What documents do taxpayers who are contractors and investors making initial tax registration participating in oil and gas contracts have to prepare?

- What is included in the initial tax registration dossier for taxpayers who are contractors and investors who receive the profit divided from oil and gas contracts in Vietnam?

- Instructions on how to fill out tax registration declarations for contractors and investors participating in oil and gas contracts in Vietnam?

- What are the steps to make the initial tax registration for taxpayers who are contractors and investors who receive profits from oil and gas contracts in Vietnam?

What is included in the initial tax registration dossier for taxpayers who are contractors and investors who receive the profit divided from oil and gas contracts in Vietnam?

Pursuant to the provisions of subsection 7 Section II Part 2 Administrative procedures promulgated together with Decision No. 2589/QD-BTC in 2021 as follows:

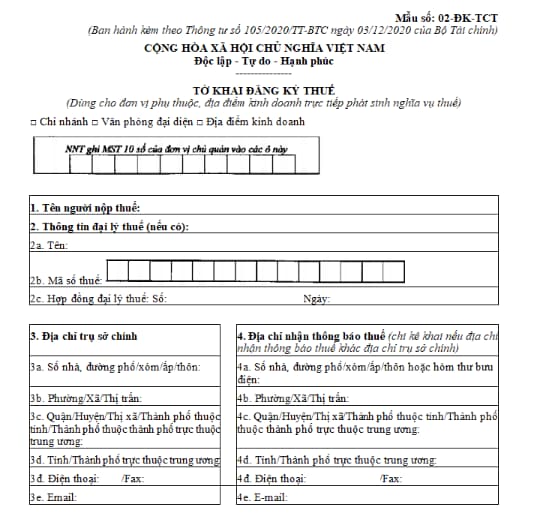

- Tax registration declaration form No. 02-DK-TCT issued together with Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance as follows:

Download the tax registration declaration form: Click here.

What documents do taxpayers who are contractors and investors making initial tax registration participating in oil and gas contracts have to prepare?

Instructions on how to fill out tax registration declarations for contractors and investors participating in oil and gas contracts in Vietnam?

Pursuant to the tax registration declaration form No. 02-DK-TCT issued together with Circular No. 105/2020/TT-BTC guiding the recording of tax registration declarations for contractors and investors participating in oil and gas contracts as follows:

(1) Taxpayer's name: Clearly and fully write in capital letters the name of the organization under the Establishment Decision or Establishment and Operation License or equivalent papers issued by a competent authority (for Vietnamese organization) or Certificate of business registration (for organizations of countries sharing a land border with Vietnam that conduct activities of buying, selling and exchanging goods at border markets, border-gate markets, market in the border gate economic zone of Vietnam).

(2) Tax agent information: Fill in all the information of the tax agent in case the tax agent signs a contract with the taxpayer to carry out tax registration procedures on behalf of the taxpayer according to the provisions of the Law on Tax Administration.

(3) Head office address: Specify house number, niche, alley, alley, street/hamlet/hamlet/village, ward/commune/town, district/district/town/city of province, province/ taxpayer's city. If there is a phone number, fax number, specify the area code - phone number/Fax number according to the following address information:

- The address of the head office of the taxpayer being an organization.

- Address of the place of business in border markets, border-gate markets, and markets in border-gate economic zones, for taxpayers who are organizations of countries sharing a land border with Vietnam.

- The address of the place where the oil and gas exploration and extraction takes place, for the oil and gas contract.

- Taxpayers must fully and accurately declare email information. This email address is used as an electronic transaction account with the tax authority for electronic tax registration records.

(4) Address to receive tax notices: If the taxpayer is an organization whose address to receive notices of tax authorities is different from the address of the head office in item 3 above, specify the address to receive the tax notice to contact tax authorities.

(5) Establishment decision:

- For taxpayers who are organizations with establishment decisions: Specify the decision number, decision issuance date and decision-issuing agency.

- For contractors and investors participating in oil and gas contracts: Specify the contract number, contract signing date, leave the decision-making agency blank.

(6) Establishment and operation license or equivalent document issued by a competent authority:

Specify the number, date of issue and the issuing authority of the Business Registration Certificate of the country sharing a border with Vietnam (for taxpayers being an organization of a country sharing a land border with Vietnam that conducts trading activities), exchange of goods at border markets, border-gate markets, markets in border-gate economic zones of Vietnam), establishment and operation license or equivalent license issued by a competent authority (for taxpayers being a Vietnamese organization).

Particularly for the information "issuer" of the Business Registration Certificate: write the name of the country sharing the land border with Vietnam that has issued the Certificate of Business Registration (Laos, Cambodia, China).

(7) Main business lines: Write according to business lines on the License for Establishment and Operation or an equivalent License issued by a competent authority (for taxpayers being a Vietnamese organization) and Certificate of Business Registration (for taxpayers who are organizations of a country sharing a land border with Vietnam that conducts activities of buying, selling and exchanging goods at border markets, border-gate markets, and markets in border-gate economic zones of Vietnam).

Note: only write 1 main line of actual business.

(8) Charter capital:

- For taxpayers in the form of limited liability company, joint-stock company, partnership: write according to charter capital License for establishment and operation or equivalent license granted by competent authority or capital source on the Establishment Decision (specify the currency, the classification of capital sources by owner, the proportion of each type of capital in the total capital).

- For taxpayers in the form of private enterprises: Record according to the investment capital on the License for establishment and operation or an equivalent license issued by a competent authority (specify the currency).

- For taxpayers who are organizations of countries sharing land borders with Vietnam and other organizations: If on the establishment decision, business registration certificate, etc., there is capital, write, if not Please leave this information blank.

(9) Business start date: Declare the date the taxpayer started actual operation if it is different from the date of issuance of the tax identification number.

(10) Economic type: Put an X in one of the corresponding boxes.

(11) Accounting form of business results: Mark X in one of the two boxes of this entry.

(12) Fiscal year: Specify from the first day and month of the accounting year to the last day and month of the accounting year according to the calendar year or fiscal year.

(13) Information about the managing unit or direct management unit: Specify the name and tax code of the superior unit directly managing the dependent unit.

(14) Information of the legal representative/owner of a private enterprise: Declare detailed information of the legal representative of the taxpayer being an organization (for economic organizations and other organizations except private enterprises) or private business owner information.

(15) Method for calculating VAT: Organizations themselves mark an X in one of the corresponding boxes.

(16) Information about related entities:

- If the taxpayer has a dependent unit, he must mark an X in the box "Has a dependent unit", then he must declare it in the "List of dependent units" with form No. BK02-DK-TCT.

- If the taxpayer has a place of business, dependent warehouses that do not have business functions, then mark an X in the box "Has a business location, dependent warehouses", and then must declare in the section “List of business locations” form No. BK03-DK-TCT.

- If taxpayers have foreign contractors and foreign sub-contractors, they must mark X in the box "There are foreign contractors and foreign sub-contractors", then they must declare in the section "List of foreign contractors, foreign subcontractors” form No. BK04-DK-TCT.

- If taxpayers have oil and gas contractors and investors, they must mark an X in the box "There are oil and gas contractors and investors", then they must declare in the section "List of oil and gas contractors and investors” form No. BK05-DK-TCT (for oil and gas contracts).

(17) Other information: Specify full name, personal tax identification number, contact phone number and email of the Director and Chief Accountant of the taxpayer.

(18) Status before the re-organization of the economic organization (if any): If the taxpayer is an economic organization registered for tax due to the reorganization of the previous economic organization, mark an X in one of the following areas: case: merger, consolidation, division, separation and must clearly state the previously issued tax identification numbers of economic organizations that are merged, consolidated, divided or separated.

(19) The part of the taxpayer or the legal representative of the taxpayer to sign and full name: The taxpayer or the legal representative of the taxpayer must sign and write his/her full name in this section.

(20) Taxpayer's stamp: If the taxpayer has a seal at the time of tax registration, this section must be stamped. If the taxpayer does not have a seal at the time of tax registration, it is not required to stamp it on the tax return. When taxpayers come to receive the results, they must add the stamp to the tax office.

(21) Tax agent staff: If the tax agent declares on behalf of the taxpayer, this information shall be declared.

What are the steps to make the initial tax registration for taxpayers who are contractors and investors who receive profits from oil and gas contracts in Vietnam?

Pursuant to the provisions of subsection 7 Section II Part 2 Administrative procedures promulgated together with Decision No. 2589/QD-BTC in 2021 on the order of implementation as follows:

Step 1: Within 10 working days from the date of signing the oil and gas contract or agreement, the taxpayer prepares a complete tax registration dossier in accordance with regulations and then sends it to the Tax Department where the head office is located for tax registration procedures.

- For the case of electronic tax registration dossiers: Taxpayers access the portal selected by the taxpayer (the portal of the General Department of Taxation/the portal of the General Department of Taxation). Competent state agencies include the National Public Service Portal, ministerial-level public service portals, and provincial-level public services in accordance with regulations on implementation of the one-stop-shop mechanism in handling administrative procedures and have been connected to the website of the General Department of Taxation / Portal of the T-VAN service provider) to declare the declaration and attach the required documents in electronic form (if any), sign electronically and sent to the tax authority through the portal selected by the taxpayer;

Taxpayers submit dossiers (tax registration dossiers concurrently with business registration dossiers under the one-stop-shop mechanism) to competent state management agencies according to regulations. The competent state management agency shall send information about the taxpayer's received dossier to the tax authority via the web portal of the General Department of Taxation.

Step 2: The tax authority receives:

- For paper tax registration dossiers:

+ In case the dossier is submitted directly at the tax office: The tax official receives and stamps the receipt into the tax registration dossier, clearly stating the date of receipt of the dossier, the number of documents according to the list of dossiers for the case of tax registration dossiers submitted directly at the tax authorities. The tax officer writes an appointment slip for the date of return of the results and the time limit for processing the received documents;

+ In case the tax registration dossier is sent by post, the tax official shall stamp the receipt, write the date of receipt of the dossier in the dossier and write the letter number of the tax authority;

Tax officials check tax registration dossiers. In case the dossier is incomplete and needs to be explained and supplemented with information and documents, the tax authority shall notify the taxpayer using form No. 01/TB-BSTT-NNT in Appendix II issued together with Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government within 02 (two) working days from the date of receipt of the application.

- For the case of electronic tax registration dossiers:

The tax authority shall receive dossiers through the portal of the General Department of Taxation, inspect and process the dossiers through the tax authority's electronic data processing system:

+ Receipt of dossiers: The website of the General Department of Taxation sends a notice of receipt of the taxpayer's submission of the dossier to the taxpayer via the portal that the taxpayer chooses to make and send the dossier (e.g. website of the General Department of Taxation/Website of a competent state agency or organization providing T-VAN services) within 15 minutes from the date of receipt of the taxpayer's electronic tax registration dossier;

+ Checking and processing dossiers: Tax authorities shall examine and process taxpayers' dossiers in accordance with the law on tax registration and return settlement results via the electronic portal that the taxpayers Taxes choose to make and send dossiers:

++ In case the dossier is complete and according to the prescribed procedures and the results must be returned: The tax authority shall send the results of the dossier settlement to the portal that the taxpayer chooses to prepare and submit the dossier according to the deadline specified in Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance guiding tax registration;

++ In case the dossier is incomplete or not according to the prescribed procedures, the tax authority shall send a notice of refusal to accept the dossier, send it to the portal that the taxpayer chooses to make and send the dossier within 02 (two) working days from the date written on the Notice of application receipt.

LawNet