Content of Support Expenditure for Human Resource Development for Small and Medium Enterprises from State Budget Funds: Implementation Details?

Content of support expenditures for human resource development for small and medium-sized enterprises from state budget funds in 2023

Circular 52/2023/TT-BTC issued on August 8, 2023, guides the mechanism for using state budget funds to frequently support small and medium-sized enterprises (SMEs) as specified in Decree 80/2021/ND-CP.

The content of support expenditures for organizing training courses in enterprise management; business start-ups; direct training at SMEs in production and processing sectors; online training via available online tools are stipulated in Clause 1 Article 8 Circular 52/2023/TT-BTC as follows:

* Basic or advanced enterprise management training course organized in the form of direct training:

- Survey expenses (mailing survey fees); enrollment expenses (mail invitation postage, phone charges, advertisement costs for the training course on information media, or hiring a service provider for enrollment).

- Lecturer and speaker fees: teaching fees (including lesson plan preparation fees); accommodation, travel, and meals (applicable to direct teaching lecturers and speakers).

- Rental of conference rooms, classrooms, computers, projectors, learning equipment; printing, photocopying, purchasing of learning materials for students according to the training program (excluding reference materials); between-class refreshments; office supplies; course opening and closing ceremonies (fresh flowers, banners); electricity, water, sanitation, car parking, photographing and archiving documentation, and other direct expenditures for the training course.

- Organizing student practice (if needed) in the forms of: experiments, model demonstrations, actual drills (costs of renting, buying, transporting to the class location the equipment, materials, tools for experiments, model demonstrations, actual drills); field surveys at domestic enterprises (cost of renting vehicles to transport students from the class to the survey location and speaker fees for the field session).

- Organizing exams, evaluating student learning outcomes (exam setting, exam supervision, exam marking); issuing certificates to students who complete the training course.

- Direct management expenses for a training course by the training unit (training unit as specified in Clause 1 Article 11 Circular 06/2022/TT-BKHDT); expenses for class management staff (accommodation, travel if the class is far from the training unit, overtime, communication); organizing meetings about the implementation of the training course (between-class refreshments, host and attendee fees).

* Basic or advanced enterprise management training course organized in a combined form (combined form of training as specified in Clause 4 Article 11 Circular 06/2022/TT-BKHDT):

Apart from the expenses specified in Point a of this Clause, additional expenses include: electronic teaching and learning materials, renting standard teaching rooms if the training unit cannot arrange rooms and has to rent externally; purchasing or renting special tools, equipment, and transmission lines to support online lessons and teaching; fees for technical support staff for online training.

* Business start-up training course:

Support expenses as specified in Point a, b of this Clause, excluding field surveys at domestic enterprises and evaluation of student learning outcomes.

* Training at SMEs in the manufacturing and processing sectors:

Support expenses as specified in Point a, b of this Clause excluding enrollment. The rental of conference rooms, classrooms, projectors, learning equipment, and electricity, water, and sanitation expenses are only determined when SMEs do not have available spaces to organize training courses.

* Online training via available online teaching tools:

Expenses as specified in Point a, b of this Clause, excluding accommodation, travel, and meals for lecturers, speakers, and class management staff; materials (hard copies), between-class refreshments, and stationary for students; field surveys; electricity, water, car parking expenses.

Content of support expenditures for human resource development for small and medium-sized enterprises from state budget funds in 2023.

What training expenses are supported by the state for developing SME human resources in 2023?

In Clause 2 Article 8 Circular 52/2023/TT-BTC, training expenses for developing SME human resources are defined as follows:

- Teaching fees for lecturers, speaker fees for class participation or field presentation: identified according to Point a Clause 2 Article 5 Circular 36/2018/TT-BTC dated March 30, 2018, of the Ministry of Finance guiding the budgeting, management, usage, and finalization of funds for training and retraining officials and public employees (hereinafter referred to as Circular 36/2018/TT-BTC).

- Accommodation, travel, and meals for lecturers, speakers, and class organizers; between-class refreshments: identified according to Circular 40/2017/TT-BTC.

- Examination setting, supervision, and marking fees: defined according to Clause 4, Point c Clause 8, Clause 10 Article 8 Circular 69/2021/TT-BTC dated August 11, 2021, of the Ministry of Finance guiding the management of funds for preparing, organizing, and attending exams applicable to general education.

- Electronic teaching materials and electronic learning materials: identified according to Circular 194/2012/TT-BTC dated November 15, 2012, of the Ministry of Finance guiding the creation of electronic information to maintain regular operations of agencies and units using state budget funds.

- Overtime expenses; determined according to the provisions of the Labor Code, Decree 145/2020/ND-CP dated December 14, 2020, of the Government of Vietnam detailing and guiding the implementation of several provisions of the Labor Code on occupational conditions and labor relations (hereinafter referred to as Decree 145/2020/ND-CP) and related guiding documents.

- Actual expenses (surveys, enrollment; printing, photocopying, purchasing learning materials; renting conference rooms, classrooms, computers, projectors, learning equipment; purchasing or renting transmission lines, special tools, online teaching and learning support equipment, and technical support staff fees for online training; office supplies; course opening and closing ceremonies; student practice; issuing certificates to students; electricity, water, sanitation, car parking, filming, photographing and archiving documentation, communication for class organizing staff): identified according to the principle specified in Point b Clause 3 Article 4 Circular 52/2023/TT-BTC.

In cases where expenses are related to many training courses (surveys, enrollment, communication; purchasing or renting package service of transmission lines, tools, and special equipment for online training for a specified period), cost allocation must be implemented for each course based on criteria determined by the training unit to ensure the rationality of the expenses.

- Direct management expenses for a training course by the training unit according to the rate specified in Point m Clause 2 Article 5 Circular 36/2018/TT-BTC, as amended in Clause 7 Article 1 Circular 06/2023/TT-BTC dated January 31, 2023, of the Ministry of Finance amending and supplementing several provisions of Circular 36/2018/TT-BTC (hereinafter referred to as Circular 06/2023/TT-BTC).

How is the determination of state budget support for SMEs implemented?

The determination of state budget support is stipulated in Clause 3 Article 8 Circular 52/2023/TT-BTC:

- Agencies and units rely on the support rates and levels for each training course specified in Article 14 Decree 80/2021/ND-CP (in which a maximum of 100% of the costs for organizing online training courses via available online teaching tools is supported) and the total cost of a training course (determined according to Clause 1, Clause 2 Article 8 Circular 52/2023/TT-BTC) to calculate the state budget support for organizing training courses.

- Students are supported with tuition fees as specified in Point b Clause 1 Article 14 Decree 80/2021/ND-CP. State budget support funds are determined based on the rate of tuition support for one student and the number of students eligible for tuition support.

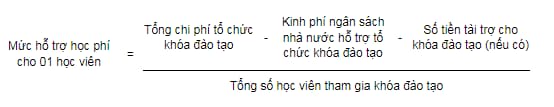

Determining the tuition support rate for one student:

Where:

+ Total cost of organizing the training course as determined according to Clause 1, Clause 2 Article 8 Circular 52/2023/TT-BTC.

+ State budget support funds for organizing the training course as determined according to Point a Clause 3 Article 8 Circular 52/2023/TT-BTC.

+ Sponsorship funds for the training course (if any) mobilized from enterprises, organizations, individuals domestically and internationally.

- Training units are responsible for preparing detailed estimates and reporting on the finalization of funds for organizing each training course according to the form attached to Circular 52/2023/TT-BTC.

LawNet