In which case does the borrower not need to register for changes of foreign loans in Vietnam?

In which case does the borrower not need to register for changes of foreign loans in Vietnam?

Pursuant to Clause 2, Article 17 of Circular No. 12/2022/TT-NHNN stipulating as follows:

The borrower shall notify the change on the website and shall not apply for registration of changes of loans in respect of the following contents:

- Change of time for withdrawal of loan proceeds, repayment of principal within 10 working days as against the once previously approved by the State Bank;

- Change of the borrower's address without change of the city or province where the borrower’s head office is located; the borrower shall send a notice of address change to the competent authority accorded authority over registration, registration for change of foreign loan;

- Change of the creditor, related information about creditors in respect of a syndicated loan that designate the representative for creditors, except when a creditor is also the representative for creditors in respect of a syndicated loan, and any change of creditors that may entail changes to the roles of the representative for creditors;

- Change of the commercial transaction name of the account service provider, the bank providing secured transactions;

- Change the plan for payment of interests and fees on the foreign loan as against the one previously confirmed by the State Bank in the written confirmation of registration or registration for change of foreign loan, but do not change the method to calculate the interests and fees specified in the foreign loan agreement. The borrower is responsible for making a schedule to calculate the interests and fees to be paid so that the account service provider has a valid ground for checking and monitoring when making the money transfer;

- Change (increase or decrease) the amount of loan proceeds to be withdrawn, repayment of principal, interests and fees within 100 currency units of the foreign loan currency as against the amount stated in the written confirmation of registration, written confirmation of registration for change of foreign loan;

- Change of the actual amount of loan proceeds to be withdrawn or principal repayment of a specific period less than the amount stated in the loan proceed withdrawal or debt repayment plan in the written confirmation of registration or written confirmation of registration for change of the foreign loan.

Note: Before withdrawing the loan proceeds or repaying the outstanding debt of a period, the borrower shall register the change of the loan proceed withdrawal and debt repayment as to the outstanding amount as prescribed in Circular No. 12/2022/TT-NHNN.

In which case does the borrower not need to register for changes of foreign loans in Vietnam?

What are the procedures for applying for changes of loans in Vietnam?

Pursuant to Clause 2, Article 17 of Circular No. 12/2022/TT-NHNN, the procedures for applying for registration of changes of loans are as follows:

Step 1. Prepare the application form for registration of change of loans:

- In case the borrower has declared loan change information on the Website before submitting the application: the borrower prints the application form from the website, signs and stamps it;

- In case the borrower does not declare loan change information on the Website before submitting the application: the borrower completes the application form for foreign loan change according to Appendix 04 issued with this Circular.

Step 2. Deadline for submitting application for change of foreign loan:

Within 30 working days from the date:

- The parties sign an agreement to change or before the time of implementation of the changed content (for the case of changed content, it is not necessary to sign an agreement to change but still ensure compliance with the foreign loan agreement);

- The organization inheriting the obligation to repay foreign loans is granted a business registration certificate or the date the parties sign an agreement on the change of the borrower in case the original borrower is divided, split, or contracted, mergered (whichever comes later) and before continuing to withdraw capital, repay foreign loans;

- The borrower completes the update of name change and/or address change and moves the head office to another province or city on the National Business Registration Database;

- The lender (or the organization representing the lender in the syndicated loan - if any), the guarantor, the guarantor or other related parties mentioned in the registration confirmation, written confirmation change registration send written notice to the borrower of the name change and before making money transfers involving these parties.

Step 3. The State Bank shall issue a written confirmation or refusal to confirm the registration of loan change (with reasons clearly stated) within the time limit:

- 12 working days from the date of receiving the borrower's complete and valid dossier in case the borrower has declared loan change information on the Website before submitting the change registration dossier, or;

- 15 working days from the date of receiving the borrower's complete and valid dossier in case the borrower does not declare loan change information on the Website before submitting the change registration dossier.

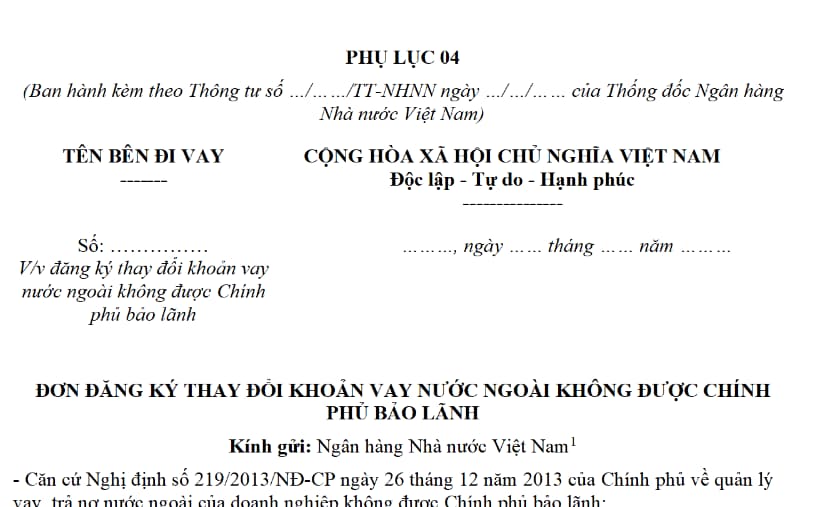

What is the application form for registration for change of foreign loans which are not guaranteed by the Government of Vietnam?

The application form for registration for change of foreign loans according to Appendix 04 issued with Circular No. 12/2022/TT-NHNN is as follows:

Download the application form for registration for change of foreign loans which are not guaranteed by the Government of Vietnam: Click here.

LawNet