Form of PIT Withholding Receipt 2023: Are Paper Copies Still Used? When Must Enterprises Issue PIT Withholding Receipts to Employees?

Is the Current Paper Version of the PIT Deduction Document Still in Use?

According to Clause 5, Article 12 of Circular 78/2021/TT-BTC, the regulation is as follows:

Transitional Handling

...

5. The use of personal income tax deduction documents continues to be carried out according to Circular No. 37/2010/TT-BTC dated March 18, 2010, of the Ministry of Finance guiding the issuance, use, and management of personal income tax deduction documents self-printed on computers (and amended, supplemented documents) and Decision No. 102/2008/QD-BTC dated November 12, 2008, of the Minister of Finance promulgating the personal income tax deduction document form until the end of June 30, 2022. In cases where organizations deduct personal income tax that meet the information technology infrastructure conditions can apply the form of electronic personal income tax deduction documents according to the provisions of Decree No. 123/2020/ND-CP before July 1, 2022, and perform procedures according to the guidance of Circular No. 37/2010/TT-BTC dated March 18, 2010, of the Ministry of Finance.

From July 1, 2022, all enterprises, organizations, and individuals must switch to using electronic personal income tax deduction documents.

Is the Paper Version of the PIT Deduction Document Still in Use in 2023? When Must Enterprises Issue PIT Deduction Documents to Employees?

What is the Regulation for the 2023 Version of the PIT Deduction Document?

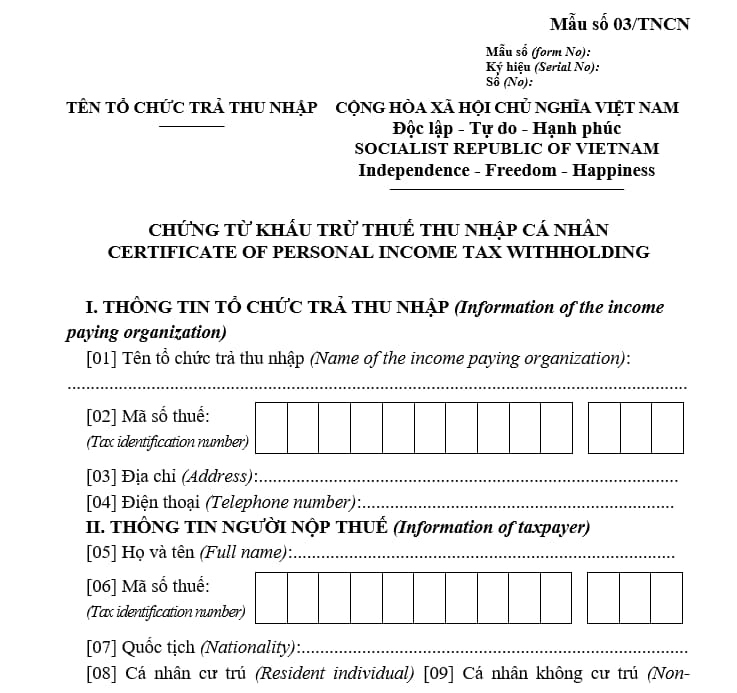

The latest personal income tax deduction document currently applied is Form 03/TNCN issued together with Decree 123/2020/ND-CP, as follows:

Download the personal income tax deduction document form here: download

When Must Enterprises Issue PIT Deduction Documents to Employees?

According to the provisions of Clause 2, Article 25 of Circular 111/2013/TT-BTC, the regulation is as follows:

Tax Deduction and Tax Deduction Documents

...

2. Tax Deduction Documents

a) Organizations and individuals paying taxable income under the guidance in Clause 1 of this Article must issue tax deduction documents according to the request of the person subject to tax deduction. In case individuals authorize tax finalization, tax deduction documents will not be issued.

b) Issuing tax deduction documents in some specific cases as follows:

b.1) For individuals who do not sign labor contracts or sign labor contracts of less than three (03) months: Such individuals have the right to request organizations and individuals paying income to issue tax deduction documents for each time of tax deduction or issue a tax deduction document for multiple tax deductions in a taxation period.

Example 15: Mr. Q signs a service contract with company X to take care of ornamental plants in the company's premises on a monthly schedule from September 2013 to April 2014. Mr. Q's income is paid monthly by the company at 03 million VND per month. In this case, Mr. Q can request the company to issue tax deduction documents monthly or one document reflecting the tax deducted from September to December 2013 and one document for the period from January to April 2014.

b.2) For individuals signing labor contracts of three (03) months or more: Organizations and individuals paying income must issue one tax deduction document per taxation period.

Example 16: Mr. R signs a long-term labor contract (from September 2013 to the end of August 2014) with company Y. In this case, if Mr. R is subject to direct tax finalization with the tax authority and requests the company to issue tax deduction documents, the company will issue 01 document reflecting the tax deducted from September to December 2013 and 01 document for the period from January to the end of August 2014.

Thus, issuing PIT deduction documents only applies to employees subject to self-tax finalization, and if such employees request, the company is obliged to issue PIT deduction documents for them.

LawNet