Guidance on Filling Out Personal Income Tax Return Form No. 02/KK-TNCN for Individuals Filing Directly

How is the latest Personal Income Tax Declaration Form regulated?

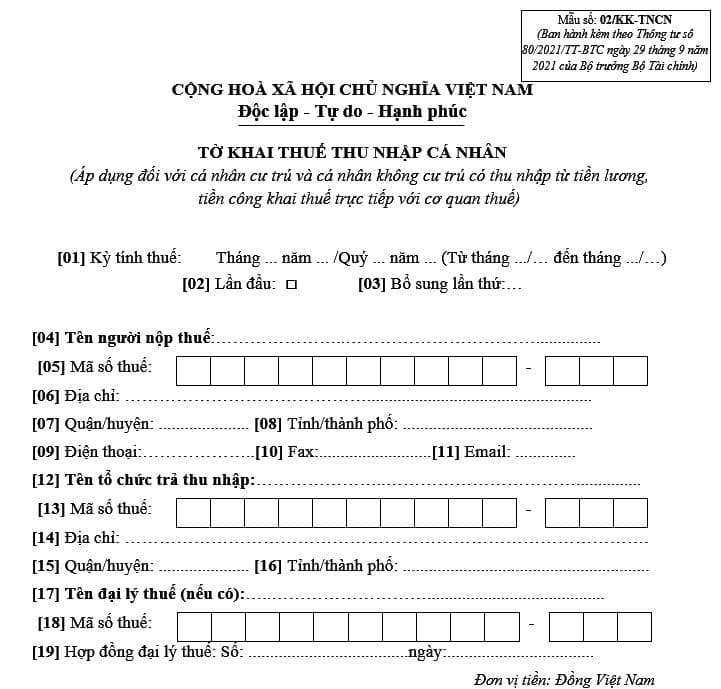

The Personal Income Tax (PIT) declaration form, according to form No. 02/KK-TNCN in Appendix II issued together with Circular 80/2021/TT-BTC, is regulated as follows:

Download the PIT declaration form No. 02/KK-TNCN here.

Guideline for completing the PIT declaration form No. 02/KK-TNCN for individuals directly declaring taxes

Guideline for completing the PIT declaration form No. 02/KK-TNCN for individuals directly declaring taxes

Below is the guideline for completing the PIT declaration form No. 02/KK-TNCN for individuals directly declaring taxes:

General Information:

[01] Tax period: Enter the month/quarter-year of the tax period. If an individual declares taxes quarterly but not for a full quarter, then full information from the month… to the month… within the quarter of the tax period must be provided.

[02] Initial declaration: If declaring taxes for the first time, mark "x" in the square box.

[03] Amendment time: If declaring after the first time, it is considered an amendment, and the number of amendments must be entered in the blank. The number of amendments is recorded in natural numbers (1, 2, 3…).

[04] Taxpayer's name: Clearly and fully enter the individual's name as per the tax registration certificate or ID card/citizen identity card/passport of the individual.

[05] Tax code: Clearly and fully enter the individual's tax code as per the taxpayer registration certificate for individuals or the tax code notification issued by the tax authority or the tax code card issued by the tax authority.

[06] Address: Clearly and fully enter the house number, ward/commune where the individual resides.

[07] District: Enter the district of the province/city where the individual resides.

[08] Province/City: Enter the province/city where the individual resides.

[09] Telephone: Clearly and fully enter the individual's phone number.

[10] Fax: Clearly and fully enter the individual's fax number.

[11] Email: Clearly and fully enter the individual's email address.

[12] Name of the organization paying income: Clearly and fully enter the name of the organization paying income (according to the establishment decision or business registration certificate or taxpayer registration certificate), where the individual receives taxable income.

[13] Tax code: Clearly and fully enter the tax code of the organization paying income, where the individual receives taxable income (if item [12] is declared).

[14] Address: Clearly and fully enter the address of the organization paying income, where the individual receives taxable income (if item [12] is declared).

[15] District: Clearly and fully enter the name of the district of the organization paying income, where the individual receives taxable income (if item [12] is declared).

[16] Province/City: Clearly and fully enter the name of the province/city of the organization paying income, where the individual receives taxable income (if item [12] is declared).

[17] Name of tax agent (if any): In case the individual authorizes a tax agent to declare taxes, clearly and fully enter the name of the tax agent as per the establishment decision or business registration certificate or taxpayer registration certificate.

[18] Tax code: Fully enter the tax code of the tax agent (if item [17] is declared).

[19] Tax agent contract: Clearly and fully enter the number and date of the tax agent contract between the individual and the tax agent (active contract) (if item [17] is declared).

Declaration of table items:

I. Residents having income from salaries and wages

[20] Total taxable income arising in the period: This is the total taxable income from salaries, wages, and other taxable incomes of a similar nature received by the individual in the period, including tax-exempt income under the Double Taxation Agreement (if any).

[21] Of which: Taxable income exempted under the Agreement: This is the total taxable income from salaries, wages, and other taxable incomes of a similar nature eligible for tax exemption under the Double Taxation Agreement (if any).

[22] Total deductions: Item [22] = [23] + [24] + [25] + [26] + [27]

[23] For oneself: This is the personal deduction according to the regulations of the tax period.

In case an individual submits tax declarations to various tax authorities in one tax period, the individual can choose to claim personal deductions for oneself at one place.

[24] For dependents: This is the dependent deduction according to the regulations of the tax period.

[25] For charity, humanitarian, study promotion: According to the actual amount contributed to charity, humanitarian, study promotion in the tax period.

[26] Deductible insurance contributions: These are contributions to social insurance, health insurance, unemployment insurance, professional liability insurance for certain professions required to participate in mandatory insurance as per regulations in the tax period.

[27] Deductible voluntary retirement fund contributions: This is the total amount contributed to the Voluntary Retirement Fund according to actual occurrences, with a maximum not exceeding one (01) million VND/month in the tax period.

[28] Total taxable income: Item [28] = [20] - [21] - [22]

[29] Total personal income tax arising in the period: Item [29] = [28] x Tax rate according to the cumulative progressive tax rate.

II. Non-residents having income from salaries and wages:

[30] Total taxable income: This is the total income from salaries, wages, and other taxable incomes of a similar nature received by non-resident individuals during the period.

[31] Tax rate: 20%

Who is required to use Form 02/KK-TNCN for PIT declarations?

The PIT declaration form No. 02/KK-TNCN in Appendix II issued together with Circular 80/2021/TT-BTC applies to resident individuals and non-resident individuals with income from salaries and wages who declare taxes directly to the tax authority, including:

- Resident individuals or non-resident individuals with income from salaries and wages paid by International organizations, Embassies, Consulates in Vietnam but have not deducted tax.

- Resident individuals with income from salaries and wages paid by organizations or individuals from abroad.

- Non-resident individuals with income from salaries and wages arising in Vietnam but received abroad.

- Individuals with income from salaries and wages received through stock reward transfers.

LawNet