Guidance on Preparing the Corporate Income Tax Finalization Declaration for the Revenue and Expense Method Using Form No. 03/TNDN

Latest Corporate Income Tax Finalization Declaration Form?

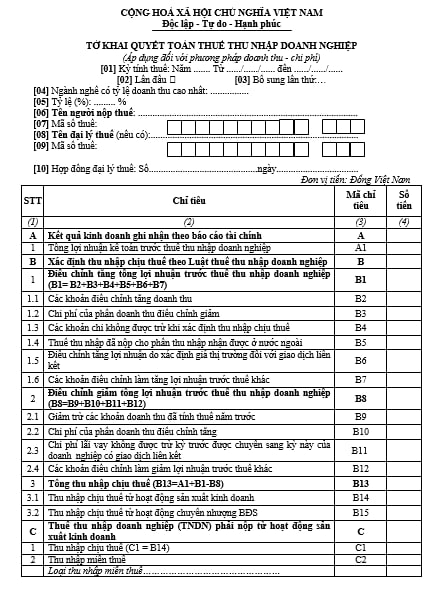

Based on the Corporate Income Tax Finalization Declaration Form applicable for the current revenue - expense method, specified in Form 03/TNDN in Section VI of Appendix II issued with Circular 80/2021/TT-BTC, as follows:

Download the form 03/TNDN - Corporate Income Tax Finalization Declaration here.

Instructions for preparing the Corporate Income Tax Finalization Declaration using the revenue - expense method under Form No. 03/TNDN?

Instructions on how to fill out Form 03/TNDN for corporate income tax finalization?

According to the guidelines from the General Department of Taxation Portal on how to fill out Form 03/TNDN for corporate income tax finalization as follows:

Item [01]: Clearly state the tax period year (according to the calendar year or the fiscal year for companies applying a different fiscal year from the calendar year), from the first day of the calendar year/fiscal year or the commencement of business activities (for newly established companies) or the effective date of the contract (for contracts) to the end of the calendar year/fiscal year or the termination of business activities or contract termination or change in company ownership form or company reorganization as determined appropriate to the accounting period according to the provisions of the Accounting Law.

Items [02], [03]: Tick "First time". If the taxpayer discovers mistakes or omissions in the initially submitted tax declaration to the tax authority, they must file additional declarations in the sequence of each supplementary time.

For electronic tax filing, upon the acceptance notification from the Etax system for the "First time" tax declaration, subsequent tax declarations for the same tax period will be "Supplementary" returns. The taxpayer must submit the "Supplementary" return according to the regulations on supplementary declarations.

Items [04], [05]: The taxpayer records the name and the revenue ratio of the industry with the highest revenue ratio in the tax period.

Items [06], [07]: Enter the "Taxpayer’s name and tax code" information according to the company's registration or taxpayer registration information.

For electronic tax filing, after accurately entering the "Tax code" information, the Etax system will automatically display the "Taxpayer’s name" information.

Items [08], [09], [10]: Record the name of the tax agent, tax agent's code, tax agent contract information in case the taxpayer files taxes through a tax agent. The tax agent must have an "Active" taxpayer registration status, and the contract must be valid at the time of tax filing.

For electronic tax filing, the Etax system will automatically display information about the registered tax agent and tax agent contracts for the taxpayer to choose in case the taxpayer has multiple tax agents and contracts.

Item [A1]: The taxpayer declares the total accounting profit before corporate income tax in the tax period as per the accounting law. Item [A1] is derived from item [22] on Appendix 03-1A or item [19] on Appendix 03-1B or item [90] on Appendix 03-1C

Item [B1]: The taxpayer declares all adjustments to revenue or expenses recorded as per accounting policies but not in compliance with the Corporate Income Tax Law, which increases the total profit before corporate income tax for the business establishment. This item is determined by the sum of Items [B2] to [B7]. Specifically:

[B1] = [B2] + [B3] + [B4] + [B5] + [B6] + [B7]

Item [B2]: The taxpayer declares all adjustments leading to an increase in taxable revenue due to differences between the accounting and tax regulations, including amounts determined as revenue for Corporate Income Tax purposes according to the Corporate Income Tax Law but not recognized as revenue according to the revenue accounting standards. This item also reflects revenue reductions accepted under accounting policies but not accepted under tax law.

View the full guidelines here.

When is the deadline for submitting the corporate income tax finalization declaration?

Based on Article 44 of the 2019 Law on Tax Administration, the regulations are as follows:

Deadline for submitting tax declarations

1. The deadline for submitting tax declarations for taxes declared monthly or quarterly is as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly declarations and payments;

b) No later than the last day of the first month of the following quarter in which the tax obligation arises for quarterly declarations and payments.

2. The deadline for submitting tax declarations for taxes with an annual tax period is as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for the annual tax finalization declaration; no later than the last day of the first month of the calendar year or fiscal year for the annual tax declaration;

b) No later than the last day of the fourth month from the end of the calendar year for the individual income tax finalization declaration by individuals directly finalizing their taxes;

c) No later than December 15 of the preceding year for the presumptive tax declarations of business households and individuals paying tax by the presumptive method; newly-established business households and individuals must submit the presumptive tax declaration no later than 10 days from the commencement of business activities.

...

According to the above regulations, the deadline for submitting the corporate income tax finalization declaration is March 31 every year.

LawNet