Sample Application for Registration of Joint Stock Company in 2022: Regulations and Important Notes

What are the regulations on the application for registration of a joint-stock company in 2022?

According to the regulations in Article 23 of Decree 01/2021/ND-CP, the application for registration of a joint-stock company includes:

- An application form for enterprise registration.

- The company's charter.

- A list of members for limited liability companies with two or more members; a list of founding shareholders and a list of shareholders who are foreign investors for joint-stock companies.

- Copies of the following documents:

+ Legal documents of the individual representing the enterprise according to the law;

+ Legal documents of the individual members, founding shareholders, and shareholders who are foreign investors; legal documents of organizations for members, founding shareholders, and shareholders who are foreign investors; legal documents of the individual representing the authorized member, founding shareholder, and shareholder who are foreign investors and the document appointing the authorized representative.

For members or shareholders who are foreign organizations, the copies of legal documents of the organization must be consularly legalized;

+ Investment registration certificate in cases where the enterprise is established or participates in the establishment by foreign investors or economic organizations with foreign investment capital as stipulated in the Investment Law and the guiding documents.

Sample application form for registration of a joint-stock company in 2022 as stipulated. What should be noted when writing the application form for registration of a joint-stock company? (Image from the Internet)

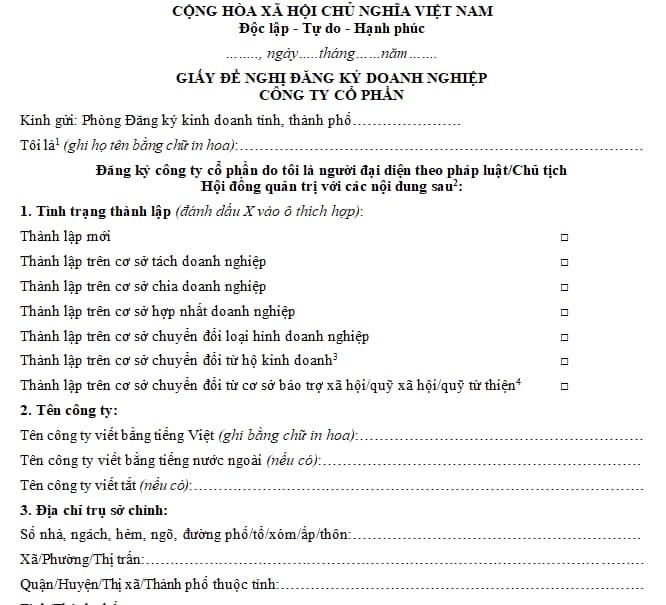

What is the sample application form for registration of a joint-stock company in 2022?

The sample application form for registration of a joint-stock company is implemented according to the form in Appendix I-4 issued with Circular 01/2021/TT-BKHDT:

Download the sample application form for registration of a joint-stock company in 2022 here.

What should be noted when writing the application form for registration of a joint-stock company?

According to the notes in the sample application form for registration of a joint-stock company issued with Appendix I-4 attached to Circular 01/2021/TT-BKHDT:

(1) In case the Court or Arbitration appoints a person to carry out the enterprise registration procedure, the appointed person shall fill in the information in this section.

(2) In case of registering to convert the type of enterprise while simultaneously registering to change the legal representative, the Chairman of the Board of Directors of the company after conversion shall fill in the information in this section.

(3), (4) In case of registering the establishment of a joint-stock company based on the conversion from a household business/social protection establishment/social fund/charity fund via electronic information network, the applicant shall scan the business registration certificate/establishment registration certificate (for social protection establishments)/license of establishment and recognition of the fund’s charter (for social funds/charity funds) in the enterprise registration dossier via electronic information network and directly submit the original documents to the Business Registration Office to be granted the enterprise registration certificate as stipulated in Articles 27 and 28 of Decree 01/2021/ND-CP.

(5) Declare in cases involving foreign investors contributing capital, purchasing shares, or contributing capital leading to changes in the content of enterprise registration.

(6) Record information of all legal representatives if the company has more than one legal representative.

(7) If the enterprise is granted a Business Registration Certificate after the declared start date of operation, the start date of operation is the date the enterprise is granted the Business Registration Certificate.

(8) In case the accounting year coincides with the calendar year, record from January 1 to December 31.

- In case the accounting year follows a fiscal year that differs from the calendar year, record the start date of the fiscal year as the first day of the quarter; the end date of the fiscal year is the last day of the quarter.

(9) Declare only in the case of new establishments. The enterprise shall base on the provisions of the law on value-added tax and its anticipated business activities to determine one of the four methods of calculating value-added tax at this indicator.

(10) The enterprise is responsible for ensuring the conditions for using self-printed invoices, ordered invoices, electronic invoices, and purchasing invoices from the tax authority as prescribed by law. Do not declare in cases of establishing enterprises based on the conversion of the type of enterprise.

(11) Do not declare in cases of establishing enterprises based on the conversion of the type of enterprise.

(12) Do not declare in cases of establishing enterprises based on the conversion of the type of enterprise.

(13) The legal representative of the enterprise shall directly sign in this section.

- In case of registering to convert the type of enterprise while simultaneously registering to change the legal representative, the Chairman of the Board of Directors of the company after conversion shall directly sign in this section.

- In case the Court or Arbitration appoints a person to carry out the enterprise registration procedure, the appointed person shall directly sign in this section.

LawNet