Sample Application for Issuance of Electronic Invoices with Tax Authority Codes on a Per-Occurrence Basis: Provisions and Guidelines

How to Determine the Tax Authority Issuing E-Invoices with Tax Authority Codes for Each Arising Instance?

Based on Point c, Clause 2, Article 13 of Decree 123/2020/ND-CP, the determination of the tax authority issuing e-invoices with tax authority codes for each arising instance is guided as follows:

- For organizations and enterprises: The tax authority managing the locality where the organization or enterprise is taxpayer registered, business registered, or where the organization is headquartered or stated in the establishment decision or where the sales of goods, service provision arise.

- For households and individual businesses:

+ For households and individual businesses with fixed business locations: Households and individual businesses submit an application for e-invoices with tax authority codes for each arising instance at the Tax Sub-Department managing where the household or individual conducts business activities.

+ For households and individual businesses without fixed business locations: Households and individual businesses submit an application for e-invoices with tax authority codes for each arising instance at the Tax Sub-Department where the individual resides or where the household or individual is business registered.

What is the application form for issuing e-invoices with tax authority codes for each arising instance?

What is the Application Form for Issuing E-Invoices with Tax Authority Codes for Each Arising Instance?

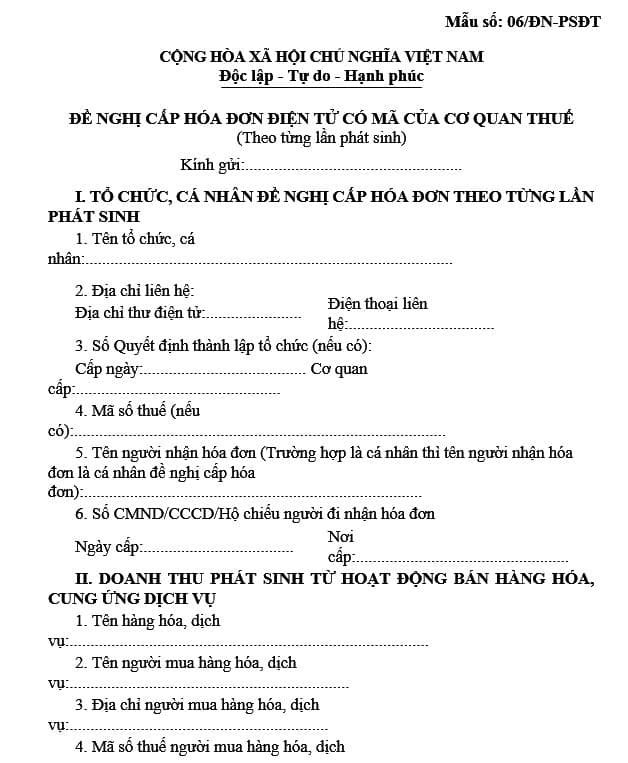

The application form for issuing e-invoices with tax authority codes for each arising instance is stipulated in Form 06/DN-PSDT issued with Decree 123/2020/ND-CP. To be specific:

Download the application form for issuing e-invoices with tax authority codes for each arising instance here.

What Needs to Be Done to Obtain E-Invoices with Tax Authority Codes for Each Arising Instance?

Based on Point b, Clause 2, Article 13 of Decree 123/2020/ND-CP, the following content is stipulated:

Applying E-Invoices When Selling Goods and Providing Services

...

2. Regulations on issuing and declaring tax obligations when the tax authority issues e-invoices with tax authority codes for each arising instance are as follows:

...

b) Enterprises, economic organizations, other organizations, households, and individual businesses eligible for e-invoices with tax authority codes for each arising instance must submit an application for e-invoices with tax authority codes in Form 06/DN-PSDT Annex IA attached to this Decree to the tax authority and access the e-invoice system of the tax authority to issue e-invoices.

After the enterprise, organization, or individual has declared and fully paid taxes as per the regulations on value-added tax, personal income tax, corporate income tax, and other taxes, fees (if any), the tax authority will, within the working day, add the tax authority code on the e-invoice issued by the enterprise, organization, or individual.

Enterprises, economic organizations, other organizations, households, and individual businesses are responsible for the accuracy of the information on the e-invoice for each arising instance issued with tax authority codes.

When eligible for e-invoices with tax authority codes for each arising instance, enterprises, economic organizations, other organizations, households, and individual businesses can submit an application for e-invoices with tax authority codes to the tax authority and access the tax authority's e-invoice system to issue e-invoices.

Subsequently, perform the declaration and full payment of taxes as per the regulations on value-added tax, personal income tax, corporate income tax, and other fees and taxes.

The tax authority will add the tax authority code on the e-invoice issued by the enterprise, organization, or individual.

Simultaneously, enterprises, economic organizations, other organizations, households, and individual businesses are responsible for the accuracy of the information on the e-invoice issued with tax authority codes for each arising instance.

LawNet