Filing Corporate Income Tax for Capital Transfer Activities of Foreign Contractors: Procedures and Requirements

How to declare CIT for capital transfer activities of foreign contractors according to procedures?

Based on sub-section 8 Section II Administrative Procedures issued together with Decision 1462/QD-BTC 2022 guiding the procedures for declaring CIT for capital transfer activities of foreign contractors as follows:

Step 1: The organization or individual receiving the capital transfer is responsible for declaring on behalf of the foreign contractor, preparing data, preparing tax declaration dossiers for each occurrence, and sending them to the tax authority directly managing the enterprise where the foreign contractor invests capital.

In case the organization or individual receiving the capital transfer is also a foreign contractor, the organization established under Vietnamese law where the foreign contractor invests capital shall prepare tax declaration dossiers for each occurrence and send them to the tax authority directly managing the enterprise where the foreign contractor invests capital.

The deadline for submitting tax declaration dossiers is no later than the 10th day from the date of arising tax obligation.

In case the taxpayer submits the dossier via electronic transactions: The taxpayer (NNT) accesses the electronic portal chosen by the taxpayer (the General Department of Taxation's electronic portal/ the competent state authority's electronic portal, including:

+ National public service portal, Ministry-level public service portal, provincial public service portal in accordance with the regulation on implementing a one-stop, interconnected one-stop mechanism in solving administrative procedures and connected with the General Department of Taxation's electronic portal (hereinafter referred to as the competent state authority's electronic portal)/the portal of the T-VAN service provider organization) to declare the tax declaration dossier and accompanying appendices in electronic form (if any), electronically sign and send to the tax authority via the electronic portal chosen by the taxpayer.

Step 2: The tax authority receives:

- In case the dossier is submitted directly at the tax authority or sent via postal services: the tax authority receives the dossier according to the regulations.

- In case the dossier is submitted via electronic transactions, the reception, inspection, acceptance, and resolution of the dossier is carried out through the tax authority's electronic data processing system:

+ Reception of the dossier: The General Department of Taxation's electronic portal sends a receipt notification that the NNT has submitted the dossier or a notification of the reason for not receiving the dossier to the NNT via the electronic portal chosen by the taxpayer to prepare and send the dossier (the General Department of Taxation's electronic portal/the competent state authority's electronic portal or the T-VAN service provider organization's portal) no later than 15 minutes after receiving the taxpayer's electronic tax declaration dossier.

+ Inspection and resolution of the dossier: The tax authority inspects and resolves the taxpayer's tax declaration dossier according to the regulations of the Law on Tax Administration and related guiding documents:

The tax authority sends a notice of acceptance/non-acceptance of the dossier to the electronic portal chosen by the NNT to prepare and send the dossier (the General Department of Taxation's electronic portal/the competent state authority's electronic portal or T-VAN service provider organization's portal) no later than 01 working day from the date recorded on the receipt notice of the electronic tax declaration dossier.

CIT declaration for capital transfer activities by foreign contractors according to procedures?

CIT declaration for capital transfer activities by foreign contractors according to procedures?

What does the CIT declaration dossier for capital transfer activities of foreign contractors include?

Based on sub-section 8 Section II Administrative Procedures issued together with Decision 1462/QD-BTC 2022, the CIT declaration dossier for capital transfer activities by foreign contractors includes:

According to the List of tax declaration dossiers in Appendix I issued with Decree 126/2020/ND-CP and Appendix II issued with Circular 80/2021/TT-BTC:

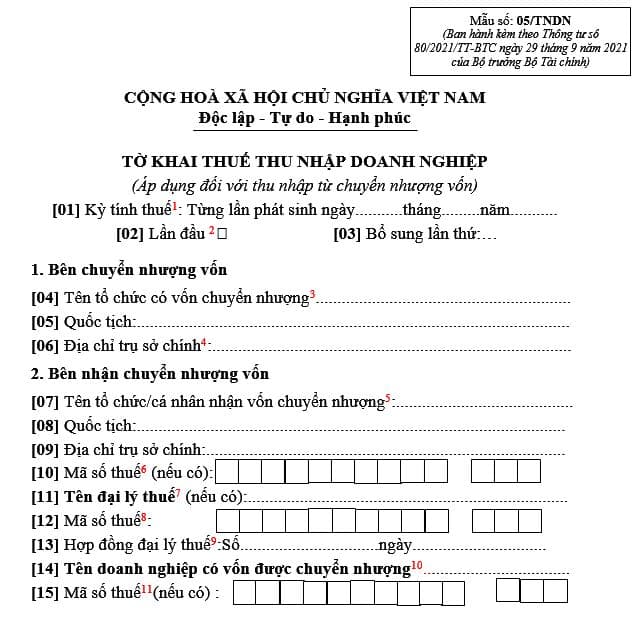

- Corporate income tax return form (applicable for income from capital transfer) according to form No. 05/TNDN issued with Circular 80/2021/TT-BTC;

- Copies of the transfer contract, copies of capital contribution certificate, original documents of expense receipts (if any).

Where to download form 05/TNDN for corporate income tax return?

The corporate income tax return form (applicable for income from capital transfer) according to form No. 05/TNDN issued with Circular 80/2021/TT-BTC is as follows:

Download the corporate income tax return form here

LawNet