Instructions on how to fill out the severance tax declaration form No. 01/TAIN? Who is subject to severance tax in Vietnam?

What are the regulations on severance tax objects and payers?

Regarding severance tax objects:

Pursuant to Article 2 of the 2009 Law on Severance tax in Vietnam (amended by Clause 1, Article 4 of the 2014 Law on Amendments of Tax Laws) stipulating that the severance tax objects are as follows:

Severance tax objects

1. Metallic minerals.

2. Non-metallic minerals.

3. Crude oil.

4. Natural gas, coal gas.

5. Natural forest products, other than animals.

6. Natural aquatic products, including marine animals and plants.

7. Natural water, including surface water and underground water, except for natural water used for agriculture, forestry, aquaculture, and salt production.

8. Natural swallow's nests.

9. Other resources prescribed by the National Assembly Standing Committee.

Thus, the objects mentioned above must be subject to severance tax in accordance with the law on severance tax.

Regarding severance taxpayers:

According to the provisions of Article 3 of the 2009 Law on Severance tax in Vietnam as amended by Clause 2, Article 67 of the 2022 Petroleum Law of Vietnam stipulating the severance taxpayers as follows:

- Severance tax payers are resource-extracting organizations and individuals subject to severance tax, except for exploitation of oil and gas fields, groups of oil fields and blocks according to the regulations of law on petroleum.

- In some cases, severance tax payers shall be defined as follows:

+ For a mining enterprise established on the basis of joint venture, the joint-venture enterprise shall pay severance tax:

+ For Vietnamese and foreign parties to a business cooperation contract to exploit natural resources, the parties' liability to pay severance tax must be specified in such contract;

+ In case an exploiter conducts small-scale exploitation of natural resources and sells them to a principal purchaser that has a written commitment or an approval to declare and pay severance tax on the exploiter's behalf, the principal purchaser shall pay severance tax.

Instructions on how to fill out the severance tax declaration form No. 01/TAIN? Who is subject to severance tax in Vietnam?

What form does the taxpayer make a severance tax declaration in Vietnam?

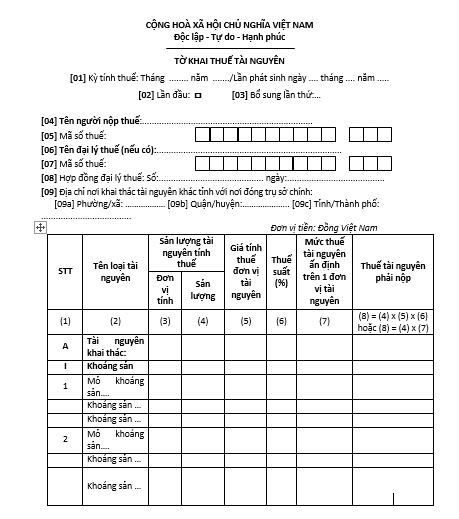

When taxpayers make a severance tax declaration, they will use Form 01/TAIN in Appendix II issued with Circular No. 80/2021/TT-BTC stipulating as follows:

Download the severance tax declaration in Vietnam: Click here.

Instructions on how to fill out the severance tax declaration form No. 01/TAIN?

According to the website of the General Department of Taxation, instructions on how to fill out the severance tax declaration form No. 01/TAIN are as follows:

General information section:

Target [01] - Tax period: The tax period is the month in which the tax liability arises. If the taxpayer is approved by the tax authority to declare quarterly tax or is a newly established taxpayer, the tax period shall be recorded as the quarter in which the tax liability arises.

Targets [02], [03]: Check “First time”. In case the taxpayer discovers that the first-time tax declaration dossier submitted to the tax agency contains errors or omissions, an additional declaration shall be made according to the ordinal number of each supplement.

Note:

+ Taxpayers make electronic declarations, Etax system supports taxpayers to determine the "First time" tax declaration corresponding to each production and business activity at target [01a].

+ From the time the Etax System has the Notice of Acceptance of Tax Declarations for the "First-Time" Tax Declaration, the subsequent Tax Declarations of the same tax period, with the same production and business activities are the declarations "Additional". The taxpayer must submit the "Additional" Declaration in accordance with the regulations on additional declarations.

Targets [04], [05]: Declare the information "Taxpayer's name and tax identification number" according to the taxpayer's business registration or tax registration information.

Note:

+ This is required information. Taxpayers make electronic tax declarations, after filling in the "Tax identification number" information completely and correctly, the Etax system automatically supports displaying information about "Taxpayer's name".

Targets [06], [07], [08]: In case the tax agent makes a tax declaration: Declare the information "name of tax agent, tax identification number" "number, date of tax agent contract". The tax agent must have "Active" tax registration status and the Contract must be valid at the time of Tax Declaration.

Note:

+ Taxpayer electronically declares, Etax system automatically supports displaying information about Tax Agent, Tax agency contract registered with tax agency for taxpayer to choose in case taxpayer has many Tax Agents, Contract copper.

Target [09]: Declare information about the area where the taxpayer has resource extraction activities different from the province where the head office is located as prescribed in Point g Clause 1 Article 11 of the Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government. In case taxpayers have resource extraction activities in many districts, they shall declare in this entry as follows:

+ If the Tax Department is the tax authority managing the collection, the taxpayer shall declare 01 representative district where the resource extraction activities occur.

+ If the regional Tax Department is the tax authority managing the collection, the taxpayer declares 01 representative district of the regional Tax Department where the resource extraction activities occur.

In case the taxpayer sends a document to the dependent unit in the area having natural resource extraction activities other than the province where the head office is located to directly declare and pay severance tax, this entry is not required.

The declaration of the table's criteria:

Column number (1) "Order number": taxpayers write the order of each type of resource exploited, purchased and paid on behalf of, and resources seized or confiscated corresponding to each tax rate for each type of resource in the Tariff and the nature of activities of exploitation, purchase and payment on behalf of, and seized and confiscated resources in the period.

Column number (2) “Name of resource type”:

For each type of natural resources exploited, purchased and paid on behalf of, resources seized and confiscated according to groups, specified types of resources, the price list for calculating severance tax of the provinces/cities is corresponding to each tax rate in the Natural Resources Tax Rate Schedule declared on one line of the declaration.

Section I: Target “Exploited resources”

The taxpayer declares the name of the exploited resources according to each group and type of prescribed resource corresponding to each prescribed tax rate and at the same time according to each mineral mine. Each resource type is declared on one line of the declaration.

As follows:

- In case the exploited resources are both consumed domestically and exported, the taxpayers shall declare them in two separate lines: resources for domestic consumption and resources for export;

- In case the exploited resource contains many different substances, it shall be exploited according to each substance in the extracted resource. Section II: Target "Resources purchased on behalf of"

Organizations and individuals that purchase and pay for natural resources on behalf of small organizations and individuals and commit in writing to approve the declaration and payment of tax on behalf of the mining organizations and individuals, the purchasing organizations and individuals shall pay instead of paying tax instead of declaring resources purchased on behalf of, each type of resource purchased is declared in a line corresponding to the prescribed tax rate.

Section III: Target “Resources seized and confiscated”

Organizations assigned to sell seized and confiscated resources must declare and pay taxes on these resources before deducting expenses related to activities of arrest, auction, and reward according to the regime. Each type of resource seized or confiscated is declared in a line corresponding to the prescribed tax rate.

Note:

+ For organizations and individuals that exploit natural resources without generating resource collection activities or selling seized or confiscated natural resources, they shall only declare exploited resources in Section I; if only the purchase and payment of natural resources arise and pay tax instead, the declaration shall be made in Section II; if only the sale and purchase of seized or confiscated natural resources arise, such declaration shall be made in Section III; For organizations and individuals that generate all three activities of mining, purchasing and paying on behalf of natural resources, with a written commitment to pay tax on behalf of organizations or individuals that exploit and trade in seized or confiscated natural resources, such organizations and individuals must declare all three items I, II, III.

Column number (3) "Unit": The taxpayer writes the unit of calculation of each type of resource exploited, purchased and paid on behalf of, resources seized, confiscated, delivered and sold in kg, m3, tons, barrels, KW/h ….

Column No. (4) “Output”: The taxpayer records the output of each type of natural resources exploited, purchased and paid for, seized, confiscated and sold during the period in column (4); The data recorded in this column can be the quantity, volume, or weight of commercial resources, regardless of the resource exploitation purpose.

Column number (5) "Taxable price of natural resources": according to the law on severance tax.

Column No. (6) “Tax rate”: The tax rate of each resource exploited, purchased and paid on behalf of, and captured or confiscated in the period recorded in column (6) is based on the tax rate specified in the tariff rate schedule for all kinds of resources, except crude oil and natural gas, coal gas currently.

Column No. (7) “The severance tax rate imposed per unit of natural resources”: The data recorded in this column is the royalty rate fixed per resource unit as prescribed by the competent authority.

Column No. (8) “Receivable Severance tax”:

Severance tax incurred in the period is determined as follows:

Severance tax payable = Taxable output of natural resources x Taxable price of natural resource unit x Severance tax rate

Or:

Severance tax payable = Taxable resource output x Fixed royalty rate per unit of resource

Target: “Total”:

The data in this row is the sum of columns (4), (8) specifically as follows:

Column (4): Is the total output of generated resources.

Column (8): Is the total amount of severance tax payable.

Signed and stamped part:

The legal representative of the taxpayer or the legal representative of the taxpayer shall sign, seal or electronically sign the declaration to submit the declaration to the tax office and take responsibility before law for the declared data. In case the tax agent declares on behalf of the taxpayer, the legal representative of the tax agent shall sign, seal or electronically sign on behalf of the taxpayer and and add the full name and full name of the tax agent employee who directly makes the tax return and the number of this employee's practice certificate in the corresponding information.

LawNet