What are the regulations on the use of receipts for fines in Vietnam? How to print and publish receipts for fines in Vietnam?

How to print and publish receipts for fines in Vietnam?

Pursuant to Clause 1, Article 10 of Circular No. 18/2023/TT-BTC stipulating as follows:

Organization of receipt printing, publication, management and utilization activities

1. Printing and publication of receipts specified in clause 1 and clause 2 of Article 8 herein shall be as follows:

a) Tax Departments order printing of receipts and dispense them to Tax Sub-departments and agencies or entities tasked with collecting fines. The number of receipts printed by placing orders varies depending on the local context. Tax Departments are entitled to the state budget's funding to print receipts with printed or unprinted face value to dispense them to Tax Sub-departments and agencies or entities tasked with collecting fines.

b) Receipts must be created according to the right form with symbols and ordinal numbers, bound into books, each of which contains 50 numbers of the receipt with printed face value, or 25 numbers of the receipt with unprinted face value. Receipts should be printed by printing houses having full legal personality under contracts for printing of the requested receipt forms. Upon completion of the printing, printouts, zinc plates and printing items that are redundant or used for testing purposes shall be destroyed before contract discharge.

c) For receipts printed according to orders placed by Tax Departments, before being dispensed for the first time, the Form of receipt publication notice No. 02/PH-BLP given in an Appendix hereto must be completed. This notice shall be sent to all Tax Departments nationwide within 10 working days after the day on which it is issued, and before the day on which receipts are dispensed.

When a Tax Department has posted the receipt publication notice on the website of the General Department of Taxation, this notice shall not need to be sent to other Tax Departments.

If there is any modification in the content of the notice, the issuing Tax Department shall follow the aforesaid procedures for issuance of another new notice.

d) When tax authorities dispense receipts to agencies and entities tasked with collecting fines, receivers of receipts shall present the letter of introduction (specifying the number of receipts to be received) from their employers, citizenship identification card/passport, and need to check and count each copy, number, book and symbol before leaving the tax authority’s office.

Before use, each receipt must bear the seal of the agency or entity tasked with collecting fines on the upper left, and be used in accordance with regulations as applied to the corresponding type of receipt.

Thus, printing and publication of receipts for fines shall be as follows:

- Tax Departments order printing of receipts and dispense them to Tax Sub-departments and agencies or entities tasked with collecting fines. The number of receipts printed by placing orders varies depending on the local context. Tax Departments are entitled to the state budget's funding to print receipts with printed or unprinted face value to dispense them to Tax Sub-departments and agencies or entities tasked with collecting fines.

- Receipts must be created according to the right form with symbols and ordinal numbers, bound into books, each of which contains 50 numbers of the receipt with printed face value, or 25 numbers of the receipt with unprinted face value. Receipts should be printed by printing houses having full legal personality under contracts for printing of the requested receipt forms. Upon completion of the printing, printouts, zinc plates and printing items that are redundant or used for testing purposes shall be destroyed before contract discharge.

- For receipts printed according to orders placed by Tax Departments, before being dispensed for the first time, the Form of receipt publication notice No. 02/PH-BLP given in an Appendix to Circular No. 18/2023/TT-BTC must be completed. This notice shall be sent to all Tax Departments nationwide within 10 working days after the day on which it is issued, and before the day on which receipts are dispensed.

When a Tax Department has posted the receipt publication notice on the website of the General Department of Taxation, this notice shall not need to be sent to other Tax Department.

If there is any modification in the content of the notice, the issuing Tax Department shall follow the aforesaid procedures for issuance of another new notice.

- When tax authorities dispense receipts to agencies and entities tasked with collecting fines, receivers of receipts shall present the letter of introduction (specifying the number of receipts to be received) from their employers, citizenship identification card/passport, and need to check and count each copy, number, book and symbol before leaving the tax authority’s office.

Before use, each receipt must bear the seal of the agency or entity tasked with collecting fines on the upper left, and be used in accordance with regulations as applied to the corresponding type of receipt.

What are the regulations on the use of receipts for fines in Vietnam? How to print and publish receipts for fines in Vietnam?

What are the regulations on forms of receipts for fines in Vietnam?

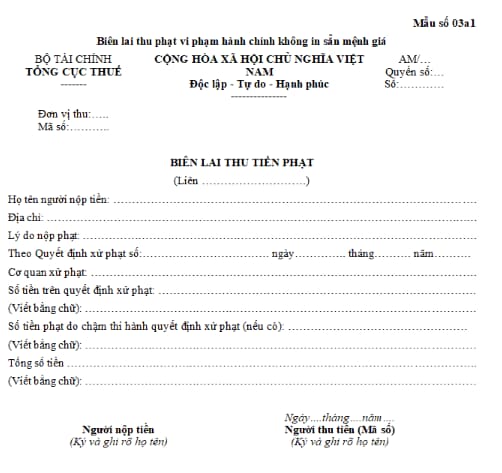

The receipt with unprinted face value shall be made according to Form No. 03a1 in Appendix I issued with Decree No. 11/2020/ND-CP as follows:

Download the form of receipt with unprinted face value: Click here.

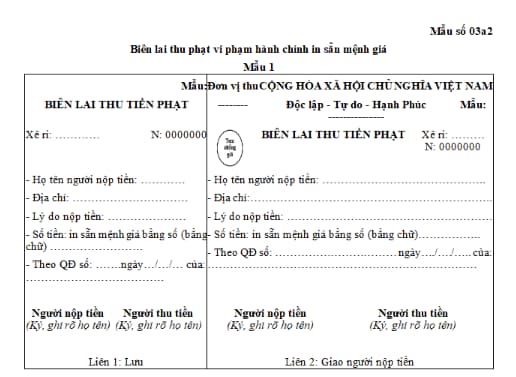

A receipt with printed face value according to Form No. 03a2 in Appendix I issued with Decree No. 11/2020/ND-CP as follows:

Download the form of receipt with printed face value: Click here.

What are the regulations on the use of receipts for fines in Vietnam?

Pursuant to Clause 2, Article 10 of Circular No. 18/2023/TT-BTC stipulating as follows:

When using receipts for printed/unprinted face value, the following regulations shall be observed:

- Receipts must be used in the ascending order of their ordinal numbers in a book. A receipt that is issued must be protected from crumpling. If it is crumpled, it needs to be diagonally crossed out and then remain in the book for the purpose of reporting to the dispensing authority;

- A receipt with unprinted face value shall be issued in front of the payer, and fully completed before all provided data entries are printed on other copies, ensuring that provided information included in copies of the receipt matches;

- Quarterly, no later than the last date of the first month of the quarter following the quarter when receipts are in use, agencies or entities tasked with collecting fines are required to report to receipts-dispensing authorities on use of receipts by completing the Form No. BC26/BLP in an Appendix to Circular No. 18/2023/TT-BTC. If that last date is a day-off or a public holiday prescribed in laws, the deadline for submission of the aforesaid report shall be extended to the date following that day-off or public holiday.

If no receipt is used in a reporting period, the number of receipts used which equals zero (=0) should be shown in the report. If all receipts in the previous period have been used up; the number of receipts in stock in the previous period which is zero (=0) has been reported; and no receipts are received or used in the reporting period in question, agencies or entities tasked with collecting fines are not required to submit the report on use of receipts.

Annually, entities tasked with collecting fines shall work with dispensing authorities to reconcile received receipts with dispensed receipts in accordance with clause 7 of Article 1 in the Circular No. 72/2021/TT-BTC, amending and supplementing point b and c of clause 7 of Article 7 in the Circular No. 328/2016/TT-BTC.

- Agencies or entities tasked with collecting fines enter the number of receipts returned to tax authorities at the column indicating receipts returned to tax authorities in the Form of report on use of receipts No. BC26/BLP in an Appendix to Circular No. 18/2023/TT-BTC in the following cases:

+ Receipts may be returned to tax authorities for future use if they remain valid for continued use, are in a book that remains intact, are not torn, damaged by termites, and are not stamped by fines collecting entities.

+ Receipts may be returned to tax authorities for destruction if receipt books remaining intact are no longer valid for use (including damaged receipts); or receipts valid for use are stamped by fines collecting entities.

If new receipts left in the receipt book (including damaged ones) are not needed by fines collecting entities, or if fines collecting entities find erroneous receipts, fines collecting entities may diagonally cross receipts and remain them in the receipt book and then listed them in the section of used receipts at the cancellation column in the Form of report on use of receipts No. BC26/BLP in an Appendix to Circular No. 18/2023/TT-BTC.

- When exercising the authority to impose fines in accordance with regulations, commune-level People's Committees must use receipts received from Tax Sub-departments to collect fines directly, and shall be prohibited from using other receipts.

Circular No. 18/2023/TT-BTC takes effect from May 05, 2023.

LawNet