Procedure for Submitting Revenue from Equitization of Enterprises, Public Service Providers to the State Budget: How is it Regulated?

Order of Procedures for Submitting Revenue from Business Equitization, Public Service Providers into the State Budget

According to the guidance in the Administrative Procedures promulgated with Decision 149/QD-BTC of 2023, the order of procedures for submitting revenue from business equitization, public service providers into the state budget is stipulated as follows:

(1) Enterprises, public service providers, and other responsible entities must declare and determine the amount of money collected from the ownership transformation of enterprises, public service providers.

(2) Within the timeframe stipulated in Article 7 of Circular 57/2022/TT-BTC, enterprises, public service providers, and responsible entities must declare and submit collected amounts to the state budget in accordance with the provisions of Article 6 of Circular 57/2022/TT-BTC, specifically:

- Revenue from equitization of enterprises, public service providers:

+ Revenue from public auction: Within five (05) working days from the deadline for investors to pay auction money, the auction organization is responsible for declaring and submitting the collected revenue from selling shares.

+ Revenue from auction among strategic investors: Within five (05) working days from the deadline for investors to pay auction money, the enterprise, public service provider is responsible for declaring and submitting the collected revenue from selling shares.

+ Revenue from underwriting: Within ten (10) days from the completion of share transactions under the underwriting contract, the underwriter must declare and submit the collected revenue from selling shares.

+ Revenue from negotiated sales to investors, preferential sale of shares to the union organization, employees, and enterprise managers: Within five (05) working days from the deadline for payment, the enterprise, public service provider must declare and submit the collected revenue from selling shares.

+ Revenue from book-building sale method: Within five (05) working days from the payment deadline for shareholders to purchase shares, the book manager organization is responsible for declaring and submitting the collected revenue from the share sale.

+ Revenue from equitization at the point of official transformation into a joint-stock company:

Within ninety (90) days from the date of issuance of the initial business registration certificate, the joint-stock company transformed from an equitized enterprise, public service provider is responsible for independently determining the amount of equitization revenue to be submitted to the state budget and for declaring and submitting it.

Within five (05) working days from the date of the decision by the owner's representative body approving the equitization revenue settlement at the official transformation into a joint-stock company, the joint-stock company transformed from an equitized enterprise, public service provider is responsible for declaring and submitting the additional difference amount (if any).

+ Other revenues:

Within thirty (30) days from the expiration date of the warranty period under the equitization contract, the equitized enterprise must declare and submit the entire provision for product, goods, and construction warranty (for contracts signed, warranty period remaining effective after the issuance of the initial business registration certificate) not fully utilized.

Within ten (10) working days from receiving revenue from debt recovery and asset handling, DATC is responsible for declaring and submitting the payable amounts. In cases where the payable amount is below 100 million VND per occurrence, DATC aggregates and submits monthly within five (05) working days from the last day of the previous month.

- Within ten (10) working days from the debt recovery date, commercial banks and enterprises operating in the telecommunications sector must declare and submit the payable amounts from recovered receivables not included in the value of the equitized enterprise.

Order of Procedures for Submitting Revenue from Business Equitization, Public Service Providers into the State Budget

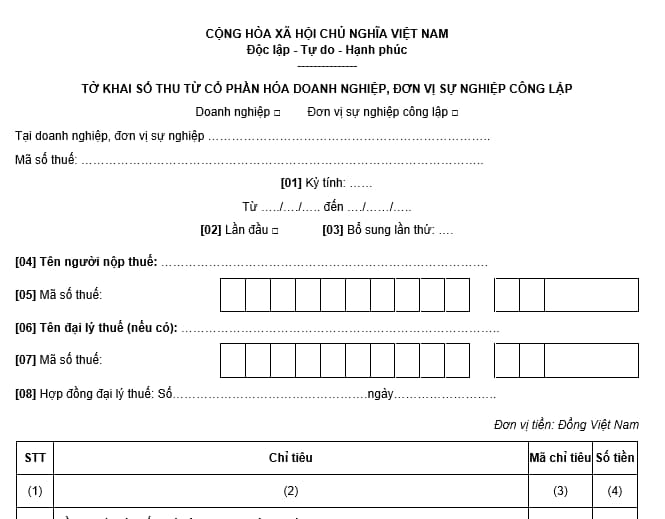

Sample Declaration Form for Revenue from Business Equitization, Public Service Providers

The sample declaration form for revenue from business equitization, public service providers is stipulated in Form No. 01/CPH issued together with Circular 57/2022/TT-BTC as follows:

Download the form here

Administrative Procedure Fees for Revenue from Business Equitization, Public Service Providers

Currently, according to the guidance in the Administrative Procedures promulgated with Decision 149/QD-BTC of 2023, no fees are charged for administrative procedures on revenue from business equitization, public service providers.

LawNet