The latest application form for registration of mortgage of land use rights in Vietnam? What are the signatures and stamps in applications for registration of mortgage of land use rights in Vietnam?

- What is the application form for registration of mortgage of land use rights in Vietnam?

- What are the signatures and stamps in applications for registration of mortgage of land use rights in Vietnam?

- What are the principles of registration for mortgage of land use rights and assets attached to land?

What is the application form for registration of mortgage of land use rights in Vietnam?

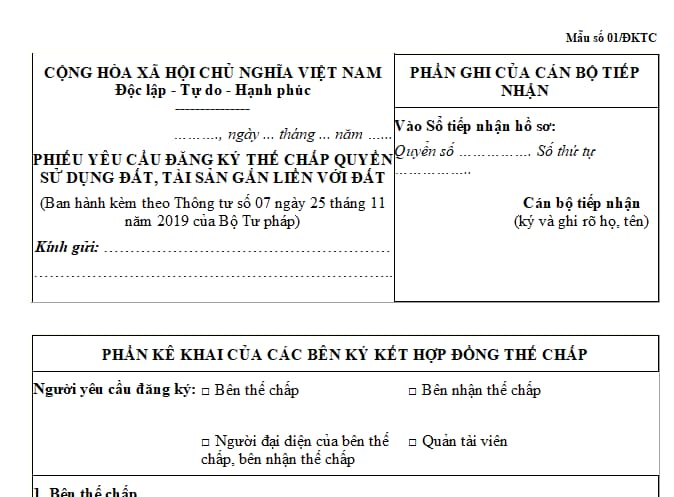

The application form for registration of mortgage of land use rights in Vietnam is form No. 01/DKTC issued together with Circular 07/2019/TT-BTP as follows:

Download the application form for registration of mortgage of land use rights in Vietnam: here.

The latest application form for registration of mortgage of land use rights in Vietnam? What are the signatures and stamps in applications for registration of mortgage of land use rights in Vietnam?

What are the signatures and stamps in applications for registration of mortgage of land use rights in Vietnam?

Pursuant to Article 6 of Circular 07/2019/TT-BTP stipulating this content as follows:

Applications must fully bear signature of competent individuals and stamps (if any) of mortgagors and mortgagees corresponding with information in mortgage agreements or of legal representatives in case mortgagors and mortgagees have representatives, except for the following cases:

- In case mortgage agreements and contracts on amendments to mortgage agreements have been certified or verified, applications only required signature of competent individuals and stamps (if any) of mortgagors, mortgagee or legal representatives thereof.

- In case of application for revision of registration contents regarding mortgagees as specified in Clause 1 Article 18 of Decree No. 102/2017/ND-CP including revision due to reorganization of juridical person, sale or purchase of debts or transition of requested rights or other civil obligations as per the law, applications are only required to bear signature of competent individuals and stamps (if any) of new mortgagees or legal representatives thereof.

In case of application for revision of registration contents regarding mortgagees in order to correct information about mortgagees; application for withdrawal of mortgaged assets; application for issuance of notice on disposal of collateral; application for withdrawal of registration, the applications are only required to bear signature of competent individuals and stamps (if any) of the mortgagees or legal representatives thereof.

- In case of application for withdrawal of registration with presence of record of mortgage agreement liquidation or documents approving registration withdrawal of mortgagees or documents confirming redemption of mortgagees, the applications are only required to bear signature of competent individuals and stamps (if any) of mortgagees or legal representatives thereof.

- In case receivers, enterprises managing or liquidating assets of other enterprises going bankrupt are applicants, applications are only required to bear signatures of competent individuals and stamps (if any) of receivers or enterprises managing or liquidating assets.

- In case of registration withdrawal as specified in Point i Clause 1 Article 21 of Decree No. 102/2017/ND-CP in which applicants are civil judgment enforcement authorities or bailiff offices that have listed and disposed mortgaged assets or assets or individuals or juridical person purchasing property for judgment enforcement, the applications are only required to bear signature of competent individuals and stamps (if any) of these organizations and individuals or legal representatives of persons or juridical person purchasing property for judgment enforcement.

- In case branches of juridical person are assigned by the juridical person to perform functions of the juridical person regarding registering security interests according to charter or authorization of competent individuals of the juridical person as per the law in cases specified in this Article, signature of competent individuals and stamps (if any) of the branches shall replace signature of competent individuals and stamps (if any) of juridical person.

What are the principles of registration for mortgage of land use rights and assets attached to land?

According to the provisions of Article 5 of Circular 07/2019/TT-BTP on the principles of registration for mortgage of land use rights and assets attached to land as follows:

- Land registration offices shall proceed with mortgage registration specified in Article 4 of this Circular of applicants and shall only proceed with registration for mortgage of land use rights, assets attached to land in case mortgagors are persons holding land use rights or owners of assets attached to land.

Parties to mortgage agreements must be responsible for details of the agreements on value of collateral, secure obligations, assurance of civil obligation satisfaction of mortgagors or other persons and other relevant regulations of civil laws; details of the agreements on collateral other than land use rights, assets attached to land and other categories that both parties are permitted to enter into agreement on as per the law.

- In case a person has registered for mortgage of property rights arising from a home purchase agreement, he/she cannot register for mortgage of that off-the-plan house; or if he/she has registered for mortgage of an off-the-plan house, he/she cannot register for mortgage of property rights arising from a home purchase agreement.

- In case a project developer has mortgaged and registered for mortgage of investment projects for construction of houses or off-the-plan houses, before selling houses in the projects, he/she must apply to revise mortgaged contents to withdraw collateral unless the project developer, buyer and mortgagee agree otherwise.

In case a project developer has mortgaged and registered for mortgage of investment projects for construction of buildings other than houses, other investment projects for construction or off-the-plan construction in projects mentioned above as per the law, before selling construction in the projects, the project developer must apply to revise mortgaged contents to withdraw collateral.

- Land registration offices shall proceed with registration for mortgage of off-the-plan assets attached to land by acknowledging registration contents according to information declared in applications. Applicants must be legally responsible for the legality, truthfulness and accuracy of declared information and of documents and papers in applications.

LawNet