Instructions for filling out the PIT declaration for individuals earning incomes from salaries and wages to declare tax directly with tax authorities in Vietnam?

- What is the form of PIT declaration for individuals earning income from salary who declare tax directly with tax authorities in Vietnam?

- Instructions for filling out the PIT declaration for individuals earning incomes from salaries and wages to declare tax directly with tax authorities in Vietnam?

- Who is in the case of direct finalization with tax authorities?

What is the form of PIT declaration for individuals earning income from salary who declare tax directly with tax authorities in Vietnam?

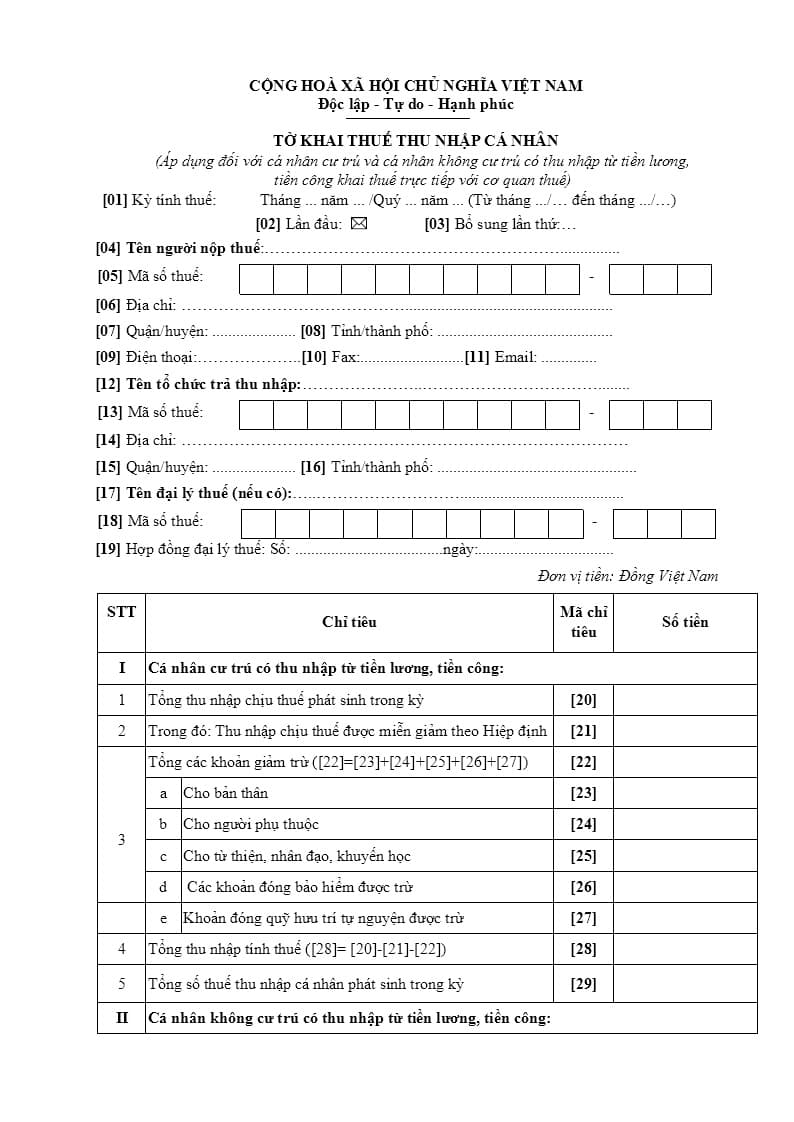

The form of PIT declaration for individuals with salary income who declare tax directly with the tax authority is Form No. 02/KK-TNCN specified in Appendix II issued together with Circular No. 80/2021/TT-BTC with the form as follows:

Download the form of personal income tax declaration for individuals earning income from salary and declare tax directly with the tax authority: Click here.

Instructions for filling out the PIT declaration for individuals earning incomes from salaries and wages to declare tax directly with tax authorities in Vietnam?

Instructions for filling out the PIT declaration for individuals earning incomes from salaries and wages to declare tax directly with tax authorities in Vietnam?

According to the website of the General Department of Taxation, the instructions for filling out the PIT declaration for individuals earning income from salaries and wages are as follows:

General information section:

[01] Tax period: Enter the month/quarter-year of the tax declaration period. In case an individual declares tax quarterly but not a full quarter, he/she must declare all information from month… to month… in the quarter of the tax declaration period.

According to the provisions of Points a and b, Clause 2, Article 9 of Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government, individuals can choose to declare tax according to the tax period of a month or a quarter and stabilize the whole calendar year at each tax office. Particularly, if an individual has chosen to declare quarterly, he/she can adjust the tax return for the month of the year if the individual changes his/her choice.

[02] First time: If you are filing for the first time, put an “x” in the box.

[03] The second addition: If the declaration is made after the first time, it will be determined as an additional declaration and fill in the blank number of additional declarations. The number of additional declarations is recorded by digits in the sequence of natural numbers (1, 2, 3….).

[04] Taxpayer's name: Clearly and completely write the individual's name according to the tax code registration sheet or the individual's identity card/citizen identity card/passport.

[05] Tax identification number: Clearly and fully write the individual's tax identification number according to the tax registration certificate for individuals or the notice of personal tax identification number issued by the tax authority or the tax identification card issued by the tax authority.

[06] Address: Clearly and fully write the address of the house, commune, ward where the individual resides.

[07] District: Enter the district in the province/city where the individual resides.

[08] Province/City: Enter the province/city where the individual resides.

[09] Phone: Write clearly and fully the individual's phone.

[10] Fax: Write clearly and fully the individual's fax number.

[11] Email: Write clearly and fully the individual's email address.

[12] Name of income paying organization: Clearly and fully write the name of the income paying organization (according to the establishment decision or the business registration certificate or the tax registration certificate) where the individual receives the income taxable.

[13] Tax code: Clearly and fully write the tax code of the income paying organization where the individual receives taxable income (if there is a declaration of the target [12]).

[14] Address: Clearly and fully write the address of the income paying organization where the individual receives the taxable income (if the target is declared [12]).

[15] District: Clearly and fully write down the name of the district/district of the income paying organization where the individual receives taxable income (if the target is declared [12]).

[16] Province/city: Clearly and fully write the name of the province/city of the income paying organization where the individual receives taxable income (if the target is declared [12]).

[17] Name of tax agent (if any): In case an individual authorizes a tax agent to declare tax, the name of the tax agent must be clearly written in accordance with the establishment decision or the business registration certificate or the tax registration certificate.

[18] Tax code: Fill in the tax agent's tax identification number (if there is a declaration of quota [17]).

[19] Tax agent contract: Specify clearly, in full, the number and date of the tax agent contract between the individual and the tax agent (the contract is in progress) (if any quota is declared [17]).

Section of declaration of targets in the table:

I. Resident individuals earning income from wages and salaries

[20] Total taxable income arising in a period: The sum of taxable incomes from salaries, wages and other taxable incomes of salary and wage nature that individuals received by the individual in the period, including income eligible for tax exemption under the Agreement on Avoiding Double Taxation (if any).

[21] In which: Taxable income exempted or reduced under the Agreement: Is the sum of taxable incomes from salaries, wages and other taxable incomes of the nature of wages and salaries that are exempt from tax under the Agreement on avoidance of double taxation (if any).

[22] Total deductions: Target [22] = [23] + [24] + [25] + [26] + [27]

[23] For yourself: A deduction for yourself according to the provisions of the tax period.

In case an individual submits tax returns at many different tax authorities in a tax period, the individual chooses to calculate the deduction for his/her family circumstances at one place.

[24] For dependents: A deduction for dependents according to the provisions of the tax period.

[25] For charity, humanitarian, study promotion: According to the actual number of charitable, humanitarian and study promotion contributions in the tax period.

[26] Deducted premiums: Social insurance, health insurance, unemployment insurance, professional liability insurance for some professions that must participate in compulsory insurance according to regulations in the tax period.

[27] Deductible voluntary retirement fund contribution: is the total amount of contributions to the voluntary retirement fund according to the actual arising, up to a maximum of one (01) million dong/month in the tax period.

[28] Total taxable income: Target [28] = [20]-[21]-[22]

[29] Total personal income tax incurred in the period: Target [29] = [28] x Tax rate according to the partially progressive tax schedule.

II. Non-resident individuals earning income from salaries and wages:

[30] Total taxable income: is the total income from wages, salaries and other taxable incomes of the nature of wages and salaries received by non-residents in the period.

[31] Tax rate: 20%

[32] Total personal income tax payable: Target [32] = [30] x Tax rate 20%

Who is in the case of direct finalization with tax authorities?

According to the guidance in subsection 1, Section I of Official Dispatch No. 13762/CTHN-HKDCN in 2023, the subjects in the case of direct finalization with tax authorities include:

- Residents who earn incomes from salaries or wages from two or more places but do not meet the conditions to be authorized to finalize as prescribed (the authorized cases mentioned at Point 3, Section I of this Official Dispatch) then must directly declare PIT finalization with tax authorities if there is additional tax payable or overpaid tax amount to be refunded or offset in the next tax period.

- Individuals present in Vietnam for less than 183 days in the first calendar year, but counting in 12 consecutive months from the first day of presence in Vietnam for 183 days or more, the first finalization year is 12 consecutive months from the first day of presence in Vietnam.

- Foreign individuals who terminate working contracts in Vietnam shall declare tax finalization with tax authorities before leaving the country. If an individual has not yet completed tax finalization procedures with the tax agency, he/she shall authorize an income paying organization or another organization or individual to finalize tax according to regulations on tax finalization applicable to individuals.

In case the income paying organization or other organizations or individuals receive authorization for finalization, they must be responsible for the additional PIT payable or have the overpaid tax refunded.

- Resident individuals earning incomes from salaries and wages paid from abroad and resident individuals earning incomes from salaries and wages paid from international organizations, Embassies and Consulates not yet Withholding tax in the year, individuals must make final finalization directly with tax authorities, if there is additional tax payable or overpaid tax amount, request refund or offset in the next tax period.

- Residents who earn incomes from salaries and wages and are considered for tax reduction due to natural disasters, fires, accidents or fatal diseases that affect their ability to pay tax shall not authorize organizations and individuals to Income tax payers instead must directly declare the final finalization with tax authorities as prescribed.

LawNet