Procedure for Supplementary Tax Declaration Dossier 2023? What documents are included in the supplementary tax declaration dossier?

What does the supplementary filing of the tax declaration dossier include?

Based on subsection 11 Section 2 of administrative procedures issued together with Decision 1462/QD-BTC 2022, the supplementary filing of the tax declaration dossier includes:

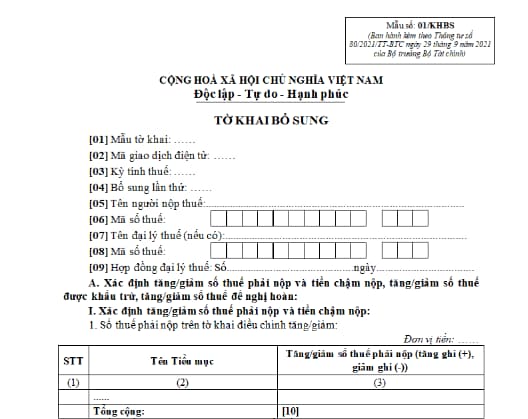

- Supplementary declaration form No. 01/KHBS (except for cases where the supplementary declaration does not change the tax obligations);

- Explanation of supplementary declaration form No. 01-1/KHBS;

- Tax declaration dossier of the tax period with errors that have been supplemented.

Latest procedures for supplementary filing of tax declaration dossier 2023? What does the supplementary filing of the tax declaration dossier include?

Latest procedures for supplementary filing of tax declaration dossier 2023?

Based on subsection 11 Section 2 of administrative procedures issued together with Decision 1462/QD-BTC 2022, the procedures for supplementary filing of the tax declaration dossier are as follows:

Step 1: The taxpayer discovers that the tax declaration dossier submitted to the tax authority has errors or omissions and proceeds with supplementary filing.

In case the taxpayer submits the dossier via electronic transaction: The taxpayer (NNT) accesses the electronic portal of their choice (the electronic portal of the General Department of Taxation or the electronic portal of a competent state agency, including the National Public Service Portal, the Ministry/Provincial Public Service Portal as per the regulations on the single-window, interagency single-window mechanism for administrative procedure settlement, which has been connected to the electronic portal of the General Department of Taxation (hereinafter referred to as the electronic portal of the competent state agency)/the portal of the T-VAN service provider) to file the tax declaration dossier and attached appendices in electronic format (if any), sign electronically, and submit to the tax authority via the selected electronic portal.

Step 2: The tax authority receives:

- In cases where the dossier is submitted directly at the tax office or sent by postal service: The tax office receives the dossier as per regulations.

- In cases where the dossier is submitted to the tax office through electronic transactions, the receipt, examination, acceptance, and resolution of the dossier are handled through the tax authority's electronic data processing system:

+ Receipt of dossier: The electronic portal of the General Department of Taxation sends a receipt notice or a notice of non-acceptance of the dossier to the taxpayer via the chosen electronic portal (the electronic portal of the General Department of Taxation/the electronic portal of the competent state agency or the T-VAN service provider) within 15 minutes of receiving the taxpayer's electronic dossier.

+ Examination and resolution of the dossier: The tax authority examines and resolves the taxpayer's tax declaration dossier in accordance with the Law on Tax Administration and guiding documents: The tax authority sends an acceptance/non-acceptance notice of the dossier to the electronic portal chosen by the taxpayer to file and submit the dossier (the electronic portal of the General Department of Taxation/the electronic portal of the competent state agency or the T-VAN service provider) within 01 working day from the date noted on the receipt notice of the electronic tax declaration dossier submission.

Where to download the supplementary tax declaration form?

- Supplementary declaration form No. 01/KHBS (except for cases where the supplementary declaration does not change tax obligations)

Download supplementary declaration form No. 01/KHBS here

LawNet