Procedure for registering changes to taxpayer registration information when transferring capital contributions or rights to participate in oil and gas contracts - how to proceed?

Procedures for Registering Changes in Taxpayer Information When Transferring Capital Contributions, Participating Rights in Petroleum Contracts

According to Subsection 11, Section 2, Part 2 Administrative Procedures issued in conjunction with Decision 2589/QD-BTC in 2021 as follows:

Step 1: Contractors or petroleum investors transferring capital contributions in economic organizations or transferring part of their participation rights in petroleum contracts must carry out the procedure to change taxpayer information with the Tax Department where the operator is headquartered within 10 (ten) working days from the date of the information change.

- For electronic taxpayer registration dossiers: Taxpayers (NNT) log into the electronic portal chosen by the taxpayer (such as the General Department of Taxation's portal, the competent state agency’s electronic portal, the National Public Service Portal, the ministry or provincial-level public service portal according to the regulations on the one-stop-shop mechanism in resolving administrative procedures, and which has been connected to the General Department of Taxation's portal or the T-VAN service provider's portal) to fill out the declaration forms and submit the required documents electronically (if any), electronically sign and send them to the tax office through the selected electronic portal;

Taxpayers submit the dossier (the taxpayer registration dossier simultaneously with the business registration dossier under the one-stop-shop mechanism) to the competent state management agency. The competent state management agency sends the taxpayer's received dossier information to the tax office through the General Department of Taxation's electronic portal.

Step 2: Tax Office Reception:

- For paper-based taxpayer information change dossiers:

+ If the dossier is directly submitted at the tax office: Tax officials receive and stamp the taxpayer registration dossier, clearly indicate the submission date, and list the number of documents according to the list of dossier contents for direct submissions at the tax office. Tax officials issue an appointment slip indicating the date for returning results and the dossier processing time;

+ If the taxpayer registration dossier is sent by post: Tax officials stamp the reception acknowledgment, note the receipt date on the dossier, and record the tax office's dispatch number;

Tax officials review the taxpayer registration dossier. If the dossier is incomplete and requires explanation or additional information, the tax office will notify the taxpayer using form 01/TB-BSTT-NNT in Appendix II issued in conjunction with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 2 (two) working days from the receipt of the dossier.

- For electronic taxpayer registration dossiers:

The tax office receives the dossier through the General Department of Taxation's electronic portal, reviews, and processes the dossier through the tax office's electronic data processing system:

+ Receiving the dossier: The General Department of Taxation's portal sends a notification of receipt confirming that the taxpayer has submitted the dossier to the selected electronic portal (the General Department of Taxation's portal, the competent state agency, or the T-VAN service provider's portal) no later than 15 minutes from receiving the taxpayer's electronic registration dossier;

+ Reviewing and processing the dossier: The tax office reviews and processes the taxpayer's dossier according to legal regulations on taxpayer registration and returns the processing results through the selected electronic portal:

++ If the dossier meets all requirements and procedures and results need to be returned: The tax office sends the dossier processing results to the selected electronic portal according to the time specified in [Circular 105/2020/TT-BTC](https://lawnet.vn/vb/Thong-tu-105-2020-TT-BTC-huong-dan-dang-ky-thue-702A9.html) dated December 3, 2020, of the Ministry of Finance guiding taxpayer registration;++ If the dossier is incomplete or does not meet the requirements, the tax office sends a notification of dossier rejection to the selected electronic portal within 2 (two) working days from the date indicated on the reception acknowledgment.

Procedures for registering changes in taxpayer information when transferring capital contributions, participating rights in petroleum contracts.

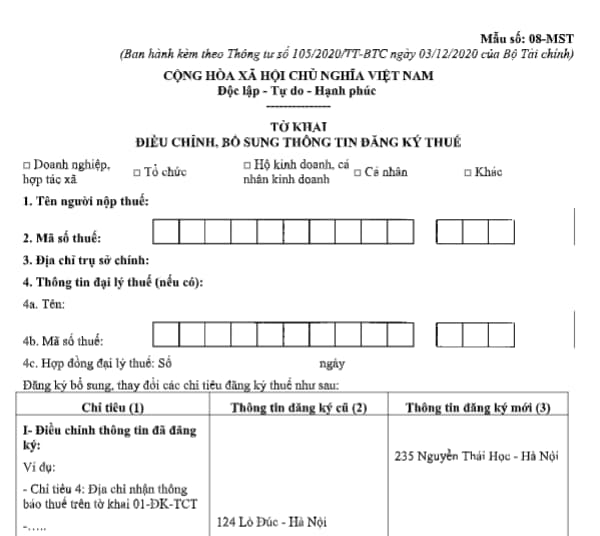

Taxpayer Information Change Declaration Form When Transferring Capital Contributions, Participating Rights in Petroleum Contracts

The taxpayer information change declaration form when transferring capital contributions, participating rights in petroleum contracts is form 08-MST issued in conjunction with Circular 105/2020/TT-BTC as follows:

Download the form for adjusting and supplementing taxpayer information here.

Processing Time for Registering Changes in Taxpayer Information When Transferring Capital Contributions, Participating Rights in Petroleum Contracts

According to Subsection 11, Section 2, Part 2 Administrative Procedures issued in conjunction with Decision 2589/QD-BTC in 2021 as follows:

- For taxpayers changing information that does not affect the information on the taxpayer registration certificate or tax identification number notification: Within 2 (two) working days from receiving the complete dossier, the tax office directly managing the taxpayer must update the information changes into the taxpayer registration application system;

- For taxpayers changing information on the taxpayer registration certificate or tax identification number notification: Within 3 (three) working days from receiving the complete dossier, the tax office directly managing the taxpayer must update the information changes into the taxpayer registration application system; simultaneously, issue the updated taxpayer registration certificate or tax identification number notification with the updated information.

LawNet