Sequence of Recording Accounting Books in Accordance with the General Journal Accounting Method for Enterprise Accounting: What are the Regulations?

What are the principles of the Journal Entry accounting method?

Based on Subsection 2 of Appendix 4 issued with Circular 200/2014/TT-BTC, the principles and basic characteristics of the Journal Entry accounting method are as follows:

All economic and financial transactions must be recorded in the Journal, with the primary focus being on the General Journal, in the order they occur and according to the economic content (accounting entry) of the transaction.

Data from the Journals is then used to record the Ledger for each transaction that occurs.

The Journal Entry accounting method includes the following main types of books:

- General Journal, Special Journals;- Ledger;- Detailed accounting books and cards.

How is the process of recording accounting books according to the Journal Entry accounting method for enterprises regulated?

How is the process of recording accounting books according to the Journal Entry accounting method for enterprises regulated?

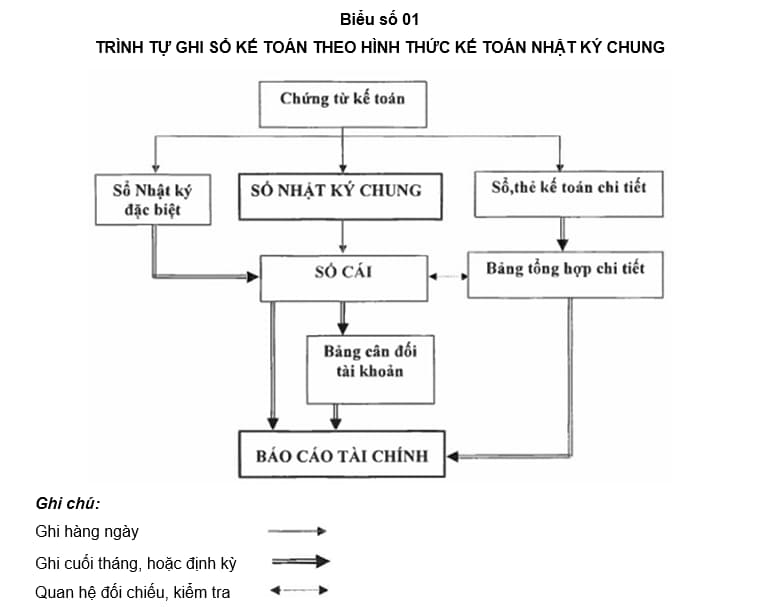

Based on Subsection 2 of Appendix 4 issued with Circular 200/2014/TT-BTC, the process of recording accounting books according to the Journal Entry accounting method is executed as the following diagram:

Note:

- Daily, based on the checked documents used as the basis for recording, first record the transactions in the General Journal, then use the data recorded in the General Journal to record in the Ledger according to the appropriate accounting accounts.

If the entity maintains detailed accounting books and cards, transactions are recorded in the related detailed accounting books and cards simultaneously with the General Journal.

- If the entity maintains Special Journals, daily or periodically, transactions are recorded in the related Special Journals based on the documents used as the basis for recording.

Periodically (3, 5, 10... days) or at the end of the month, depending on the volume of transactions, summarize each Special Journal and use the data to record the appropriate accounts in the Ledger after eliminating duplicate entries due to a transaction being recorded in multiple Special Journals (if any).

- Monthly, quarterly, and yearly, add up the data in the Ledger and prepare the Trial Balance. After verifying and matching the data correctly, the data recorded in the Ledger and the detailed summary table (compiled from the detailed accounting books and cards) are used to prepare financial reports.

- As a principle, the total Debits and total Credits on the Trial Balance must match the total Debits and total Credits in the General Journal (or General Journal and Special Journals after eliminating duplicate entries in the Special Journals) for the same period.

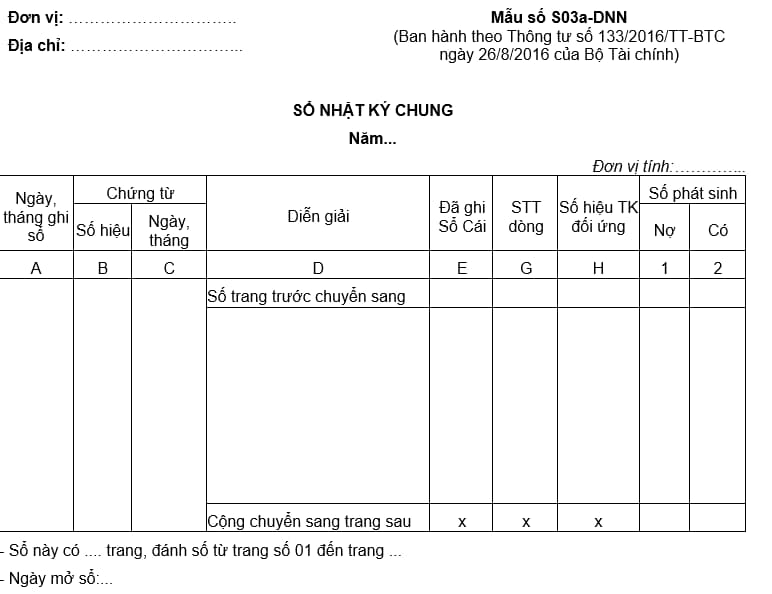

Sample General Journal for enterprise accounting activities

Currently, the General Journal sample for enterprises is specified in Sample S03a-DNN, Appendix 4 issued with Circular 200/2014/TT-BTC:

Download the General Journal Sample for enterprise accounting activities: here

Instructions for recording the General Journal for enterprise accounting activities

The structure of the General Journal is uniformly specified according to the sample issued in this policy:

- Column A: Record the date and month of the entry.- Column B, C: Record the number and date of issuance of the accounting documents used as the basis for recording.- Column D: Summarize the content of economic and financial transactions of the accounting documents.- Column E: Mark the transactions recorded in the General Journal that have been posted to the Ledger.- Column G: Record the line number of the General Journal.- Column H: Record the numbers of the Debit and Credit accounts according to the accounting entry of the transactions. The Debit account is recorded first, and the Credit account is recorded next, each on a separate line.- Column 1: Record the amount for the Debit accounts.- Column 2: Record the amount for the Credit accounts.

At the end of the page, add the cumulative amounts to transfer to the next page. At the beginning of the page, record the carry-over amount from the previous page.

In principle, all economic and financial transactions must be recorded in the General Journal. However, in cases where one or several accounting objects have a large number of transactions, to simplify and reduce the amount of Ledger entries, enterprises may open Special Journals to separately record transactions related to those accounting objects.

Special Journals are a part of the General Journal, so the recording method is similar to the General Journal. However, to avoid duplication, transactions recorded in the Special Journals are not recorded in the General Journal. In this case, the basis for recording the Ledger is the General Journal and the Special Journals.

LawNet