Procedure for initial taxpayer registration for diplomatic missions eligible for VAT refund

What does the initial taxpayer registration dossier for diplomatic representative agencies eligible for VAT refunds include?

Based on sub-section 4, Section 2, Administrative Procedures promulgated under Decision 2589/QD-BTC in 2021, the initial taxpayer registration dossier for tax subjects such as diplomatic representative agencies, consular offices, and representative offices of international organizations in Vietnam eligible for VAT refunds for beneficiaries of diplomatic privileges and immunities includes the following:

01 set of documents:

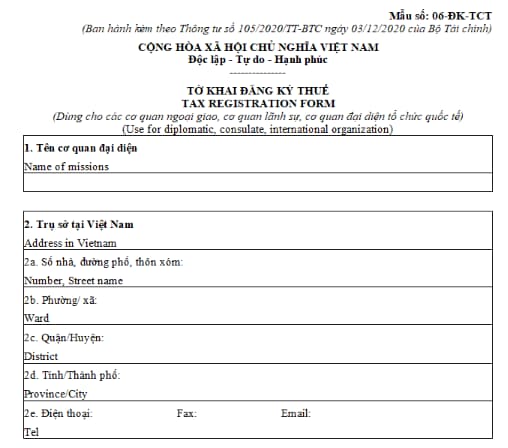

- Taxpayer registration declaration form according to form No. 06-DK-TCT issued together with Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance:

Download the taxpayer registration declaration form here.

- Confirmation letter from the State Protocol Department - Ministry of Foreign Affairs.

Initial taxpayer registration procedure for diplomatic representative agencies eligible for VAT refunds

What is the initial taxpayer registration procedure for diplomatic representative agencies eligible for VAT refunds?

Based on sub-section 4, Section 2, Administrative Procedures promulgated under Decision 2589/QD-BTC in 2021, the procedures are as follows:

Step 1: Within 10 working days from the date of the arising tax refund request, the organizations and individuals eligible for VAT refunds shall submit the dossier to the Tax Department where the organization is headquartered or where the individual has a permanent address in Vietnam.

- For electronic taxpayer registration dossiers: Taxpayers (NNT) shall access the electronic portal chosen by the taxpayer (the portal of the General Department of Taxation/the portal of competent state agencies, including the national public service portal, ministry and provincial public service portals as per the regulations on single-window and interlinked single-window mechanisms in handling administrative procedures and already connected to the electronic portal of the General Department of Taxation/portals of T-VAN service providers) to fill out the declaration form and send the required documents in electronic form (if any), sign electronically, and send to the tax authority through the chosen electronic portal.

NNT submits the dossier (taxpayer registration dossier simultaneously with the business registration dossier through one-stop-shop) to competent state management agencies. The competent state management agencies then send the received taxpayer's dossier information to the tax authority via the General Department of Taxation's electronic portal.

Step 2: Tax authority reception:

- For paper-based taxpayer registration dossiers:

+ If the dossier is submitted directly at the tax office: Tax officials receive and stamp the receipt on the taxpayer registration dossier, clearly stating the receipt date, the number of documents according to the document list for dossiers submitted directly at the tax office. Tax officials issue a receipt with a return date and processing time for the received dossier;

+ If the taxpayer registration dossier is sent via postal service: Tax officials stamp the receipt, note the receipt date on the dossier, and record the document number of the tax authority;

Tax officials review the taxpayer registration dossier. If the documents are incomplete and require explanation or additional information/documents, the tax authority notifies the taxpayer using form No. 01/TB-BSTT-NNT in Appendix II issued with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 02 (two) working days from the date of dossier receipt.

- For electronic taxpayer registration dossiers:

The tax authority receives the dossier through the electronic portal of the General Department of Taxation, checks and processes the dossier via the tax authority's electronic data processing system:

+ Receipt of the dossier: The electronic portal of the General Department of Taxation sends a receipt notice to the taxpayer through the chosen electronic portal within 15 minutes of receiving the taxpayer’s electronic registration dossier;

+ Review and processing of the dossier: The tax authority checks and processes the taxpayer's dossier as per the legal regulations on taxpayer registration and returns the result via the chosen electronic portal:

+ If the dossier is complete and in accordance with the legal procedures, and the result must be returned: The tax authority sends the result to the chosen electronic portal within the time limit specified in Circular 105/2020/TT-BTC.

+ If the dossier is incomplete or does not comply with the regulations, the tax authority sends a notice of refusal via the chosen electronic portal within 02 (two) working days from the date indicated on the receipt notice.

What taxpayer registration methods can taxpayers choose?

Based on sub-section 4, Section 2, Administrative Procedures promulgated under Decision 2589/QD-BTC in 2021, taxpayers can choose one of the following registration methods:

- Submit directly at the headquarters of the Tax Authority;

- Send via postal service;

- Or electronically via the electronic portal of the General Department of Taxation/the electronic portal of competent state agencies, including the national public service portal, ministry and provincial public service portals as per the regulations on the single-window and interlinked single-window mechanism for administrative procedures, and have connected to the electronic portal of the General Department of Taxation/portals of T-VAN service providers according to the regulations in Circular 19/2021/TT-BTC.

LawNet