Template for Recording the Purchase of Goods and Services Without Invoices? How should households record in the accounting books when purchasing goods from farmers?

In which cases without invoices are allowed to make a purchase record of goods and services?

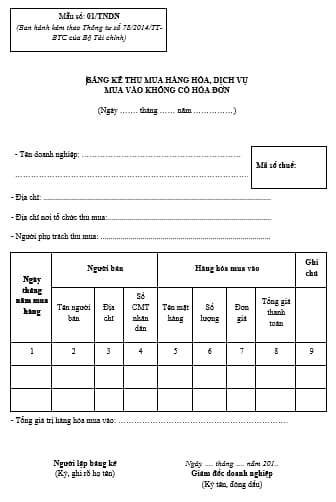

According to Point 2.4, Clause 2, Article 6 of Circular 78/2014/TT-BTC dated June 18, 2014, from the Ministry of Finance, the case of purchasing goods and services (without invoices, allowed to make a purchase record of goods and services according to form 01/TNDN) covers the following cases:

+ Purchasing agricultural, seafood, and aquatic products directly sold by producers and fishermen;

+ Purchasing handicraft products made from jute, sedge, bamboo, rattan, leaves, rattan, straw, coconut shell, or recycled materials from agricultural products directly sold by non-commercial producers;

+ Purchasing soil, stone, sand, and gravel directly sold by households and individuals who self-exploit; purchasing scrap collected by individuals;

+ Purchasing goods, assets, and services from households and business individuals (excluding the above cases) with revenue below the VAT threshold (100 million VND).

How to purchase goods and services without invoices? How do households shifting to the declaration method record inventory in the accounting books when purchasing goods from farmers? (Image from the internet)

How do households in the food and beverage business shifting to the declaration method record inventory in the accounting books when purchasing goods from farmers?

According to Question 13 in the Electronic Invoice Handbook No.2 issued by the Ho Chi Minh City Tax Department, the guidance is as follows:

+ If the food and beverage business households shift to the declaration method when purchasing goods and food products from farmers meeting the above conditions, they are allowed to make a purchase record of goods and services according to form 01/TNDN, and record in the Inbound Goods Receipt, Detailed Inventory of Materials, Tools, Products, and Goods as stipulated in Circular 88/2021/TT-BTC from the Ministry of Finance.

How to make a purchase record of goods and services according to Form 01/TNDN?

The purchase record of goods and services without invoices, issued together with Circular 78/2014/TT-BTC is as follows:

Download the form: Here.

Download the Electronic Invoice Handbook No.2: Here.

LawNet