Decree 90/2023/ND-CP on road user charges in Vietnam: 05 cases of road user charges exemption?

Decree 90/2023/ND-CP: 05 cases of road user charges exemption in Vietnam?

According to Article 3 of Decree 90/2023/ND-CP, there are 05 cases of road user charges (RUC) exemption. Specifically:

Cases of Fee Exemption

Exemption from RUC for fee payers for the following types of automobiles:

1. Ambulances.

2. Fire trucks.

3. Specialized vehicles used for funeral services, including:

a) Vehicles specifically designed for funeral services (including funeral cars, refrigerated trucks for storing and transporting corpses).

b) Vehicles associated with funeral services (including vehicles transporting funeral attendees, flower trucks, image-carrying vehicles) that are exclusively used for funeral activities and have vehicle registration certificates in the name of the funeral service provider. The funeral service provider must declare that these vehicles are only used for funeral services and send a commitment to the registration unit when inspecting the vehicles (specifying the number of vehicles and their license plates by type).

4. Specialized vehicles serving national defense, including vehicles with red backgrounds and white embossed letters and numbers, equipped with specialized national defense equipment (including tankers, cranes, vehicles transporting armed forces personnel understood as passenger cars with 12 seats or more, covered cargo trucks equipped with seating, control vehicles, military inspection vehicles, specialized prisoner transport vehicles, rescue and salvage vehicles, satellite communication vehicles, and other specialized vehicles serving national defense).

5. Specialized vehicles of units within the organizational system of the people's police force, including:

a) Traffic police vehicles with the inscription: "TRAFFIC POLICE" on both sides of the vehicle body.

b) 113 police vehicles with the inscription: "POLICE 113" on both sides of the vehicle body.

c) Mobile police vehicles with the inscription "MOBILE POLICE" on both sides of the vehicle body.

d) Transport vehicles with seating installed in the cargo area of the people's police force on duty.

đ) Prisoner transport vehicles, rescue and salvage vehicles, and other specialized vehicles of the people's police force.

e) Specialized vehicles (satellite communication vehicles, armored vehicles, anti-terrorism and riot control vehicles, and other specialized vehicles of the people's police force).

Thus, according to the regulations, the 05 types of automobiles exempt from RUC include:

- Ambulances.

- Fire trucks.

- Specialized vehicles used for funeral services.

- Specialized vehicles serving national defense as specified above.

- Specialized vehicles of units within the organizational system of the people's police force as specified above.

Decree 90/2023/ND-CP: How much is RUC? What are 05 cases of road user charges exemption in Vietnam? (Image from Internet)

What are RUC according to Decree 90/2023/ND-CP?

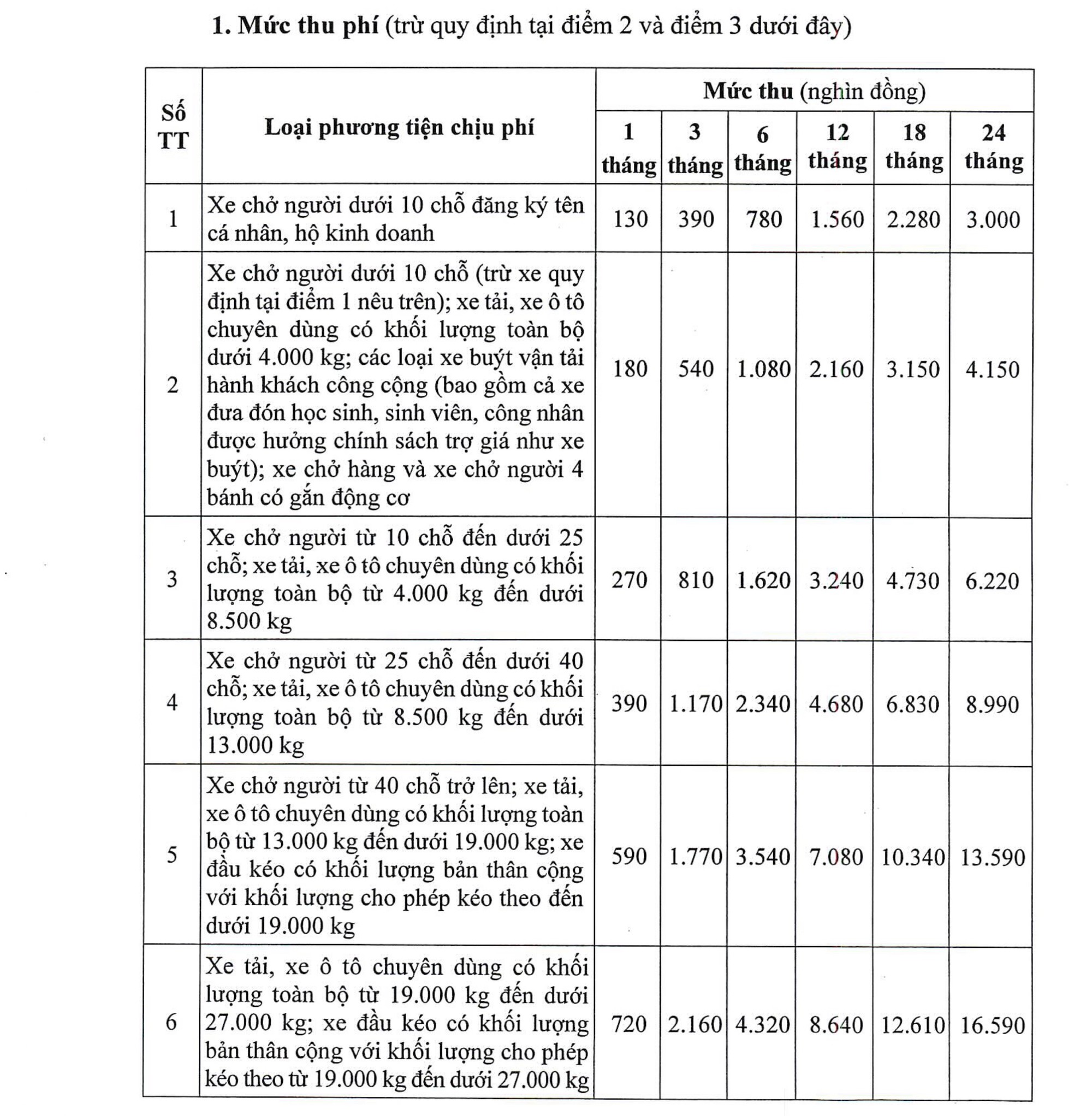

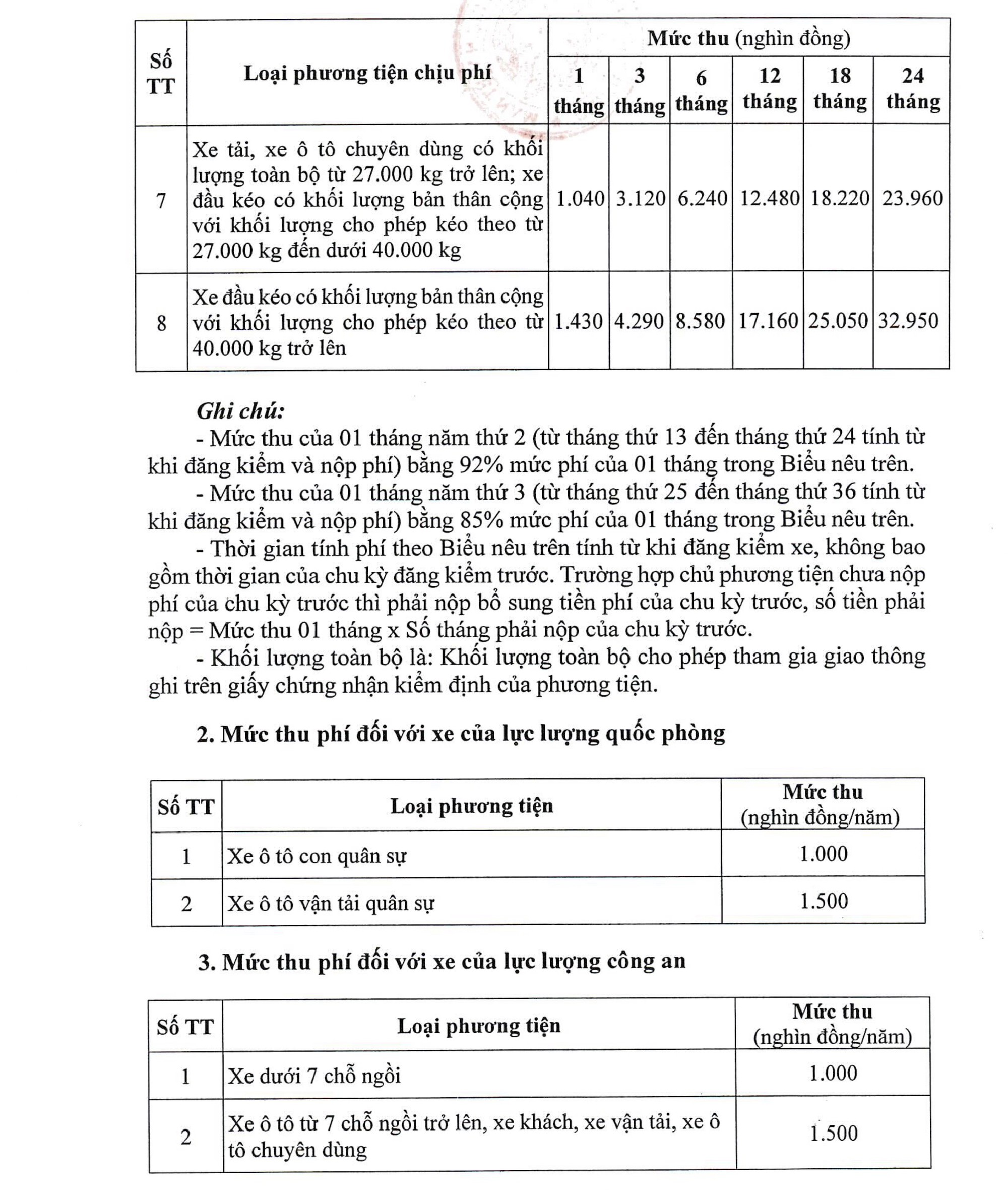

The RUC are implemented according to Article 5 of Decree 90/2023/ND-CP and Appendix I attached to Decree 90/2023/ND-CP.

To be specific, as follows:

Note: In case the fee amount to be paid is an odd amount, the fee collection organization rounds the number according to the principle that an odd amount below 500 dong is rounded down, and an odd amount from 500 dong to less than 1,000 dong is rounded up to 1,000 dong.

When does Decree 90/2023/ND-CP take effect?

According to the provisions of Article 10 of Decree 90/2023/ND-CP on the effective date as follows:

Effective Date

1. This Decree takes effect from February 1, 2024.

2. Repeal:

a) Clause 1 of Article 2 of Decree No. 09/2020/ND-CP dated January 13, 2020, of the Government of Vietnam, abolishing several legal documents on the Road Maintenance Fund.

b) Circular No. 70/2021/TT-BTC dated August 12, 2021, of the Minister of Finance, regulating the rates, collection policies, payment, exemption, management, and use of RUC.

3. Other matters related to the collection, payment, management, use, receipt, and disclosure of road usage fee collection policies not provided in this Decree shall be implemented according to the Law on Fees and Charges, the Law on Tax Administration, Decree No. 120/2016/ND-CP, Decree No. 82/2023/ND-CP, Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam, detailing several articles of the Law on Tax Administration, Decree No. 91/2022/ND-CP dated October 30, 2022, of the Government of Vietnam, amending and supplementing several articles of Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam, detailing several articles of the Law on Tax Administration; Decree No. 123/2020/ND-CP dated October 19, 2020, of the Government of Vietnam, on invoices and vouchers.

4. During the implementation process, if the referenced legal documents in this Decree are amended, supplemented, or replaced, the new amended, supplemented or replaced legal document shall be applied.

5. Ministers, Heads of ministerial-level agencies, Heads of agencies under the Government of Vietnam, the Chairmen of the People's Committees of provinces and centrally-run cities shall be responsible for the implementation of this Decree.

Thus, Decree 90/2023/ND-CP takes effect from February 1, 2024.

LawNet