Instructions to fill out the PIT declaration in Vietnam for individuals earning income from real estate transfer according to form No. 03/BDS-TNCN?

- What is the form of PIT declaration in Vietnam for individuals earning income from real estate transfer, receiving inheritance and gift receipt which is real estate?

- Instructions to fill out the PIT declaration in Vietnam for individuals earning income from real estate transfer according to Form No. 03/BDS-TNCN?

- When is the deadline for submission of tax declaration dossiers of real estate transfer in Vietnam?

What is the form of PIT declaration in Vietnam for individuals earning income from real estate transfer, receiving inheritance and gift receipt which is real estate?

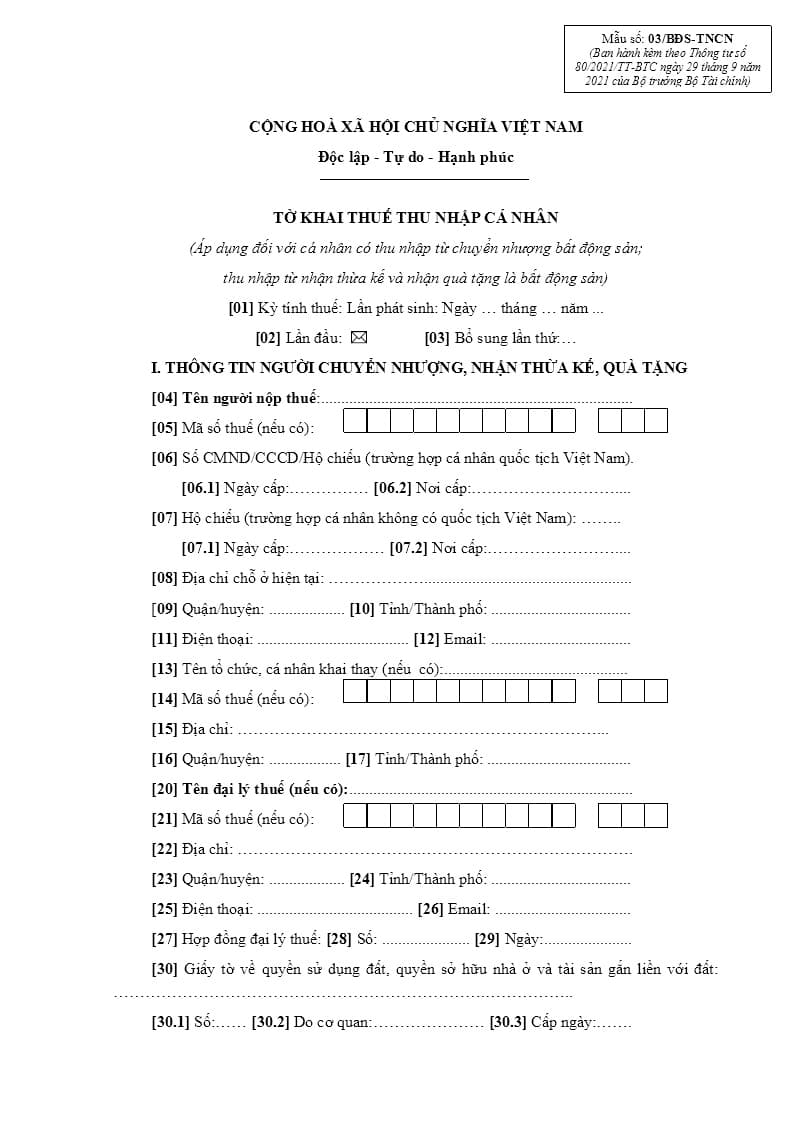

PIT declaration in Vietnam for individuals earning income from real estate transfer, receiving inheritance and gift receipt which is real estate, made according to form No. 03/BDS-TNCN issued together with Circular No. 80/2021/TT- BTC is as follows:

Download form No. 03/BDS-TNCN here: Click here.

Instructions to fill out the PIT declaration in Vietnam for individuals earning income from real estate transfer according to form No. 03/BDS-TNCN? When is the deadline for submission of tax declaration dossiers of real estate transfer in Vietnam?

Instructions to fill out the PIT declaration in Vietnam for individuals earning income from real estate transfer according to Form No. 03/BDS-TNCN?

According to the website of the General Department of Taxation on instructions on filling in the PIT declaration for individuals earning income from real estate transfer made according to form No. 03/BDS-TNCN as follows:

General information section:

[01]: Tax period: Specify the date, month and year of making the tax declaration.

[02] First time: If you are filing for the first time, put an “x” in the box.

[03] The second addition: If the declaration is made after the first time, it will be determined as an additional declaration and fill in the blank number of additional declarations. The number of additional declarations is recorded by digits in the sequence of natural numbers (1, 2, 3….).

* The declaration of the table's targets:

I. INFORMATION OF TRANSFEROR, RECEIVER OF INHERITANCE OR GIFT

[04] Taxpayer's name: Clearly and fully write the full name according to tax registration or number of ID card/citizen identity card/Passport of the individual who is the transferor or the receiver of inheritance or gift which is real estate.

In case the transferred real estate is jointly owned by many individuals, the co-owners authorize an individual to declare tax, the name of the individual represents the tax declaration. In case the inheritance or gift is jointly owned by many individuals, each individual receiving the inheritance or gift shall declare on a declaration.

[05] Tax identification number: Clearly and fully write the individual's tax identification number according to the individual tax registration certificate or the personal tax identification number notice issued by the tax authority (if not, leave blank. and required to declare the target [06] or [07]).

[06] ID card/citizen identity card/Passport number (in case of individual Vietnamese nationality): [06.1] Date of issue:…………………… [06.2] Place of issue:…..

Clearly and fully write the number, date of issue, place of issue of ID card/citizen identity card/Passport of Vietnamese national without tax identification number.

[07] Passport (in case the individual does not have Vietnamese nationality):

[07.1] Date of issue:…………………… [07.2] Place of issue:…………

Clearly, fully write the number, date of issue, place of issue Passport of individuals without Vietnamese nationality without tax identification numbers.

[08] Current residential address: Write clearly and fully the address of the individual's house, commune, ward, and current residence.

[09] District: Enter the county, district in the province/city where the individual is currently living.

[10] Province/City: Enter the province/city of the individual's current residence.

[11] Phone: Write clearly and fully the individual's phone number.

[12] Email: Write clearly and fully the individual's email address.

[13] Name of organization or individual declaring on behalf (if any): Clearly and fully write the name of the organization making the declaration (according to the establishment decision or the business registration certificate or the tax registration certificate) in in case the organization declares tax on behalf of an individual or pays tax on behalf of an individual. Or write the full name of the individual filing tax on behalf of, paying tax on behalf of the tax registration or number of ID card/citizen identity card/Passport in case the individual declares or pays tax on behalf of the individual.

[14] Tax identification number (if any): Specify clearly and fully the tax identification number of the organization/individual that declares tax on behalf of or pays tax on behalf of (if any declaration is made [13]).

[15] Address: Clearly and fully write the address of the organization/individual that declares tax on behalf of or pays tax on behalf of (if any declaration is made [13]).

[16] District: Clearly and fully write down the name of the district/district of the organization/individual that declares tax on behalf of or pays tax on behalf of (if there is a declaration of quota [13]).

[17] Province/city: Clearly and fully write the name of the province/city of the organization/individual that declares tax on behalf of, or pays tax on behalf of (if there is a declaration of quotas [13]).

[18] Phone: Clearly and fully write down the phone number of the organization/individual that declares tax on behalf of or pays tax on behalf of (if there is a declaration of quotas [13]).

[19] Email: Clearly and fully write the email address of the organization/individual that declares tax on behalf of, or pays tax on behalf of (if there is a declaration of quota [13]).

[20]: Name of tax agent (if any): In case an individual authorizes a tax agent to declare tax, it must clearly and fully write the name of the tax agent according to the establishment decision or the business registration certificate of the tax agent.

[21] Tax identification number: Clearly and fully write the tax agent's tax identification number (if there is a declaration of quota [20])

[22] Address: Enter the correct address of the head office where the tax agent's business is registered under the business license as registered with the tax authority (if there is a declaration [20])

[23] District: Clearly and fully write down the name of the tax agent's district/district (if any quota is declared [20]).

[24] Province/city: Clearly and fully write down the name of the province/city Tax agent (if any declaration of quota [20]).

[25] Phone: Write clearly and fully the phone number of the tax agent (if there is a declaration of quota [20]).

[26] Email: Clearly and fully write down the email address of the tax agent (if there is a declaration of quota [20]).

[27], [28], [29] Tax agency contract: Specify clearly, in full, the number and date of the tax agency contract between the individual and the tax agent (ongoing contract) (if target [20] is declared).

[30] Papers on land use rights, house ownership and land-attached assets:

[30.1] Number:………… [30.2] By agency:………… [30.3] Issued date:…………..

Write information about the name of the Certificate, number, issuing agency, and date of issuance of the Paper on land use rights, ownership of houses and assets attached to land (Land Use Right Certificate) in case the real estate has been issue with Land Use Right Certificates (in case of transfer of house purchase and sale contracts, commercial houses, future construction works, construction works, houses that have been handed over and put into use by the project but the certificate of land use rights and ownership of houses and assets on land has not been issued according to the provisions of the law on housing, then declare the target [31]

[31] Contracts for purchase and sale of houses and construction works to be formed in the future signed with level 1, level 2 project owners or project owners' trading floors:

[31.1] No.…………..[31.2] Date:…………

Enter information about the name of the project owner, the number of the contract, the date of the contract of the house purchase and sale contract, the construction work to be formed in the future signed with the level 1, level 2 project owner or project owner's trading floor.

[32] Real estate transfer and exchange contract:

[32.1] Number:………….… [32.2] Place of establishment…………. [32.3] Date of establishment:………….

[32.4] Authentication authority ………… [32.5] Authentication date: ............

Write the contents of the number, place of making, date of making, certifying agency, and date of certification of the real estate transfer contract in case of real estate sale or exchange.

II. INFORMATION OF TRANSFEREE, GIVER OF INHERITANCE, GIFT

[33] Taxpayer's name: Write clearly, full name according to tax registration or ID card/citizen identity card/Passport number of the individual who is the assignee or the heir or gift is immovable produce.

In case real estate is transferred, inherited, or given as a gift, which is jointly owned by many individuals, co-owners authorize an individual to declare tax, the name of the individual who represents the tax declaration shall be recorded.

[34] Tax identification number: Clearly and fully write the individual's tax identification number according to the individual tax registration certificate or the personal tax identification number notice issued by the tax authority (if not, leave blank and mandatory declaration of targets [35]).

[35] ID card/citizen identity card/Passport number (in case there is no tax identification number):

[35.1] Date of issue:……………… [35.2] Place of issue:……………..

If the individual does not have a tax identification number, clearly and fully write the number, date of issue, and place of issue of ID card/citizen identity card/Passport number.

[36] Documents on division of inheritance, gifts as Real Estate:

[36.1] Place of making dossiers for receipt of inheritances and gifts: ............[36.2] Date of making: ......

[36.3] Authentication authority:................[36.4] Authentication date: ............

Write the content of the place where the application for inheritance or gift is made, the date of making, the certifying agency, the date of certification of the document Distribution of inheritance or gift as real estate in case of individuals earning income from inheritance, gifts and real estate.

III. TYPES OF REAL ESTATE TRANSFERRED, INHERITED, OR GIVEN AS A GIFT

[37] If the real estate transferred, inherited, or given as a gift is the right to use land and assets attached to the land, it shall be included in this indicator.

[38] If the real estate transferred, inherited, or given as a gift is the right to own or use a house, check this entry.

[39] If the real estate transferred, inherited, or given as a gift is the right to rent land or rent water surface, it shall be included in this indicator.

[40] If the real estate transferred, inherited, or given as a gift is other real estate that does not fall into the above cases, it shall be included in this indicator.

IV. CHARACTERISTICS OF REAL ESTATE TRANSFERRED, INHERITED, OR GIVEN AS A GIFT

[41]: Information on land: Declare information about land according to the information on the LURC, documents proving house ownership or ownership of works on the land or contracts for purchase and sale of off-plan houses and constructions, etc.

[41.1]: Enter the plot number and map sheet number (if not, leave blank)

[41.2], [41.3], [41.4], [41.5], [41.6]: Enter the address of the land plot

[41.7]: Type of land, location of land plot (1,2,3,4…) (if not available, leave blank)

- Record information according to the land use right documents, depending on the location of the land plot, it can be position 1, position 2.

- If there is no location stated on the land use right document, the actual location of the land parcel shall be recorded.

- Type of land, area: On the document proving the land use right, the name of the land types and the use area will be shown;

Example: Land type 1: Residential land, area 100m2; Land type 2: Agricultural land, area: 200m2...

[41.8]: Coefficient (if any): Enter land coefficient information (if not, leave blank)

[41.9]: Origin of land: Write according to the origin of the land recorded in the certificate of land use right or in another paper of equivalent value (if not, leave blank).

[41.10]: Actual transferred land value (if any): Write it according to the price on the real estate transfer contract (if the real estate transfer contract states the total amount, leave this item blank).

[42]: Information about houses and constructions: Write information about houses and constructions according to the information on the Land Use Right Certificate, documents proving house ownership or ownership of works on land or contracts for purchase and sale of off-plan houses or construction works, etc.

[42.1], [42.2], [42.3]: Write information about the type of house, housing grade, floor area of construction.

[42.4] Actual value of house transferred (if any): Write according to the price on the transfer contract (if the transfer contract states the total amount, leave this item blank)

[42.5] to [42.15]: Enter information about the project owner, project address, work, construction area, construction floor area, area of common ownership, area of private ownership, structure, number of floors, number of basements, year of completion of the apartment building (if there is no information, leave blank)

[42.16]: Actual transferred house value (if any): Write according to the price on the real estate transfer contract (if the real estate transfer contract states the total amount, leave this item blank)

[42.17]. In case the origin of the house is due to the transfer, check this target and write the time of making the house transfer document [42.19].

[42.20] to [42.27]: Enter information about the project owner, project address, work, type of work, work items, work grade, construction area, construction floor area, coefficients, unit prices of construction works (except for houses) (if no information is available, leave blank).

[42.28]: Actual transferred value (if any): Write according to the price on the real estate transfer contract (if the real estate transfer contract states the total amount, leave this blank)

[43] Land-attached assets: Enter information about assets attached to land (except houses and construction works) according to information on the LURC, documents proving house ownership or ownership of works on land or contracts for purchase and sale of off-plan houses or construction works, etc.

[43.1]: Type of property attached to land: Specify type of property attached to land.

[43.2]: Actual value of transferred land-attached assets (if any): Write according to the price on the real estate transfer contract (if the real estate transfer contract states the total amount, leave this target blank)

V. INCOME FROM REAL ESTATE TRANSFER; FROM RECEIVING INHERITANCE, GIFT WHICH IS REAL ESTATE

[44] Type of income: If the income comes from real estate transfer, then enter the target [44.1]. If income is received from inheritance or gifts, then enter the target [44.2].

[45] The transfer value of real estate and other properties attached to land or the value of inherited or gifted real estate: is the real estate transfer price stated in the transfer contract, (if the transfer price is real estate lower than the price prescribed by the provincial People's Committee, write the price of the Committee) in case of transfer or exchange; is the price set by the Provincial People's Committee in the case of inheritance or gift receipt. In case the transfer contract does not separate the land price and the house and property on the land, the total value of the transfer contract shall be declared in this entry.

[46] Personal income tax incurred on real estate transfer: Target [45]x2%

[47] Tax-free income: The part of income that is exempt from tax as prescribed by law.

[48] Exempt personal income tax: Target [47] x 2%

[49] Personal income tax payable on real estate transfer: Target [46]- Target [48]

[50] Payable personal income tax on inheritance or gift as real estate: (Target [45]- Target [47]-10,000,000) x 10%

[51] Tax payable and exempted of owners: In case there is a co-owner or an owner or co-owner is exempt from tax, determine the ownership percentage, payable tax amount, exempted tax amount, and reason for exemption of each owner and co-owner and enter this section.

- In case the taxpayer does not have a co-owner, if he or she is exempted from the entire tax amount according to the regulations on personal income tax (PIT) for real estate transferred, inherited, or given as a gift, only enter the first line of column [51.7] or state the reason for the exemption in column [51.8] without having to declare other information;

- In case there is a Co-owner (including tax exempt or not exempted), the taxpayer's representative fully declares all information on the Target [51];

- In case the taxpayer does not have a co-owner but has a partially exempted PIT amount, declare the corresponding targets:

+ For exempted tax amounts: taxpayers declare the items [51.2], [51.3], [51.4], [51.6] and [51.7] or [51.8]

+ For payable tax amounts: taxpayers declare targets [51.2], [51.3], [51.4] and targets [51.5].

- Declare targets [51.4]:

+ In case of Co-Ownership: the representative of the taxpayer declares the ownership percentage of the Owner and the Co-owners;

+ In case the taxpayer does not have a co-ownership and has incurred a partially exempted tax amount, the taxpayer shall determine the ownership percentage by himself as a basis for calculating the payable tax amount, the tax exempted from personal income tax for the transfer, inheritance. The gift is real estate.

Instructions for declaring Section: "TAXPAYER or LEGAL REPRESENTATIVE OF THE TAXPAYER": only declare instead in case the exempted tax amount does not arise and must clearly write "Declared on behalf of" before signing. Declare on behalf of the case in which the content of the real estate transfer contract states that the buyer must be responsible for PIT declaration or where the taxpayer authorizes another individual as prescribed by law.

When is the deadline for submission of tax declaration dossiers of real estate transfer in Vietnam?

Pursuant to Article 44 of the 2019 Law on Tax Administration in Vietnam stipulating as follows:

Deadlines for submission of tax declaration dossiers

…

3. For declaration of taxes that are declared and paid upon incurrence: the 10th day from the day on which tax is incurred.

Thus, within 10 days from the day on which tax is incurred, the individual must submit the tax declaration dossier of real estate transfer.

LawNet