Does the General Department of Taxation of Vietnam require a weekly VAT refund report? Latest form for reporting results in 2023?

Urgent direction to report VAT refund status weekly according to Official Dispatch No. 2426/TCT-KK in 2023?

On June 15, 2023, the General Department of Taxation of Vietnam issued Official Dispatch No. 2426/TCT-KK in 2023, implementing the direction of the Prime Minister, the Ministry of Finance, and the General Department of Taxation of Vietnam on VAT refund.

According to that, the Official Dispatch stated that on May 26, 2023, the General Department of Taxation of Vietnam issued Official Dispatch No. 2099/TCT-KK in 2023, implementing the direction of the Prime Minister at Official Telegram No. 470/BTC-VP on VAT refund.

Then, the General Department of Taxation of Vietnam proposed the Director of the Tax Department, no later than 4 p.m. every Friday, to assign the focal point unit to summarize the results of the work mentioned in Official Dispatch No. 2099/TCT-KK in 2023 to the time of reporting, send it to the General Department of Taxation of Vietnam via the Tax Declaration and Accounting Department (email address: pdphi@gdt.gov.vn).

The specific contents of the report are as follows:

- Report the results of dialogue with associations and businesses in the area according to the content mentioned at point 4 of Official Dispatch No. 2099/TCT-KK in 2023, including: name of the Association, the enterprise that has conducted the dialogue, time implementation, content of dialogue, results of tax refund settlement of taxpayers participating in the dialogue (refund request dossier, amount to request refund, amount already settled for tax refund, amount not yet settled for tax refund , estimated time of tax refund for enterprises) according to the form attached to Official Dispatch No. 2426/TCT-KK in 2023.

- Report problems on VAT refund policy, VAT refund management; suggestions, recommendations.

- For tax refund dossiers that have been received or are being processed for tax refunds, subject to pre-tax refund inspection, which has been over 40 days since receipt of the dossiers, the General Department of Taxation of Vietnam (eg. The department recommends that the Director of the Tax Department assign the Ministry of legal assessment or internal inspection) to coordinate and work directly with the Departments of Inspection - Checking and Tax Sub-Departments that are presiding over processing tax refund dossiers to clarify the existing content, thereby proposing solutions to speed up the settlement of tax refund for taxpayers.

In addition, also periodically before 4 p.m. every Friday, report to the General Department of Taxation of Vietnam on the settlement status of key tax refund dossiers according to the list of General Department of Taxation of Vietnam enclosed with Official Dispatch No. 2426/TCT-KK in 2023, including:

Tax identification number, name of taxpayer, tax refund period, amount requested for refund, date of issuance of the decision on inspection/inspection at the taxpayer's office, date of completion of inspection/inspection at the taxpayer's office, number of times of extension/postponement/extension of inspection/inspection at the taxpayer's office or providing information and documents (if there is progress/results of verification/invoice reconciliation/origin of purchased goods (if any), related problems (if any) and clearly stating the expected time limit for issuing the decision on tax refund.

Does the General Department of Taxation of Vietnam require a weekly VAT refund report? Latest form for reporting results in 2023?

What are the tasks for VAT refund under Official Dispatch No. 2099/TCT-KK in 2023?

In Official Dispatch No. 2099/TCT-KK in 2023, the General Department of Taxation of Vietnam requested the Directors of the Departments of Taxation to promptly implement without delay the following tasks:

Firstly, the Director of the Department is fully responsible for the management of VAT refund in the locality, directs the organization to perform tax refund in accordance with the authority, according to the provisions of the law, not to prolong the backlog, causing frustration for people and enterprises;

At the same time, it is responsible for allocating adequate resources, urging its affiliated units to expeditiously complete the tax refund inspection of tax refund application dossiers received from taxpayers and classified as subject to inspection first, tax refund later, ensuring the settlement of taxpayers' tax refund dossiers within the prescribed time limit, right subjects and tax refund cases according to the provisions of tax laws and tax administration law.

Secondly, for the VAT refund application dossiers that have been checked and determined the tax amount eligible for refund, it is necessary to urgently issue a decision on tax refund to the enterprise, ensuring the prescribed time limit.

For dossiers of application for VAT refund which are being examined and verified for tax amounts eligible for refund, taxpayers must be notified of the progress of processing dossiers, estimated time for tax refund to be resolved to taxpayers to ensure publicity and transparency.

For the tax amount that has the results of inspection and verification, the tax refund shall be promptly processed in accordance with the provisions of Article 34 of Circular No. 80/2021/TT-BTC dated September 29, 2021 of the Ministry of Finance, do not wait for full verification to process tax refund for taxpayers.

Thirdly, if the application file for tax refund shows signs of law violation and has been transferred to an investigation agency, a written notice must be sent to the taxpayer and based on the conclusion of the competent authority to handle in accordance with the law according to Article 34, Article 35 of Circular No. 80/2021/TT-BTC.

Fourthly, for VAT refund dossiers that have problems, reported by associations and businesses by the following methods:

- Organize an immediate dialogue with associations and businesses from May 29, 2023 to June 2, 2023 to clarify problems, summarize and report results to the General Department of Taxation of Vietnam;

- Actively handle and resolve problems within the competence of the Tax Department. In case of problems beyond the handling competence of the Tax Department, they shall report them to the General Department of Taxation of Vietnam for timely guidance on handling.

Fifthly, receive the application for VAT refund according to the correct composition and procedures specified in Article 28 of Circular No. 80/2021/TT-BTC. In case the application has not been accepted due to insufficient procedures, must notify in writing to the taxpayer clearly stating the reason for not accepting the dossier as prescribed in Article 32 of Circular No. 80/2021/TT-BTC.

Sixthly, urgently review VAT declaration dossiers of enterprises engaged in production and trading of exported goods and services and enterprises with investment projects being implemented in the area to guide enterprises to declare, submit a tax refund application in accordance with regulations.

Strengthen the propaganda of policies on tax refund dossiers and procedures in Circular No. 80/2021/TT-BTC dated September 29, 2021 of the Ministry of Finance so that enterprises can be proactive in preparing tax refund applications, creating favorable conditions for the tax authorities when receiving the dossiers, avoiding the fact that the dossiers do not meet the requirements when sent to the tax authorities.

Seventhly, strengthen inspection and post-refund examination for tax refund decisions subject to tax refund first, check later to promptly detect the use of illegal invoices or illegal use of invoices, profiteering in tax refund to appropriate state budget, strictly handled according to the provisions of law.

For the refunded tax amount pending the response and verification results of the relevant agencies, the tax authority must clearly state in the inspection report, the inspection conclusion that there are not enough grounds to conclude that the tax amount is eligible for tax refund. Upon receiving the results of the response and verification of the relevant agencies, the tax authority determines that the refunded tax amount is not eligible for tax refund, then promulgate a Decision on tax refund recovery and penalties and calculation of late payment interest (if any) in accordance with the provisions of Articles 77, Article 113 of the 2019 Law on Tax Administration and Article 39 of Circular No. 80/2021/TT-BTC of the Ministry of Finance.

Eighthly, the Director of the Tax Department directs the propaganda department to support and promote propaganda, guidance and support for taxpayers in the area to promptly grasp and implement policies on extension, exemption and reduction of taxes, fees, charges and land rents already approved by competent authorities in order to support people, businesses, and promote production and business.

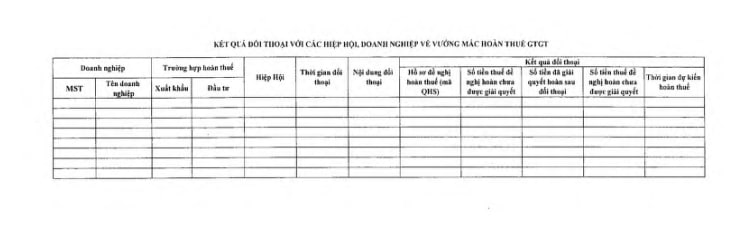

Form for reporting results of dialogue with associations and enterprises about VAT refund problems?

The form for reporting the results of dialogue with associations and enterprises on VAT refund problems, issued together with Official Dispatch No. 2426/TCT-KK in 2023, is used to summarize the results of the implementation of the tasks mentioned in Official Dispatch No. 2099/ TCT-KK in 2023.

LawNet