Procedure for Registering Dependents for Family Circumstance Deduction for Individuals with Income from Salaries and Wages

Form 07/DK-NPT-TNCN Latest Dependent Registration Form?

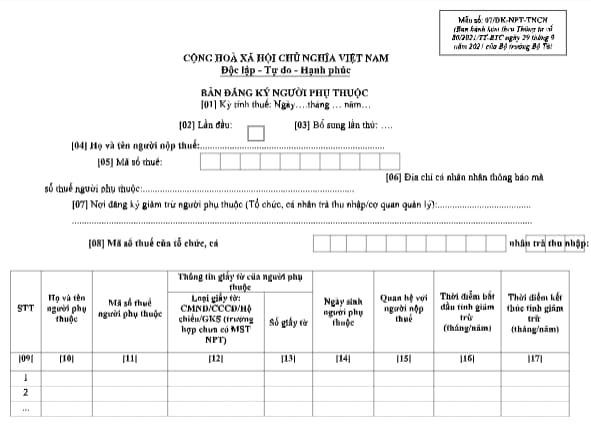

The Dependent Registration Form is Form 07/DK-NPT-TNCN issued with Circular 80/2021/TT-BTC as follows:

Download the Dependent Registration Form here.

Procedures for registering dependents to reduce family circumstance deductions for individuals with income from wages and salaries?

What are the components of the dependent registration dossier for individuals with income from wages and salaries to reduce family circumstance deductions?

Based on Section 1 Part II Administrative Procedures issued with Decision 40/QD-BTC in 2023 regulations on the dependent registration dossier for individuals with income from wages and salaries as follows:

- Case (1): Taxpayer registers to deduct dependents through organizations or individuals paying income

+ Taxpayer submits the dependent registration dossier to the organization or individual paying income including:

++ Dependent registration form No. 07/DK-NPT-TNCN according to Appendix I - List of tax declaration dossiers issued with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam and Appendix II - Specimen tax forms issued with Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance;

++ Appendix of declaration of those who are directly nurtured, form No. 07/XN-NPT-TNCN according to Appendix I - List of tax declaration dossiers issued with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam and Appendix II - Specimen tax forms issued with Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

++ Dependent proof dossier according to the guidance in Article 1 Circular 79/2022/TT-BTC dated December 30, 2022, by the Ministry of Finance.

(Note: The italicized content has been amended and supplemented)

+ Organizations or individuals paying income submit the dependent registration dossier to the directly managing Tax Department including:

Appendix of aggregated registration of dependents for those deducting family circumstance (applied to organizations or individuals paying income to register dependents for employees), form No. 07/THDK-NPT-TNCN according to Appendix I - List of tax declaration dossiers issued with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam and Appendix II - Specimen tax forms issued with Circular 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

- Case (2): Taxpayer registers to directly deduct dependents with the Tax Department, the dependent registration dossier includes:

+ Dependent registration form No. 07/DK-NPT-TNCN according to Appendix I - List of tax declaration dossiers issued with Decree 126/2020/ND-CP and Appendix II - Specimen tax forms issued with Circular 80/2021/TT-BTC.

+ Appendix of declaration of those who are directly nurtured, form No. 07/XN-NPT-TNCN according to Appendix I - List of tax declaration dossiers issued with Decree 126/2020/ND-CP and Appendix II - Specimen tax forms issued with Circular 80/2021/TT-BTC;

+ Dependent proof dossier according to the guidance in Article 1 Circular 79/2022/TT-BTC.

(Note: The italicized content has been amended and supplemented)

- Number of sets: 01 set.

For individuals paying tax through organizations or individuals paying income, submit 02 sets of dependent registration forms for family circumstance deduction to the organization or individual paying income.

How is the process of registering dependents to reduce family circumstance deductions for individuals with income from wages and salaries?

Based on Section 1 Part II Administrative Procedures issued with Decision 40/QD-BTC in 2023 regulations on the process of registering dependents to reduce family circumstance deductions for individuals with income from wages and salaries as follows:

Step 1: Register, submit the dependent proof dossier

- Register dependents:

Case (1): The taxpayer prepares the initial dependent registration dossier to calculate family circumstance deductions throughout the deduction period, submits it to the organization or individual paying income (if the taxpayer pays tax through the organization or individual paying income) no later than the tax declaration deadline (or before submitting the tax settlement dossier of the organization or individual paying income according to the provisions of the Law on Tax Administration).

The organization or individual paying income keeps one (01) set of the dossier and submits one (01) set to the directly managing Tax Department at the same time as submitting the personal income tax (PIT) declaration of that tax declaration period (or when submitting the PIT settlement dossier according to the provisions of the Law on Tax Administration).

Case (2): The taxpayer directly declares tax with the Tax Department then submits the Dependent Registration dossier to the directly managing Tax Department at the same time as submitting the personal income tax declaration of that tax declaration period according to the provisions of the Law on Tax Administration or when submitting the tax settlement dossier according to the provisions.

For dependents like siblings; grandparents; uncles, aunts, etc., according to the guidance in sub-point d.4, point d, Clause 1, Article 9 Circular No. 111/2013/TT-BTC dated August 15, 2013, by the Ministry of Finance, the deadline for registering family circumstance deductions is no later than December 31 of the tax year.

During the deduction period, if the taxpayer changes (increase/decrease) dependents or changes the workplace, the taxpayer must re-register the dependents (dossier, deadline, steps, as the initial dependent registration).

- Submit the dependent proof dossier: No later than 03 months from the date of the initial dependent registration, the taxpayer prepares the dependent proof dossier according to the guidance in Article 1 Circular 79/2022/TT-BTC, submits it to the organization or individual paying income or the Tax Department (where the initial dependent registration form was submitted).

During the deduction period, if the taxpayer changes (increase/decrease) dependents or changes the workplace, the taxpayer must re-submit the dependent proof dossier (dossier, steps, as the initial dependent proof dossier submission).

Step 2: The Tax Department receives:

- If the dossier is submitted directly at the Tax Department or by post: The Tax Department shall receive and process the dossier according to regulations.

- If the dossier is submitted via electronic transactions, receiving, checking, accepting, processing the dossier (and returning results if any) shall be done through the electronic data processing system of the Tax Department.

LawNet