Order and procedures for reissuance of taxpayer registration certification for individuals in case of loss or destruction as prescribed

Procedure for Reissuing When a Personal Taxpayer Registration Certificate is Lost or Burned

According to the guidance in Subsection 18, Section 2 of Administrative Procedures issued together with Decision 2589/QD-BTC in 2021 on the procedure for reissuing a Personal Taxpayer Registration Certificate, it is as follows:

Step 1:

- When a taxpayer loses or has their Personal Taxpayer Registration Certificate, Tax Code Notification, Dependent Tax Code Notification, the taxpayer shall submit a dossier requesting the reissue of the Certificate or Notification to the tax authority directly managing them;

- Individuals authorizing taxpayer registration for income-paying agencies or individuals registering for taxpayer codes through tax filing dossiers already granted the tax codes as per point a, clause 9, Article 7 of Circular 105/2020/TT-BTC, when wishing to reissue the Personal Taxpayer Registration Certificate, shall send a written request to the tax authority that issued the tax code;

- For electronic taxpayer registration dossiers:

The taxpayer accesses the electronic information portal chosen by the taxpayer (the General Department of Taxation's electronic information portal/ the competent state authority's electronic information portal, including the National Public Service Portal, the Ministry-level and provincial-level public service portals as per the regulations on single-window and interconnected single-window mechanism in administrative procedures resolution, and connected to the General Department of Taxation’s electronic portal/ the T-VAN service provider's electronic portal) to fill out the form and attach electronic dossiers as required (if any), sign electronically, and submit to the tax authority via the chosen electronic portal;

The taxpayer submits the dossier (concurrently applying both taxpayer registration and business registration under the single-window mechanism) to the competent state authority as prescribed. The competent state authority shall transfer the taxpayer's dossier information to the tax authority via the General Department of Taxation’s electronic portal.

Step 2: Tax Authority Receives:

- For paper-based taxpayer registration dossiers:

+ If the dossier is submitted directly at the tax authority: The tax official receives and stamps the docket of receipt on the taxpayer registration dossier, indicating the submission date, number of documents according to the list of documents for direct submission at the tax authority. The tax official issues a receipt, stating the date for returning results and the processing time for the received dossier;

+ If the taxpayer registration dossier is submitted by post: The tax official stamps the receipt and records the receiving date on the dossier and the tax authority's correspondence number;

The tax official shall review the taxpayer registration dossier. If the dossier is not complete and needs clarification or additional documents, the tax authority shall notify the taxpayer within 2 (two) working days from the date of receiving the dossier.

- For electronic taxpayer registration dossiers:

The tax authority receives the dossier via the General Department of Taxation's electronic portal, examine, and process the dossier through the tax authority's electronic data processing system:

+ Receiving the dossier: The General Department of Taxation's electronic portal notifies the taxpayer of the receipt of the dossier within 15 minutes from the time the taxpayer’s electronic registration dossier was submitted to the chosen electronic portal (the General Department of Taxation's electronic portal/the competent state authority's electronic portal or the T-VAN service provider’s electronic portal);

+ Reviewing and processing the dossier: The tax authority examines and processes the taxpayer's dossier according to the legal provisions on taxpayer registration and returns the results via the electronic portal chosen by the taxpayer:

++ If the dossier is complete and valid, the tax authority shall send the dossier’s processing results to the electronic portal chosen by the taxpayer within the stipulated time according to Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance guiding taxpayer registration;

++ If the dossier is not complete or invalid, the tax authority shall notify the non-acceptance of the dossier to the chosen electronic portal within 2 (two) working days from the date of the Notification of Dossier Receipt.

Procedure for Reissuing When a Personal Taxpayer Registration Certificate is Lost or Burned

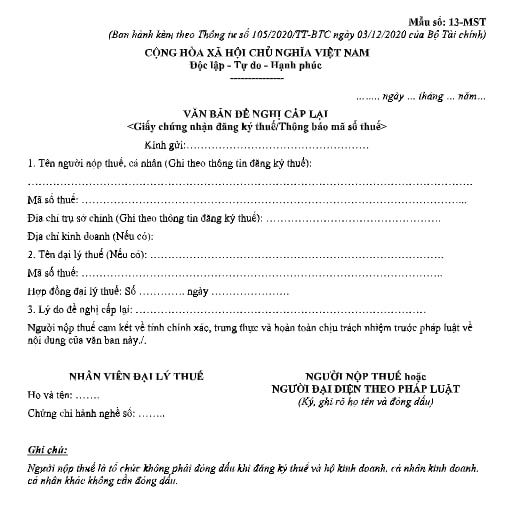

What is the Form for Requesting the Reissue of a Torn Taxpayer Registration Certificate?

For taxpayers whose Taxpayer Registration Certificate is lost, torn, damaged, or burned, the request for reissuing the Taxpayer Registration Certificate shall use form number 13-MST issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance:

Download form number 13-MST here: download

What Methods Can Taxpayers Use to Request the Reissue of a Torn or Burned Taxpayer Registration Certificate?

According to the guidance in Subsection 18, Section 2 of Administrative Procedures issued together with Decision 2589/QD-BTC in 2021, taxpayers can choose one of the following methods to request the reissue of a torn Taxpayer Registration Certificate:

- Submit directly at the Tax Authority’s office;

- Or send via the postal system;

- Or electronically via the General Department of Taxation’s electronic portal / the competent state authority’s electronic portal, including the National Public Service Portal, the Ministry-level and provincial-level public service portals according to regulations on the single-window mechanism in resolving administrative procedures and connected to the General Department of Taxation's electronic portal/ the T-VAN service provider's electronic portal.

LawNet