Instructions on how to fill out the VAT declaration in Vietnam according to Form No. 04/GTGT for taxpayers whose tax is calculated by the direct method on revenue?

- Where is the VAT declaration for taxpayers whose tax is calculated by the direct method on revenue stipulated?

- Instructions on how to fill out the VAT declaration in Vietnam according to Form No. 04/GTGT for taxpayers whose tax is calculated by the direct method on revenue?

- Which entities shall be applied to the method of calculating VAT directly on revenue?

Where is the VAT declaration for taxpayers whose tax is calculated by the direct method on revenue stipulated?

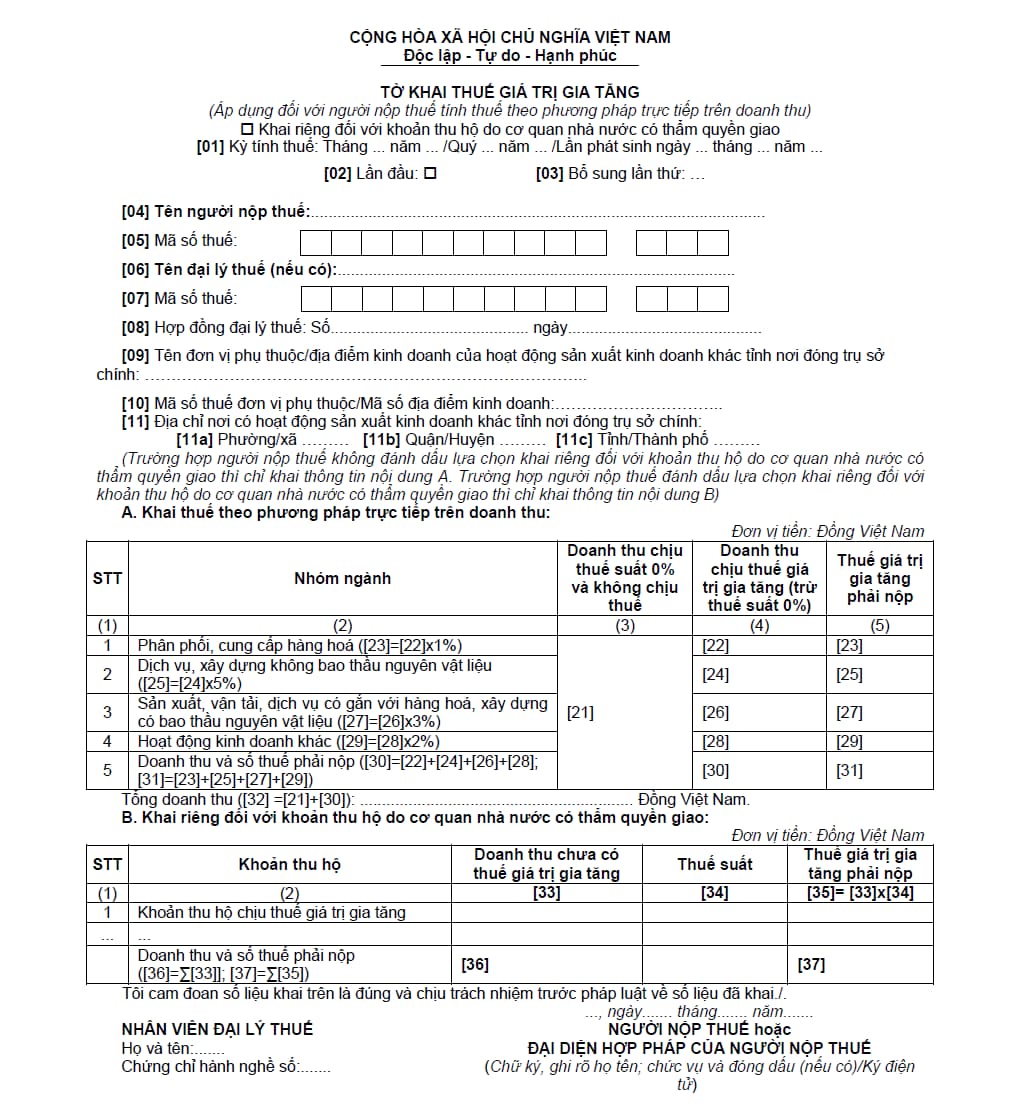

The VAT declaration for taxpayers whose tax is calculated by the direct method on revenue is specified according to Form No. 04/GTGT in Appendix II issued together with Circular No. 80/2021/TT-BTC as follows:

Download the VAT return for taxpayers whose tax is calculated by the direct method on revenue: Click here.

Instructions on how to fill out the VAT declaration in Vietnam according to Form No. 04/GTGT for taxpayers whose tax is calculated by the direct method on revenue?

Instructions on how to fill out the VAT declaration in Vietnam according to Form No. 04/GTGT for taxpayers whose tax is calculated by the direct method on revenue?

VAT declaration form No. 04/GTGT promulgated together with Circular No. 80/2021/TT-BTC for taxpayers whose tax is calculated by the direct method on revenue according to the following instructions:

General information section:

In case the taxpayer has a collection on behalf of a competent state agency under the provisions of Point c, Clause 2, Article 7 of the Government's Decree No. 126/2020/ND-CP dated October 19, 2020, it must accumulate Select the box "Separate declaration for incomes assigned by competent state agencies" and fill in details in section B of the declaration.

Target [01] - Tax period: The tax period is the month in which the tax liability arises. If the taxpayer is approved by the tax authority to declare quarterly tax or is a newly established taxpayer, the tax period shall be recorded as the quarter in which the tax liability arises. In case of not regularly arising business activities, the declaration shall be made according to each time when tax obligations arise.

Targets [02], [03]: Check “First time”. In case the taxpayer discovers that the first-time tax declaration dossier submitted to the tax agency contains errors or omissions, an additional declaration shall be made according to the ordinal number of each supplement.

Note:

- Taxpayers make electronic declarations, Etax system supports taxpayers to determine the "First time" tax declaration corresponding to each business and production activity at target [01a].

- From the time the Etax System has the Notice of Acceptance of Tax Returns for the "First-Time" Tax Return, subsequent tax declarations of the same tax period, with the same production and business activities are the declarations "Additional". The taxpayer must submit the "Additional" Declaration in accordance with the regulations on additional declarations.

Targets [04], [05]: Declare the information "Taxpayer's name and tax identification number" according to the taxpayer's business registration or tax registration information.

Targets [06], [07], [08]: In case the tax agent makes a tax declaration: Declare the information "name of tax agent, tax identification number" "number, date of tax agent contract". The tax agent must have "Active" tax registration status and the Contract must be valid at the time of tax return.

Note:

Taxpayers make electronic tax declarations, Etax system automatically supports displaying information about tax agents, tax agency contracts registered with tax authorities for taxpayers to choose in case taxpayers have many tax agents, contracts. .

Targets [09], [10], [11]: Declare information of dependent units, business locations located in localities other than the province where the head office is located for the cases specified at points b, c Clause 1, Article 11 of Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government.

- In case there are many dependent units and business locations located in many districts under the management of the Tax Department, select one representative unit to declare in this target. In case there are many dependent units, business locations located in many districts under the management of the regional Tax Department, select one representative unit of the district under the management of the regional Tax Department to declare in this target.

- Taxpayers make electronic tax declarations, the Etax system automatically supports displaying information about dependent units, registered business locations for taxpayers to choose.

Section of declaration of targets in the table:

A. Tax declaration by direct method on revenue:

Based on invoices and vouchers sold in the period to declare in this section.

Target [21]: Declare information about 0% taxable revenue and non-taxable revenue without having to make detailed declarations for each industry group.

Target [22]: Declare information on revenue subject to value added tax (except for the tax rate of 0%) for the group of goods distribution and supply industries.

Target [23]: Declare information on payable value-added tax for the group of goods distribution and supply industries, determined by the formula [23]=[22]x1%.

Target [24]: Declare information on revenue subject to value-added tax (except for the tax rate of 0%) for service and construction industry groups, excluding raw materials bidding.

Norm [25]: Declare payable value added tax information for service and construction industry groups excluding raw materials, which is determined by the formula [25]=[24]x5%.

Norm [26]: Declare information on revenue subject to value added tax (except for the tax rate of 0%) for groups of manufacturing, transportation and service industries associated with goods and construction, including raw materials.

Norm [27]: Declare information on payable value-added tax for groups of manufacturing, transportation and service industries associated with goods, and construction including raw materials, which is determined by the formula [27] 27]=[26]x3%.

Target [28]: Declare information on revenue subject to value added tax (except for the tax rate of 0%) for other groups of business activities.

Target [29]: Declare information on payable value-added tax for other groups of business activities, determined by the formula [28]=[29]x2%.

Target [30]: Declare information about total revenue subject to value added tax (minus 0% tax rate) according to the formula [30]=[22]+[24]+[26]+[28].

Target [31]: Declare the total amount of value added tax payable according to the formula [31]=[23]+[25]+[27]+[29].

Target [32]: Declare total revenue according to the formula [32]=[21]+[30].

B. To declare separately for the collection on behalf of a competent state agency:

In case the taxpayer has a collection on behalf of a competent state agency under the provisions of Point c, Clause 2, Article 7 of Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government, then provide details in this section.

Target column [33]: Declare information about VAT-inclusive revenue of household revenues assigned by competent state agencies.

Target column [34]: Declare information on VAT rates of household revenues assigned by competent state agencies.

Target column [35]: Declare information about payable value-added tax on household revenues assigned by competent state agencies. The data in this column is determined by the formula [35] = [33] x [34].

Target [36], target [37]: Declare information on total revenue excluding VAT and payable VAT according to the formula [36]= total column [33]; [37]= total column [35].

Signed and stamped section:

The legal representative of the taxpayer or the legal representative of the taxpayer shall sign, seal or electronically sign the declaration to submit the declaration to the tax office and take responsibility before law for the declared data. In case the tax agent declares on behalf of the taxpayer, the legal representative of the tax agent shall sign, seal or digitally sign on behalf of the taxpayer and add the full name of the tax agent employee who directly makes the tax return and the number of this employee's practice certificate in the corresponding information.

Which entities shall be applied to the method of calculating VAT directly on revenue?

Pursuant to Clause 2, Article 13 of Circular No. 219/2013/TT-BTC, cases in which VAT is calculated by directly multiplying a rate (%) by the revenue as follows:

- The operational companies and cooperatives that earn less than 1 billion VND in annual revenues, except for those that voluntarily apply credit-invoice method prescribed in Clause 3 Article 12 of Circular No. 219/2013/TT-BTC;

- The new companies and cooperatives, except for those that voluntarily apply credit-invoice method prescribed in Clause 3 Article 12 of Circular No. 219/2013/TT-BTC;

- Business households and businesspeople;

- The foreign entities doing business in Vietnam without following the Law on Investment; the organizations that fail to adhere to accounting and invoicing practice, except for those that provide goods and services serving petroleum exploration and extraction.

- The business organizations other than companies and cooperatives, except for those that voluntarily apply credit-invoice method.

LawNet