What are details of form of quality assessment of valuation training class in Vietnam from July 1, 2024, according to Circular 39?

What are details of form of quality assessment of valuation training class in Vietnam from July 1, 2024, according to Circular 39?

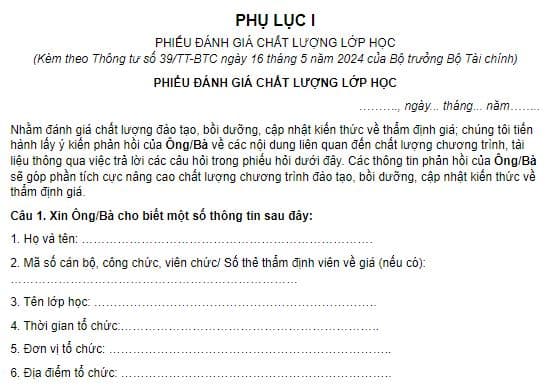

According to Appendix I attached to Circular 39/2024/TT-BTC dated May 16, 2024, by the Minister of Finance, the form of quality assessment of valuation training class in Vietnam is regulated as follows:

>> Form of quality assessment of valuation training class in Vietnam: Download

What are details of form of quality assessment of valuation training class in Vietnam from July 1, 2024, according to Circular 39? (Internet Image)

What are regulations on final examination and assessment of trainees’ performance in asset and business valuation training class in Vietnam?

According to Article 11 of Circular 39/2024/TT-BTC, the examination and assessment of trainees’ performance in Vietnam is regulated as follows:

- Upon completion of the valuation training class, the training unit must organize an assessment of learning outcomes. The content of the tests must reflect the basic knowledge of the topics in the training program:

+ For training classes specified in points a and b, Clause 2, Article 10 of Circular 39/2024/TT-BTC, the assessment is conducted with two (02) written tests; the test for general knowledge lasts 120 minutes, and the test for professional knowledge lasts 150 minutes;

+ For learners specified in point d, Clause 2, Article 10 of Circular 39/2024/TT-BTC, a written test of 150 minutes is required for supplementary topics.

- The tests are graded on a scale of 10 (ten). Tests scoring below 5 points are considered unsatisfactory.

- Learners who attend less than 80% of the required course time for each topic are not eligible to participate in the final assessment for that topic and must retake the missing topic.

- In cases of maternity leave, accidents, illness with a hospital certificate (hereafter referred to as special reasons), learners who cannot attend the final assessment must apply for a postponement and receive approval from the Head of the training unit.

- Learners with unsatisfactory tests and those unable to attend tests due to special reasons stipulated in Clause 4, Article 11 of Circular 39/2024/TT-BTC are entitled to re-sit the tests once. The time for retaking the tests is determined by the Head of the training unit but must not exceed 6 (six) months from the course end date.

Who are the trainees of asset and business valuation training class in Vietnam?

According to Article 8 of Circular 39/2024/TT-BTC, the trainees of asset and business valuation training class in Vietnam include:

Trainees

1. Individuals who intend to take the exam to be granted an appraiser card.

2. Other individuals interested in participating in the valuation training class.

Thus, there are 02 trainees for asset valuation and enterprise valuation training: individuals intending to take the exam to be granted an appraiser card and other interested individuals.

According to Article 13 of Circular 39/2024/TT-BTC, the trainees for state valuation refresher training include:

Trainees of state valuation refresher training

1. Individuals conducting state valuation work.

2. Other individuals in government agencies and individuals interested in state valuation training.

Thus, there are 02 trainees for state valuation training: individuals conducting state valuation work and other individuals in government agencies and those interested.

In addition, According to Article 3 of Circular 39/2024/TT-BTC, the principles of training, education, and knowledge updating are regulated as follows:

- The program, content, and duration of training, education, and knowledge updating must be suitable for the participants as specified in Circular 39/2024/TT-BTC.

- The content for training, education, and knowledge updating must be regularly updated, improved in quality, and meet the requirements of the participants.

- Training, education, and knowledge updating are conducted in a centralized manner. In emergencies, incidents, disasters, natural calamities, epidemics, or other necessary cases, the Ministry of Finance will notify that the training, education, and knowledge updating will be conducted online.

- The organization of training, education, and knowledge updating must comply with the regulations in Circular 39/2024/TT-BTC.

What are the topics included in the valuation training in Vietnam?

According to Appendix V attached to Circular 39/2024/TT-BTC dated May 16, 2024, by the Minister of Finance, the framework of the valuation training program includes the following topics:

- Legal topics applicable in valuation.

- Principles of market price formation and basic principles of valuation.

- Financial analysis of enterprises.

- Real estate valuation

.- Movable asset valuation 1 (valuation of machinery and equipment)

.- Movable asset valuation 2 (valuation of intangible assets and other movable assets).

- Enterprise valuation.

LawNet