Vietnam: In case dividends are paid in shares, is the company required to follow the procedures for offering shares according to current regulations?

When is the time to pay dividends to shareholders?

Pursuant to Clause 4, Article 135 of the 2020 Law on Enterprises in Vietnam on the dividend payment as follows:

Paying dividends in Vietnam

...

4. Dividends shall be fully paid within 06 months form the ending date of the annual General Meeting of Shareholders. The Board of Directors shall compile a list of shareholders that receive dividends, dividend of each share, time and method of payment at least 30 days before each payment of dividends. The notification of dividend payment shall be sent by express mail to the shareholders’ registered addresses at least 15 days before the dividend payment date. Such a notification shall contain the following information:

...

Thus, the dividends shall be fully paid within 06 months form the ending date of the annual General Meeting of Shareholders.

On the other hand, according to the provisions of Article 139 of the 2020 Law on Enterprises in Vietnam, the annual General Meeting of Shareholders is convened once a year, within 04 months from the end of the fiscal year (ie. The General Meeting of Shareholders in 2023 will be convened no later than April 2023)

Note: The mentioned financial year applies to enterprises that choose a fiscal year that coincides with the calendar year.

Vietnam: In case dividends are paid in shares, is the company required to follow the procedures for offering shares according to current regulations?

When to send the notification of dividend payment to shareholders?

Pursuant to Clause 4, Article 135 of the 2020 Law on Enterprises in Vietnam on dividend payment as follows:

Paying dividends in Vietnam

...

4. Dividends shall be fully paid within 06 months form the ending date of the annual General Meeting of Shareholders. The Board of Directors shall compile a list of shareholders that receive dividends, dividend of each share, time and method of payment at least 30 days before each payment of dividends. The notification of dividend payment shall be sent by express mail to the shareholders’ registered addresses at least 15 days before the dividend payment date. Such a notification shall contain the following information:

a) The company’s name and headquarters address;

b) Full name, mailing address, nationality and legal document number if the shareholder is an individual;

c) Name, EID number or legal document number and headquarters address if the shareholder is an organization;

d) Quantity of each type of shares; dividend of each share and the total dividends receivable by the shareholder;

dd) Time and method of dividend payment;

e) Full names and signatures of the company’s legal representatives and the President of the Board of Directors.

...

Thus, the notification of dividend payment shall be sent by express mail to the shareholders’ registered addresses at least 15 days before the dividend payment date.

Such a notification shall contain the following information:

- The company’s name and headquarters address;

- Full name, mailing address, nationality and legal document number if the shareholder is an individual;

- Name, EID number or legal document number and headquarters address if the shareholder is an organization;

- Quantity of each type of shares; dividend of each share and the total dividends receivable by the shareholder;

- Time and method of dividend payment;

- Full names and signatures of the company’s legal representatives and the President of the Board of Directors.

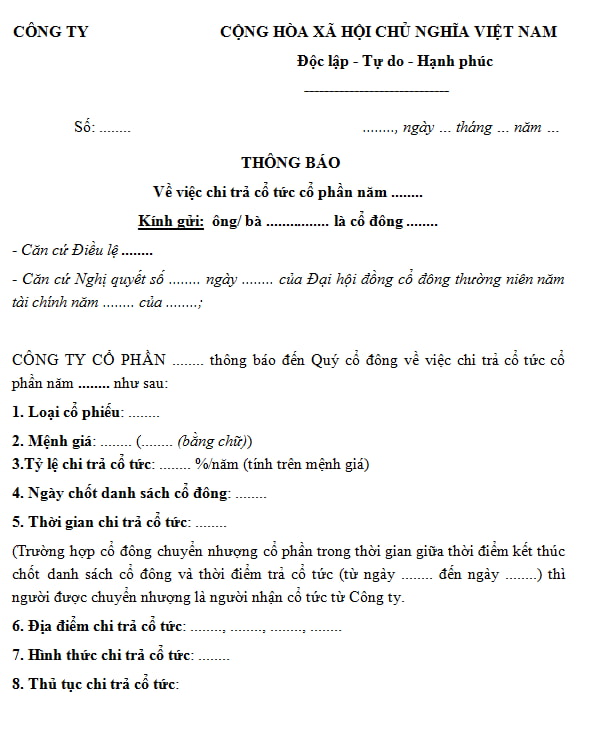

Currently, the law does not specify the form of notification of dividend payment. However, based on the content specified in Clause 4, Article 135 of the 2020 Law on Enterprises in Vietnam, the company can refer to the following sample of notification of dividend payment:

Download the form of notification of dividend payment: Click here.

Download the form of notification of dividend payment: Click here.

In case dividends are paid in shares, is the company required to follow the procedures for offering shares?

Pursuant to Clause 6, Article 135 of the 2020 Law on Enterprises in Vietnam as follows:

Paying dividends in Vietnam

...

6. In case dividends are paid in shares, the company is not required to follow the procedures for offering shares prescribed in Articles 123, 124 and 125 of this Law and is only required to register the charter capital increase, which is equal to the total face value of shares paid as dividends, within 10 days from the completion date of dividend payment.

Thus, in case dividends are paid in shares, the company is not required to follow the procedures for offering shares, and is only required to register the charter capital increase, which is equal to the total face value of shares paid as dividends, within 10 days from the completion date of dividend payment.

LawNet