Vietnam: Is the CIT applicable to the method of percentage of turnover a tax declared separately?

What are the cases of declaration of CIT according to the method of percentage of turnover in Vietnam?

Pursuant to Clause 5, Article 3 of Circular No. 78/2014/TT-BTC stipulating as follows:

Method of tax calculation

...

5. For public service providers, other non-enterprise organizations established and operating under Vietnamese law, and enterprises paying value-added tax by the direct method which trade in goods or provide services liable to CIT and can determine the turnover from but cannot determine the costs of and incomes from these business activities, they shall declare and pay CIT at the following percentage of the turnover from the sale of goods or services, specifically as follows:

+ For services (including interests from deposits and loans): 5%; Particularly, education, health and art performance activities: 2%.

+ For goods trading: 1%;

+ For other activities: 2%.

Example 3: Non-business unit A leases a house and earns an annual turnover of VND 100 million. It cannot determine the cost of and income from this activity, so it chooses to declare and pay CIT at a percentage of the turnover from the sale of goods and services as follows:

Payable CIT amount = VND 100,000,000 x 5% = VND 5,000,000.

...

Thus, according to the provisions on non-business units, for public service providers, other non-enterprise organizations established and operating under Vietnamese law, and enterprises paying value-added tax by the direct method which trade in goods or provide services liable to CIT and can determine the turnover from but cannot determine the costs of and incomes from these business activities, they shall declare and pay CIT at the following percentage of the turnover from the sale of goods or services.

Vietnam: Is the CIT applicable to the method of percentage of turnover a tax declared separately? (Image from the Internet)

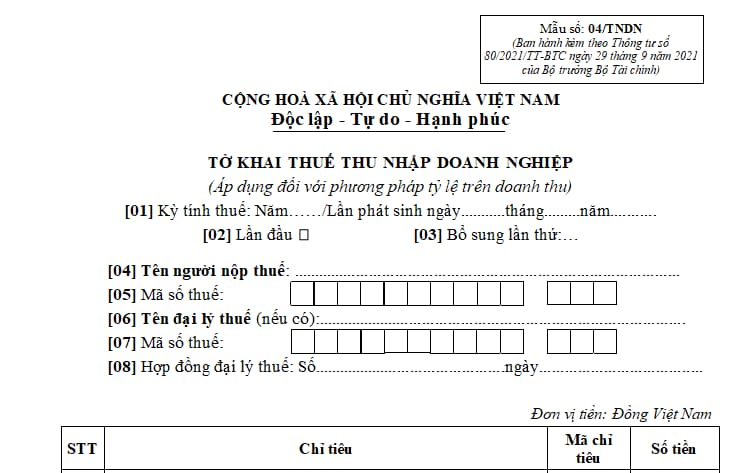

What is the CIT declaration Form No. 04/TNDN applicable to the method of percentage of turnover in Vietnam?

The form of CIT declaration applicable to the method of percentage of turnover is Form No. 04/TNDN issued together with Circular No. 80/2021/TT-BTC. Below is an image of the CIT declaration applicable to the method of percentage of turnover:

Download the form of CIT declaration applicable to the method of percentage of turnover: Click here.

Is the CIT applicable to the method of percentage of turnover a tax declared separately?

Pursuant to Point dd, Clause 4, Article 8 of Decree No. 126/2020/ND-CP stipulating as follows:

Taxes declared monthly, quarterly, annually, separately; tax finalization

...

4. The following taxes and other amounts shall be declared separately:

a) VAT payable by taxpayers specified in Clause 3 Article 7 of this Decree or taxpayers that declare VAT directly on added value as prescribed by VAT laws and also incur VAT on real estate transfer.

b) Excise tax incurred by exporters on goods that are sold domestically instead of being exported if excise tax is not paid during manufacture of such goods. Excise tax incurred by business establishments buying domestically manufactured motor vehicles, airplanes, yachts that were originally not subject to excise tax but then repurposed and become subject to excise tax.

c) Tax on exports and imports, including: export duty, import duty, safeguard duty, anti-dumping tax, countervailing duty, excise tax, environment protection tax, VAT. The Ministry of Finance shall specify the cases in which separate declaration of tax on exports and imports is not required.

d) Resource royalty payable by the organization assigned to sell confiscated resources; resource royalty on irregular resource extraction licensed by competent authorities or exempt from licensing as prescribed by law.

dd) Irregular VAT and corporate income tax incurred by payable by taxpayers paying tax directly on value added and revenue as prescribed by VAT and corporate income tax laws. In case these taxes are incurred multiple times within a month, they may be declared monthly.

...

Thus, according to the above provisions, the CIT applied to the method of percentage of turnover is a tax declared separately, except for the case these taxes are incurred multiple times within a month, they may be declared monthly.

LawNet