Is it mandatory to submit a statement of production costs when applying for determining the origin of imports and exports in Vietnam?

- Is it mandatory to submit a statement of production costs when applying for determining the origin of imports and exports in Vietnam?

- What is the latest form of statement of production costs for imports and exports in 2023?

- When following customs procedures for exports, do the customs declarants have to submit the proof of origin of such goods to the customs authority?

Is it mandatory to submit a statement of production costs when applying for determining the origin of imports and exports in Vietnam?

Pursuant to Article 3 of Circular No. 33/2023/TT-BTC stipulating as follows:

Application for pre-determination of origin

Before following customs procedures for their import or export shipment, the organization or individual that requests pre-determination of origin shall submit an application for pre-determination of origin which includes:

1. An application form made using the Form in Appendix I enclosed herewith: 01 original;

2. The statement of production costs made using the Form in Appendix II enclosed herewith and the origin declaration made using the Form in Appendix III enclosed herewith by the domestic producer/supplier of materials or supplies which are used in the production of another product: 01 copy;

3. The production process or certificate of analysis (if any): 01 copy.

4. Catalogue or photos of goods: 01 copy.

Thus, the statement of production costs is one of the components of the application for pre-determination of origin of imports and exports. Other components of the application include:

- An application form for pre-determination of origin of imports and exports;

- The origin declaration made using the Form in Appendix III enclosed herewith by the domestic producer/supplier of materials or supplies which are used in the production of another product;

- The production process or certificate of analysis (if any);

- Catalogue or photos of goods.

Is it mandatory to submit a statement of production costs when applying for determining the origin of imports and exports in Vietnam?

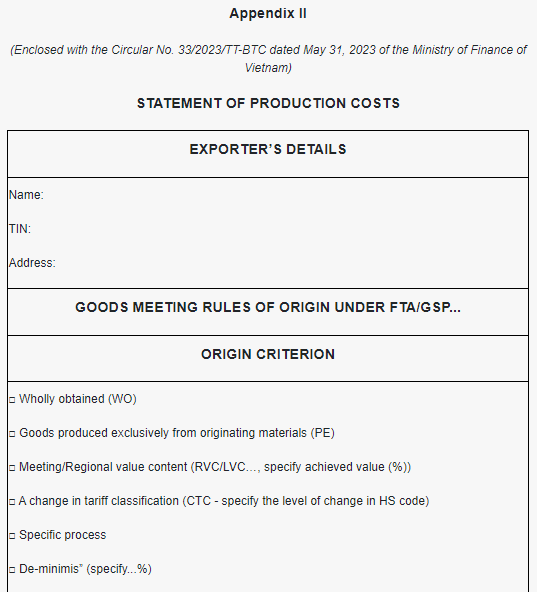

What is the latest form of statement of production costs for imports and exports in 2023?

The latest form of statement of production costs for imports and exports is the form in Appendix II issued together with Circular No. 33/2023/TT-BTC, which has the following form:

Download the latest form of statement of production costs for imports and exports: Click here.

When following customs procedures for exports, do the customs declarants have to submit the proof of origin of such goods to the customs authority?

Pursuant to Article 5 of Circular No. 33/2023/TT-BTC stipulating as follows:

Declaration and submission of proofs of origin of exports

1. When following customs procedures, the customs declarant shall declare the origin of exported good in the "description of goods” box of the electronic customs declaration which is made using Form No. 02 in Appendix I enclosed with the Circular No. 39/2018/TT-BTC dated April 20, 2018 of the Ministry of Finance of Vietnam. To be specific:

a) If the exported good qualifies as an originating good of Vietnam as prescribed in the Government’s Decree No. 31/2018/ND-CP dated March 08, 2018, the format “mô tả hàng hóa#&VN” (“description of goods#&VN”) shall apply;

b) If the exported good qualifies as an originating good of another country, the format “mô tả hàng hóa#& (mã nước xuất xứ của hàng hóa)” (“description of goods#& (code of the country of origin)”) shall apply;

c) If the exported good is produced from originating materials of different countries or materials of undetermined origin or the exported good has only undergone some minimal operations and processes in Vietnam, meeting the requirement of neither Point a nor Point b Clause 1 of this Article, the format “mô tả hàng hóa#&KXD” (“description of goods#&KXD”);

If a physical customs declaration is used, the origin of good shall be declared in the “origin” box of Form No. HQ/2015/XK in Appendix IV enclosed with the Circular No. 38/2015/TT-BTC.

2. If the origin of the exported good has been pre-determined under a notice given by the Director General of the General Department of Vietnam Customs, number, issue date and expiry date of that notice shall be declared in the “license” box of Form No. 02 in Appendix II or Form No. HQ/2015/XK in Appendix IV enclosed with the Circular No. 38/2015/TT-BTC.

3. When following customs procedures for the exported good, the customs declarant must not submit the proof of origin of such good to the customs authority. If the customs declarant wishes to submit the proof of origin or notice of origin pre-determination results, the customs authority shall receive and inspect such documents in accordance with the provisions of Articles 6, 7, 8 and 9 of this Circular.

Thus, when following customs procedures for exports, the customs declarants must not submit the proof of origin of such good to the customs authority.

Circular No. 33/2023/TT-BTC officially takes effect from July 15, 2023.

LawNet