Sample Salary and Income Payment Table for Employees? Instructions for Recording the Salary and Income Payment Table?

How are the payroll and income payment forms for employees regulated?

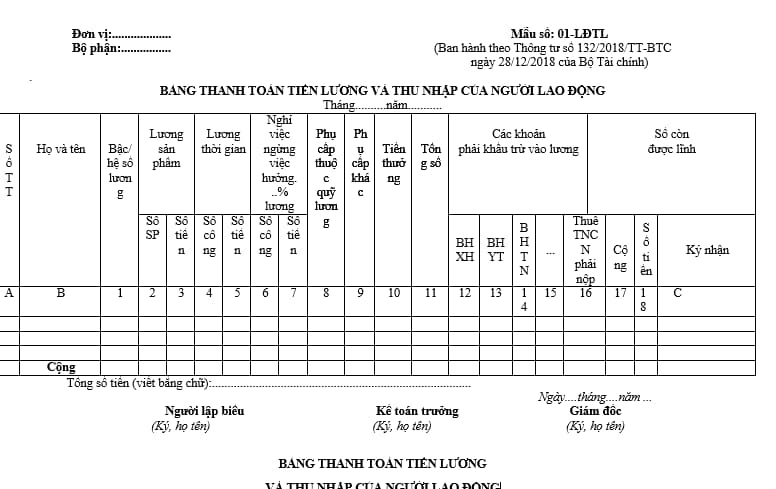

Currently, the payroll and income payment forms for employees are regulated under Form No. 01-LDTL issued together with Circular 132/2018/TT-BTC:

Download the payroll and income payment form for employees: here

Guidelines for the method and responsibility of recording the payroll and income payment form

- The payroll and income payment form for employees is made monthly. The basis for making the payroll and income payment form for employees includes relevant documents such as: timesheet, product or completed work confirmation slips...

- Column A, B: Record the serial number and full name of the employee receiving the salary.

- Column 1: Record the salary grade or salary coefficient of the employee.

- Columns 2, 3: Record the number of products and the amount calculated based on the product salary.

- Columns 4, 5: Record the number of workdays and the amount calculated based on the time salary.

- Columns 6, 7: Record the number of workdays and the amount calculated based on the time salary or leave with different percentages of salary.

- Column 8: Record allowances under the salary fund.

- Column 9: Record other allowances that are included in the employee’s income but not in the salary or bonus fund.

- Column 10: Record the total bonus amount entitled by the employee.

- Column 11: Record the total salary and allowances, bonuses that the employee is entitled to.

- Columns 12, 13, 14, 15, 16, 17: Record the amounts to be deducted from the employee's salary and calculate the total deduction for the month. In which column 17 is the total of deductions from the salary, column 17 = column 12 + column 13 + column 14 + column 15 + column 16.

- Column 18: Record the salary, bonuses, and other incomes that the employee is entitled to receive.

- Column 19: The employee signs upon receiving the salary. Each time salary is collected, the employee must sign directly in the "Signature" column or the proxy must sign on their behalf.

Payroll and income payment form for employees? Guidelines for recording the payroll and income payment form?

Can micro-enterprises choose to apply accounting vouchers according to Circular 133 or Circular 132?

(1) For micro-enterprises paying corporate income tax (CIT) based on taxable income

According to Clause 3, Article 9 of Circular 132/2018/TT-BTC:

Accounting Vouchers

...

3. In addition to the accounting vouchers guided in Clause 1 of this Article, micro-enterprises may choose to apply the accounting vouchers in Circular No. 133/2016/TT-BTC of the Ministry of Finance dated August 26, 2016, guiding accounting policies for small and medium-sized enterprises to meet the management requirements of the enterprise’s business activities.

Micro-enterprises paying CIT based on taxable income can use accounting vouchers as stipulated in Clause 1, Article 9 of Circular 132/2018/TT-BTC. Alternatively, they can choose to apply accounting vouchers in Circular 133/2016/TT-BTC.

(2) For micro-enterprises paying CIT based on the percentage of revenue from the sale of goods and services

According to Clause 2, Article 15 of Circular 132/2018/TT-BTC:

Accounting Vouchers

...

2. The forms, content, and method of preparing accounting vouchers prescribed in Clause 1 of this Article are guided in Appendix 1 "Forms and Methods of Preparing Accounting Vouchers" issued together with this Circular.

In addition to the accounting vouchers in Clause 1 of this Article, micro-enterprises may choose to apply the accounting vouchers in Clause 1, Article 9 of this Circular or Circular No. 133/2016/TT-BTC of the Ministry of Finance dated August 26, 2016, to serve the management requirements of the enterprise’s business activities.

In addition to the accounting vouchers in Clause 1, Article 15 of Circular 132/2018/TT-BTC, micro-enterprises may choose to apply the accounting vouchers in Clause 1, Article 9 of Circular 132/2018/TT-BTC or Circular 133/2016/TT-BTC.

What principles must be ensured when preparing and storing accounting vouchers of micro-enterprises?

According to Clause 1, Article 4 of Circular 132/2018/TT-BTC:

Accounting Vouchers

1. The content of accounting vouchers, the preparation and signing of accounting vouchers of micro-enterprises shall be in accordance with Articles 16, 17, 18, and 19 of the Law on Accounting and specific guidance in this Circular.

Thus, the preparation and signing of accounting vouchers of micro-enterprises are carried out according to the Law on Accounting and other related guidelines.

Referring to Article 18 of Law on Accounting 2015:

Preparation and Storage of Accounting Vouchers

1. Economic and financial transactions arising in connection with the activities of the accounting unit must be recorded in accounting vouchers. Accounting vouchers must be made only once for each economic and financial transaction.

2. Accounting vouchers must be prepared clearly, fully, promptly, and accurately according to the content specified in the form. In cases where the accounting voucher does not have a form, the accounting unit shall prepare its own accounting voucher but must ensure that it includes all the contents specified in Article 16 of this Law.

3. The content of economic and financial transactions on accounting vouchers must not be abbreviated, erased, or corrected; writing must be done in ink, numbers, and letters must be continuous, without interruption, and blank spaces must be crossed out. Erased or corrected vouchers are not valid for payment and accounting records. If an error is made in the accounting voucher, it must be canceled by crossing out the incorrect voucher.

4. Accounting vouchers must be made in a sufficient number of copies as prescribed. If an accounting voucher needs to be made in several copies for an economic and financial transaction, the contents must be the same in all copies.

5. The preparer, approver, and other signatories on accounting vouchers must be responsible for the content of the accounting vouchers.

6. Accounting vouchers prepared electronically must comply with Article 17 and Clauses 1 and 2 of this Article. Electronic vouchers must be printed on paper and stored according to Article 41 of this Law. In cases where electronic storage is used without printing, it must ensure the safety and security of data information and must be retrievable within the storage period.

The preparation and storage of accounting vouchers of micro-enterprises must ensure the principles outlined above.

LawNet