Procedure for Initial Taxpayer Registration for Dependent Units: How is it Implemented?

What is the procedure for initial taxpayer registration for dependent units?

According to Subsection 2, Section 2 of the Administrative Procedures issued with Decision 2589/QD-BTC of 2021 as follows:

Step 1: Within 10 working days from the date of issuance of the establishment decision or equivalent document, the taxpayer (NNT) must prepare a complete taxpayer registration dossier conformably and send it to the tax authority for taxpayer registration according to the place of submission as follows:

- Dependent units of economic organizations (except cooperatives) as prescribed at Point a, Point b, Clause 2, Article 4 of Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance, submit initial taxpayer registration dossiers at the Tax Department where the headquarters are located;

- Dependent units of other organizations as prescribed at Point c, Point n, Clause 2, Article 4 of Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance, submit initial taxpayer registration dossiers at the Tax Department where the organization is headquartered for central and provincial level decision-making agencies;

- For electronic taxpayer registration dossiers: Taxpayers (NNT) access the electronic information portal of their choice (General Department of Taxation’s information portal/authorized state agency information portal including National Public Service Portal, Ministry-level, provincial-level public service portals complying with one-stop-shop mechanism regulations, and have been connected to the General Department of Taxation’s information portal/authorized electronic service provider T-VAN) to fill out the declaration and attach the required dossiers in electronic form (if any), sign electronically and send it to the tax authority via the selected electronic information portal;

NNT submits the dossier (taxpayer registration dossier simultaneously with the business registration dossier through the one-stop-shop mechanism) to the competent state management agency as prescribed. The state management agency sends the received dossier information of the NNT to the tax authority via the General Department of Taxation’s information portal.

Step 2: Tax authority reception:

- For paper taxpayer registration dossiers:

- If the dossier is submitted directly at the tax authority: The tax officer receives and stamps the receipt on the taxpayer registration dossier, noting the date of receipt, the number of documents according to the list of documents for dossiers submitted directly at the tax authority. The tax officer writes a receipt for the date of return of results, processing time of received dossiers;

- If the taxpayer registration dossier is sent by post: The tax officer stamps the receipt, noting the date of receipt on the dossier and the office's dispatch number;

The tax officer checks the taxpayer registration dossier. If the dossier is incomplete and requires explanations or additional information, the tax authority will notify the taxpayer using form 01/TB-BSTT-NNT in Appendix II issued with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 02 (two) working days from the date of receipt of the dossier.

- For electronic taxpayer registration dossiers:

The tax authority receives the dossier via the General Department of Taxation’s information portal, processes the dossier through the electronic data processing system of the tax authority:

- Dossier reception: The General Department of Taxation’s information portal sends a receipt notice to NNT through the selected electronic information portal (General Department of Taxation’s portal/state authority or T-VAN service provider portal) no later than 15 minutes from the receipt of the taxpayer registration electronic dossier from the taxpayer;

- Dossier check and processing: The tax authority checks and processes the taxpayer’s dossier according to legal regulations on taxpayer registration and returns the result through the electronic information portal selected by the taxpayer to establish and send dossiers:

- If the dossier is complete and correct as prescribed and needs to be returned: The tax authority sends the processing results to the electronic information portal selected by the taxpayer to establish and send dossiers within the time limit prescribed in Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance;

- If the dossier is incomplete and or incorrect according to regulations, the tax authority sends a notice of non-acceptance of the dossier to the electronic information portal selected by the taxpayer to establish and send dossiers within 02 (two) working days from the date on the Receipt Notice.

What is the procedure for initial taxpayer registration for dependent units?

What are the documents required for initial taxpayer registration for dependent units?

According to Subsection 2, Section 2 of the Administrative Procedures issued with Decision 2589/QD-BTC of 2021 as follows:

- For dependent units of economic organizations (except cooperatives), the following documents are required:

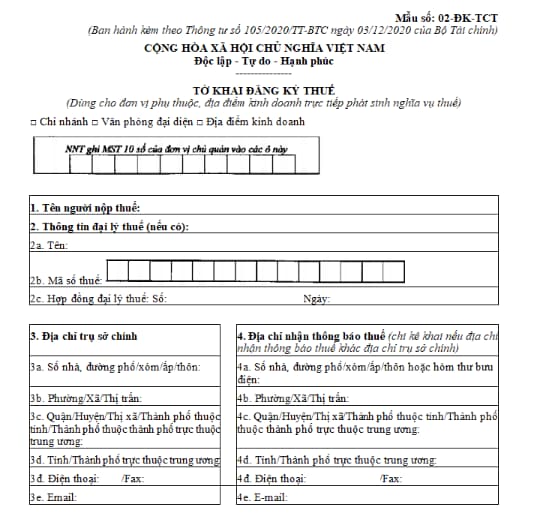

- Taxpayer registration declaration form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance;

- List of dependent units form No. BK02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- List of business locations form No. BK03-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- List of foreign contractors, foreign subcontractors form No. BK04-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- List of petroleum contractors and investors form No. BK05-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- A copy of the Certificate of Registration of the dependent unit’s operations, or the Establishment Decision, or an equivalent document issued by a competent authority, or the Certificate of Business Registration in accordance with the laws of the bordering country (for organizations from countries sharing a land border with Vietnam conducting buying, selling, and exchanging goods in border markets, border gates, or economic zone markets on Vietnam’s border).

- For dependent units of other organizations, the following documents are required:

- Taxpayer registration declaration form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance;

- List of dependent units form No. BK02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- List of business locations form No. BK03-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- List of foreign contractors, foreign subcontractors form No. BK04-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance (if any);

- A copy not required to be certified of the Establishment Decision, or an equivalent document issued by a competent authority.

How is the initial taxpayer registration declaration form for dependent units regulated?

The taxpayer registration declaration form is specified in form No. 02-DK-TCT issued with Circular 105/2020/TT-BTC dated December 03, 2020, of the Ministry of Finance as follows:

Download the initial taxpayer registration declaration form for dependent units here.

LawNet