the director or authorized person for approval, transfer it to the accountant to prepare a cheque and issue a salary. The salary payment table is stored in the accounting department of the unit.

Each time the employee receives a salary, the employee must directly sign the "Sign" column or the recipient must sign on its behalf.

LawNet