Guidelines for Taxpayers on Declaring Value-Added Tax Using the Direct Method on Revenue

Procedures for Filing Value Added Tax Using Direct Calculation Method on Revenue

According to Subsection 3, Section II, Part I of Administrative Procedures issued with Decision 1462/QD-BTC in 2022, the procedures for filing VAT using the direct calculation method on revenue are as follows:

Step 1. Taxpayers who apply the VAT calculation method using the direct method on revenue as prescribed by VAT laws (including separate filing for VAT collected on behalf of state agencies with authority) must prepare and submit the VAT declaration form to the tax authority no later than the 20th day of the month following the month when the tax obligation occurs (for monthly VAT declaration and payment);

No later than the last day of the first month of the subsequent quarter when the tax obligation occurs (for quarterly VAT declaration and payment); no later than the 10th day from the date the tax obligation occurs (for ad-hoc VAT declaration and payment).

If taxpayers submit documents via electronic transactions: Taxpayers (TAX) should access the electronic portal chosen by the taxpayer (the General Department of Taxation’s electronic portal/competent state authority’s electronic portal including:

National public service portal, Ministry-level public service portals, Provincial-level public service portals as prescribed by the single-window mechanism in handling administrative procedures and connected to the General Department of Taxation’s electronic portal (hereinafter referred to as the competent state authority’s electronic portal)/T-VAN service provider’s portal) to file the tax declaration form and related annexes electronically (if any), sign electronically, and send to the tax authority through the chosen electronic portal.

Step 2. Tax authority reception:

- For documents submitted directly at the tax office or sent by postal service: the tax authority processes and receives documents as prescribed.

- For documents submitted through electronic transactions, processing, checking, acceptance, and resolution of documents are done through the tax authority’s electronic data processing system:

+ Document reception:

The General Department of Taxation’s electronic portal sends a notification of document receipt or states the reason for not receiving the documents to the taxpayer’s chosen portal (General Department of Taxation’s electronic portal/competent state authority’s electronic portal or T-VAN service provider’s portal) within 15 minutes from the time the electronic tax declaration is received.

+ Document checking and processing: The tax authority checks and processes the taxpayer’s tax declaration documents as prescribed by the Law on Tax Administration and guiding documents:

The tax authority sends a notification of acceptance/non-acceptance of documents to the taxpayer’s chosen portal (General Department of Taxation’s electronic portal/competent state authority’s electronic portal or T-VAN service provider’s portal) no later than 1 working day from the date of the document receipt notification.

Guidance for taxpayers on filing value-added tax using the direct method on revenue?

Which VAT declaration form should taxpayers use for the direct calculation method on revenue?

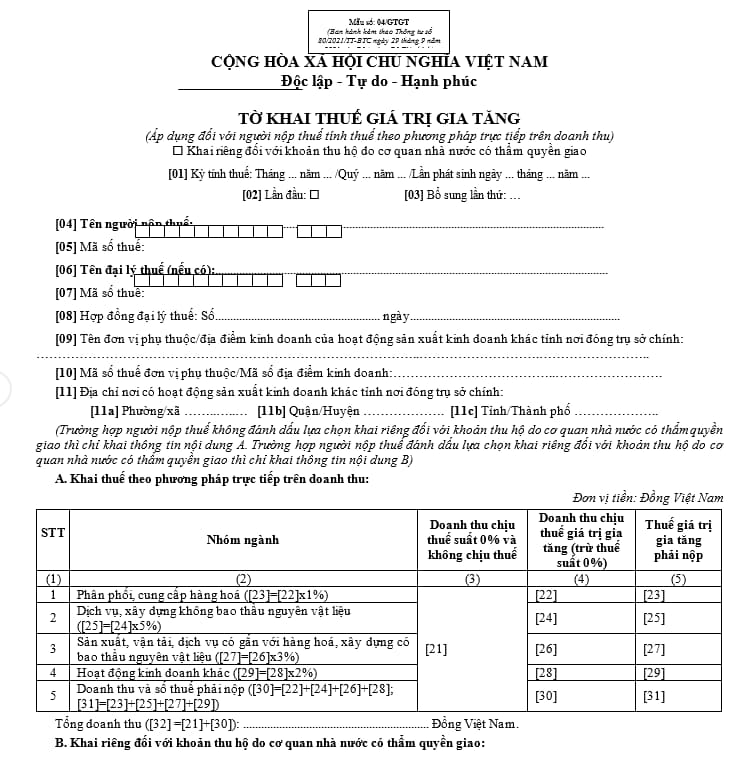

The value-added tax declaration form for taxpayers using the direct calculation method on revenue is Form No. 04/GTGT issued with Circular 80/2021/TT-BTC as follows:

Download Form No. 04/GTGT here: download

What methods can taxpayers choose to file VAT using the direct calculation method on revenue?

According to Subsection 3, Section II, Part I of Administrative Procedures issued with Decision 1462/QD-BTC in 2022, taxpayers can file value-added tax using the direct calculation method on revenue in one of the following three ways:

- Submit directly at the tax office;

- Send via postal service;

- Or electronically through the General Department of Taxation’s electronic portal; or the competent state authority’s electronic portal; or through a T-VAN service provider.

LawNet