Excess Value-Added Tax: Refund Eligibility and Required Documentation for VAT Refund Requests

Is Overpaid Value Added Tax Refundable?

Pursuant to the provisions of Article 25 Circular 80/2021/TT-BTC on the handling of overpaid tax, late payment interest, and fines as follows:

Handling of Overpaid Tax, Late Payment Interest, and Fines

1. Taxpayers with overpaid tax, late payment interest, or fines (hereinafter referred to as overpaid amounts) as stipulated in Clause 1 Article 60 of the Law on Tax Administration shall be entitled to offset or refund as follows:

a) Offset overpaid amounts against outstanding tax, late payment interest, or fines (hereinafter referred to as outstanding amounts) or offset against tax, late payment interest, or fines arising for the next tax period (hereinafter referred to as arising amounts) in the following cases:

a.1) Offset against outstanding amounts of the taxpayer having the same economic content (sub-item) and in the same budgetary jurisdiction as the overpaid amounts.

a.2) Offset against arising amounts of the taxpayer having the same economic content (sub-item) and in the same budgetary jurisdiction as the overpaid amounts.

...

b) Refund, refund combined with offset for budget revenue

Taxpayers with overpaid amounts after offsetting according to the guidance at point a of this clause still having overpaid amounts or having no outstanding amounts shall be entitled to submit a dossier requesting a refund or a refund combined with offsetting state budget revenue as prescribed in Article 42 of this Circular. Taxpayers shall be refunded the overpaid amounts when they no longer have outstanding amounts.

Thus, taxpayers who overpay Value Added Tax (VAT) will be refunded according to the above regulations.

Is Overpaid Value Added Tax Refundable? What are the regulations for the VAT refund application?

What are the regulations for the VAT refund application?

The guidelines for the application for a refund of overpaid tax are stipulated in Clause 2 Article 42 Circular 80/2021/TT-BTC as follows:

Application for Refund of Overpaid Amounts

1. Application for personal income tax refund for income from salaries, wages

a) In case organizations or individuals paying income from salaries or wages finalize on behalf of individuals who have authorized them

The dossier includes:

a.1) Written request for handling overpaid tax, late payment interest, and fines according to Form No. 01/DNXLNT issued together with Appendix I of this Circular;

a.2) Power of attorney according to legal regulations in case the taxpayer does not directly carry out the tax refund procedures, except for cases where the tax agent submits the tax refund dossier based on the contract signed between the tax agent and the taxpayer;

a.3) List of tax payment vouchers according to Form No. 02-1/HT issued together with Appendix I of this Circular (applicable to organizations or individuals paying income).

b) In case individuals with income from salaries or wages directly finalize tax with the tax authority, having overpaid tax and requesting a refund on their personal income tax finalization declaration, they do not have to submit a tax refund dossier.

The tax authority shall resolve the refund based on the personal income tax finalization dossier to settle the overpaid amount for the taxpayer as per regulations.

2. Application for refund of overpaid amounts for other taxes and charges includes:

a) Written request for handling overpaid tax, late payment interest, and fines according to Form No. 01/DNXLNT issued together with Appendix I of this Circular;

b) Power of attorney in case the taxpayer does not directly carry out the tax refund procedures, except for cases where the tax agent submits the tax refund dossier based on the contract signed between the tax agent and the taxpayer;

c) Accompanying documents (if any).

Thus, the application for a refund of overpaid VAT includes:

- Written request for handling overpaid tax, late payment interest, and fines

- Power of attorney according to legal regulations in case the taxpayer does not directly carry out the tax refund procedures, except for cases where the tax agent submits the tax refund dossier based on the contract signed between the tax agent and the taxpayer;

- Accompanying documents (if any)

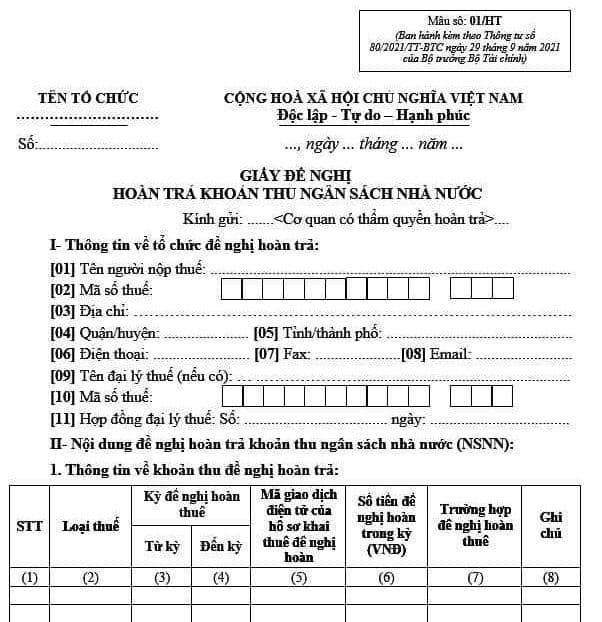

How is the VAT refund request form regulated?

Currently, when organizations or business establishments request a VAT refund (except for cases of VAT refund according to international treaties; refund of input VAT not yet fully credited when transferring ownership, converting enterprises, merging, consolidating, splitting, dissolution, bankruptcy, or ceasing operations), they need to prepare a VAT refund request form according to Form No. 01/HT Appendix I issued together with Circular 80/2021/TT-BTC as follows:

Download the VAT refund request form here.

LawNet