Vietnam: Application form for certificate of eligibility for tax procedures in 2022?

Application for a certificate of eligibility for tax procedures in Vietnam 2022?

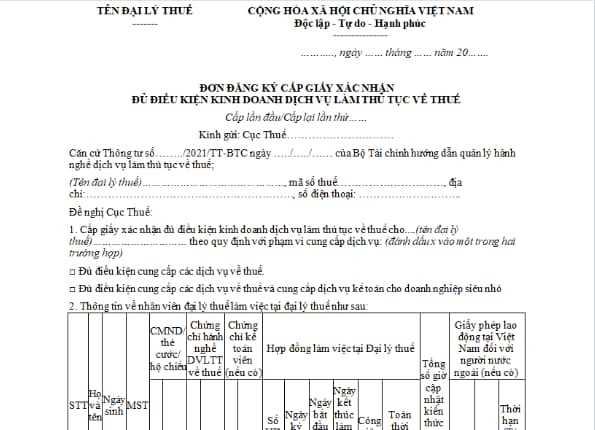

Pursuant to the provisions of Form 2.6 of the Appendix issued together with Circular 10/2021 / TT-BTC, the application form for issuance of a certificate of eligibility for provision of tax procedures in 2022 is as follows:

See details and download the application form for the certificate of eligibility for tax procedures in 2022: Here.

Vietnam: Application form for certificate of eligibility for tax procedures in 2022?

Dossier of registration of the certificate of eligibility for tax procedures for tax agents in Vietnam?

* Conditions for issuance of certificates of eligibility for provision of tax procedures:

Pursuant to the provisions of Clause 1, Article 22 of Circular 10/2021 / TT-BTC, regulations on conditions for issuance of certificates of eligibility for provision of tax procedures services are as follows:

- Being an enterprise that has been established in accordance with the provisions of law;

- At least 02 people are granted certificates of practicing tax procedures and working full-time at the enterprise;

- There is at least one tax agent with an accountant certificate working full-time at the enterprise in case of registration to provide accounting services for micro-enterprises.

* Regarding the dossier of registration for issuance of certificate of eligibility for provision of tax procedures:

Pursuant to the provisions of Clause 2, Article 22 of Circular 10/2021 / TT-BTC, the dossier regulations include:

- An application for a certificate of eligibility for provision of tax procedures according to Form 2.6 in the Appendix issued together with Circular 10/2021/ TT-BTC;

- Certificate of practicing tax procedures services of individuals working at the enterprise (scanned copy);

- Certificate of the accountant of an individual working at the enterprise (if registered as an accounting service for a micro-enterprise) (scanned copy);

- Labor contract between the enterprise and an individual with a certificate of practicing tax procedures services, an accountant's certificate (scanned copy);

What tax services does a tax agent provide taxpayers with in Vietnam?

Pursuant to the provisions of Article 23 of Circular 10/2021/TT-BTC, tax agents will provide taxpayers with the following services:

- Each service specified in Article 104 of the Law on Tax Administration 2019 provided by a tax agent must be clearly shown on the contract signed with the taxpayer, including:

+ Procedures for tax registration, tax declaration, tax payment, tax finalization, preparation of application for tax exemption, tax reduction, tax refund and other tax procedures on behalf of taxpayers;

+ Tax consulting services;

+ Accounting services for micro-enterprises as prescribed in Article 150 of this Law. Micro-enterprises are determined in accordance with the law on supporting small and medium-sized enterprises.

- The service provision contract between the tax agent and the taxpayer must show the scope and duration of service provision; scope of authorized tax procedures authorized deadlines.

In case the contract for providing tax procedures services is still valid but the tax agent is suspended from providing tax procedures services or has had his certificate of eligibility for tax procedure services revoked, the tax agent must immediately notify the taxpayer to take measures to suspend or terminate. terminate the contract for the provision of services.

Thus, the tax agent is provided to the taxpayer with the services specified above.

LawNet