What are instructions for preparing a bonus payment table for enterprise accountants in Vietnam? Are employee bonuses deductible expenses?

Are employee bonuses deductible expenses in Vietnam?

Pursuant to Clause 2, Article 6 of Circular 78/2014/TT-BTC (as amended by Article 4 of Circular 96/2015/TT-BTC, Clause 2, Article 3 of Circular 25/2018/TT-BTC) stipulates as follows:

Deductible and non-deductible expenses in determining taxable income

...

2. Non-deductible expenses in determining taxable income include:

...

2.5. Expenses for wages, salaries, and bonuses for employees in the following cases:

a) Expenses for wages, salaries, and other payables to employees that have been accounted for in the business production costs for the period but have not actually been paid or do not have supporting payment documents as regulated by law.

b) Bonuses for employees that are not specifically stipulated in the employment contract; collective labor agreement; financial regulations of the Company, Corporation, Group; or bonus regulations issued by the Chairman of the Board, General Director, or Director according to the company's financial regulations.

At the same time, pursuant to Clause 1, Article 6 of Circular 78/2014/TT-BTC (as amended by Article 4 of Circular 96/2015/TT-BTC) stipulates as follows:

Deductible and non-deductible expenses in determining taxable income

1. Except for non-deductible expenses stated in Clause 2 of this Article, enterprises are allowed to deduct all expenses if they meet the following conditions:

a) Actual expenses incurred related to the production and business activities of the enterprise.

b) Expenses must have adequate legal invoices, documents as stipulated by law.

c) For expenses with invoices for the purchase of goods and services worth 20 million VND or more (inclusive of VAT) per transaction, the payment must be made through non-cash payment methods.

Non-cash payment documents are implemented according to the regulations of legal documents on value-added tax.

For purchases of goods and services worth 20 million VND or more per invoice that have not been paid at the time of expense recognition, enterprises can still include them in deductible expenses when determining taxable income. However, if no non-cash payment document is available when payment is made, enterprises must declare and adjust to reduce the expenses for that portion without non-cash payment documents in the tax period in which the cash payment occurs (even if tax authorities and other authorities have already issued inspection decisions for the tax period where these expenses arose).

For invoices for the purchase of goods and services paid by cash before Circular 78/2014/TT-BTC took effect, there is no need to adjust as per this Point.

...

Thus, employee bonuses can be considered deductible expenses if:

- The expenses actually incurred related to the production and business activities of the enterprise.

- The expenses have adequate legal invoices and documents as stipulated by law.

- The conditions for the bonus and the amount must be specifically stipulated in one of the following documents: employment contract, financial regulations, bonus regulations, etc.

What are instructions for preparing a bonus payment table for enterprise accountants in Vietnam? Are employee bonuses deductible expenses?

Bonus Payment Table Sample for Enterprise Accountants in Vietnam

The bonus payment table sample is a document confirming the bonus amount for each employee, serving as the basis for calculating each employee's income and recording it in the accounting books.

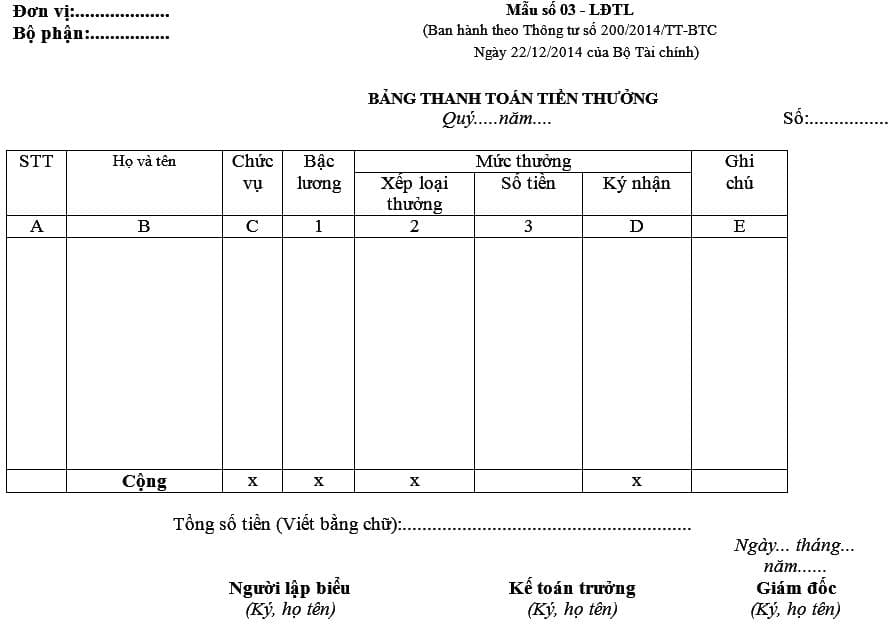

The bonus payment table sample for enterprise accountants is specified in Form 03-LDTL Appendix 2 issued together with Circular 200/2014/TT-BTC. To be specific:

Download the sample here.

Instructions for Preparing the Bonus Payment Table for Enterprise Accountants

Based on Appendix 2 issued together with Circular 200/2014/TT-BTC, the bonus payment table is instructed to be filled in as follows:

- The top left corner of the Bonus Payment Table must clearly state the name of the unit and the department receiving the bonus.

- Columns A, B, C: Record the serial number, full name, and position of the recipient.

- Column 1: Record the current salary level to calculate the monthly salary.

- Columns 2 and 3: Clearly state the type of bonus being evaluated and the amount for each type.

- Column D: The recipient signs to acknowledge the bonus receipt.

- The bonus payment table is prepared by the accounting department for each department and must include the signatures (full names) of the preparer, chief accountant, and director.

LawNet