Procedures for Temporarily Suspending the Enforcement Measure of Halting Customs Procedures: What are the Regulations?

What are the conditions for temporarily suspending the application of the enforcement measure to stop customs procedures?

Based on Clause 5, Article 33 of Decree 126/2020/ND-CP stipulates the conditions for temporarily suspending the application of the enforcement measure to stop customs procedures as follows:

Enforcement by stopping customs procedures for export and import goods

...

5. Temporarily suspend the application of the enforcement measure to stop customs procedures if the taxpayer meets the following conditions:

a) No longer has overdue tax debts, late payment interest, or fines for other consignments,

b) The taxpayer must pay taxes before customs clearance or release goods for the consignment currently undergoing customs procedures.

c) The outstanding tax amounts, late payment interest, and fines owed by the taxpayer must be guaranteed according to regulations.

Accordingly, if the taxpayer meets the following conditions, the application of the enforcement measure to stop customs procedures shall be temporarily suspended:

- No longer has overdue tax debts, late payment interest, or fines for other consignments,

- The taxpayer must pay taxes before customs clearance or release goods for the consignment currently undergoing customs procedures.

- The outstanding tax amounts, late payment interest, and fines owed by the taxpayer must be guaranteed according to regulations.

How is the procedure for temporarily suspending the application of the enforcement measure to stop customs procedures regulated?

How are the application documents for temporarily suspending the enforcement measure to stop customs procedures regulated?

Based on Section 1, Appendix 2, Administrative Procedures issued with Decision 1462/QD-BTC in 2022, the application documents for temporarily suspending the enforcement measure to stop customs procedures include:

- Document components:

+ A proposal letter from the taxpayer;

+ A guarantee letter from a credit institution.

- Number of documents: 01 set

- Administrative procedure execution agency:

+ Competent authority: Ministry of Finance.

+ Authorized or decentralized agencies or individuals (if any): None.

+ Directly executing agencies: Ministry of Finance, General Department of Customs, Custom Departments.

How is the procedure for temporarily suspending the enforcement measure to stop customs procedures regulated?

Based on Section 1, Appendix 2, Administrative Procedures issued with Decision 1462/QD-BTC in 2022, the procedure for temporarily suspending the enforcement measure to stop customs procedures is regulated as follows:

- Step 1: The taxpayer meeting the conditions for temporarily suspending the enforcement measure to stop customs procedures as regulated in Clause 5, Article 33 of Decree 126/2020/ND-CP dated October 19, 2020, by the Government of Vietnam submits a proposal letter and a guarantee letter from a credit institution for the outstanding tax amounts, late payment interest, and fines to the Custom Department where the debt, which results in the enforcement measure to stop customs procedures, arises.

- Step 2: The Custom Department where the taxpayer has the debt, which results in the enforcement measure to stop customs procedures, receives, checks the accuracy and completeness of the documents, and reports, proposes to the General Department of Customs within 05 working days from the date of receiving complete documents.

In case the documents are incomplete, within 03 working days from the receipt of the documents, the customs authority receiving the documents must notify the taxpayer for document completion.

- Step 3: The General Department of Customs, based on the regulations in Clause 5, Article 33 of Decree 126/2020/ND-CP dated October 19, 2020, by the Government of Vietnam, consults relevant units (if any), and reports to the Ministry of Finance within a maximum of 07 working days from the date of receiving complete documents.

- Step 4: The Ministry of Finance considers and resolves the temporary suspension of the enforcement measure to stop customs procedures for each specific case as proposed by the General Department of Customs within 05 working days from the date of receiving the report.

- Step 5: The customs authority issuing the enforcement decision, based on the document from the Ministry of Finance, temporarily suspends the application of the enforcement measure to stop customs procedures.

How is the decision on temporarily suspending the enforcement measure to stop customs procedures for export and import goods issued?

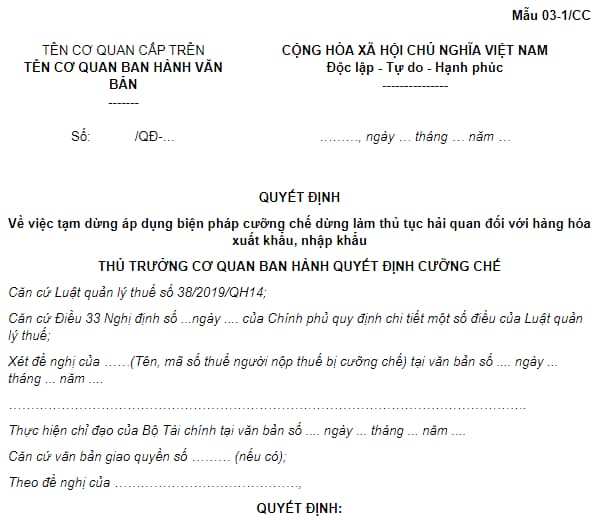

The decision on temporarily suspending the enforcement measure to stop customs procedures for export and import goods is issued according to Form No. 03-1/CC attached to Decree 126/2020/ND-CP as follows:

See the detailed Form No. 03-1/CC here

LawNet