Instructions for filling out declaration of tax dossier supplementation in Vietnam according to form No. 01/KHBS? When do I have to make a tax dossier supplementation?

When do I have to make a tax dossier supplementation in Vietnam?

Pursuant to Article 47 of the 2019 Law on Tax Administration in Vietnam stipulating the cases where tax dossier supplementation are required as follows:

Tax dossier supplementation in Vietnam

1. In case the tax declaration dossier submitted to the tax authority is erroneous or inadequate, supplementary documents may be provided within 10 years from the deadline for submission of the erroneous or inadequate tax declaration dossier but before the tax authority or a competent authority announces a decision on tax document examination.

2. When the tax authority or a competent authority has announced the decision on tax inspection or tax audit on the taxpayer’s premises, the taxpayer is still allowed to provide supplementary documents; the tax authority shall impose administrative penalties for the violations specified in Article 142 and 143 of this Law.

3. After the tax authority or competent authority issues a conclusion or tax decision when the inspection is done:

a) The taxpayer may provide supplementary tax documents if they increase the tax payable or reduce the deductible tax, exempted tax or refundable tax, and shall face administrative penalties for the violations specified in Article 142 and Article 143 of this Law;

b) If the supplementation leads to a decrease in the tax payable or an increase in the deductible tax, exempted tax or refundable tax, the taxpayer shall follow procedures for filing tax-related complaints.

4. Supplementary documents include:

a) The supplementary tax return;

b) The explanation for the supplementation and relevant documents.

5. Supplementary tax documents on exports and imports shall be provided in accordance with customs laws.

Thus, in case the tax declaration dossier submitted to the tax authority is erroneous or inadequate, supplementary documents may be provided within 10 years from the deadline for submission of the erroneous or inadequate tax declaration dossier but before the tax authority or a competent authority announces a decision on tax document examination.

When the tax authority or a competent authority has announced the decision on tax inspection or tax audit on the taxpayer’s premises, the taxpayer is still allowed to provide supplementary documents; the tax authority shall impose administrative penalties for the violations specified in Article 142 and 143 of the 2019 Law on Tax Administration in Vietnam.

After the tax authority or competent authority issues a conclusion or tax decision when the inspection is done, the taxpayer may provide supplementary tax documents if they increase the tax payable or reduce the deductible tax, exempted tax or refundable tax, and shall face administrative penalties for the violations specified in Article 142 and Article 143 of the 2019 Law on Tax Administration in Vietnam.

Instructions for filling out declaration of tax dossier supplementation in Vietnam according to form No. 01/KHBS? When do I have to make a tax dossier supplementation?

What is the form of declaration of tax dossier supplementation?

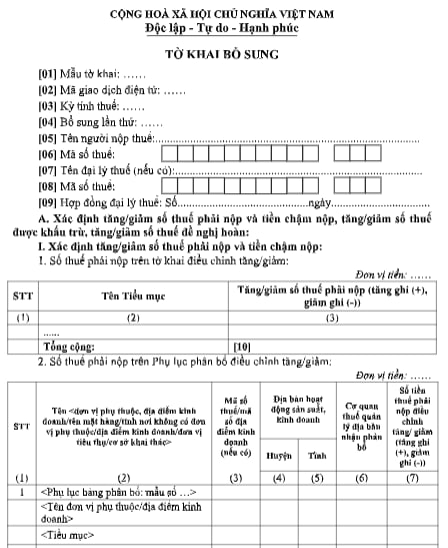

Taxpayers shall make supplementary declaration and statement of PIT in 2023 according to Form 01/KHBS issued together with Circular No. 80/2021/TT-BTC, which has the following form:

Download the form of declaration of tax dossier supplementation: Click here.

Instructions for filling out declaration of tax dossier supplementation in Vietnam according to form No. 01/KHBS?

According to the website of the General Department of Taxation, the instructions for filling in the supplementary declaration are made according to the form No. 01/KHBS as follows:

General information section:

Target [01]: Symbol of the supplementary declaration of the taxpayer.

Target [02]: The electronic transaction code of the declaration for the first time has errors that need to be supplemented and adjusted.

Target [03]: The tax period of the tax declaration file has errors that need to be supplemented and adjusted.

Target [04]: The number of times the taxpayer makes supplementary declarations compared with the first declaration that has been notified and accepted by the tax authority.

Targets [05], [06]: Declare the information "Taxpayer name and tax identification number" according to the taxpayer's business registration or tax registration information.

Targets [07], [08]: Declare information "name of tax agent, tax identification number" according to his/her business registration or tax registration information in case the taxpayer signs a contract with a tax agent to declare value added tax on behalf of the taxpayer.

Target [09]: Declare the number and date of the tax agent contract in case the taxpayer signs a contract with the tax agent to declare value added tax on behalf of the taxpayer.

The declaration of the table's criteria:

A. Determination of increase/decrease in payable tax amount and late payment interest, increase/decrease in deductible tax, increase/decrease in tax amount requested for refund:

The data in this section is determined according to each group of payable tax amount, late payment interest (if any), deductible tax amount or tax amount requested for refund, increase/decrease between the supplementary declaration and the previous declaration of the same period that was submitted and accepted by the tax authorities, for example:

- The first supplementary declaration: The difference between the first supplementary declaration and the first declaration of the tax period;

- Second supplementary declaration: The difference between the second supplementary declaration and the first supplementary declaration of the tax period.

I. Determination of increase/decrease in payable tax amount and late payment interest:

1. Tax payable on the increase/decrease adjustment declaration:

Column (2): Declare information about the name of the subsection of the budget index system of the tax with adjustments or additions that increase or decrease the payable tax amount compared to the incorrect or erroneous tax declaration.

Column (3): Declare information about increased or decreased tax payable. The data to be recorded in this column is taken from the corresponding data in column (7) of the explanation form No. 01-1/KHBS (data for increase and decrease must be paid).

Target [10]: Declare the total payable tax amount, which is increased or decreased after supplementary declaration compared to the declared amount on the tax declaration.

Note: This section only declares information related to the increase or decrease in the payable tax amount on the tax declaration.

In case the annual tax statement declaration has not been submitted, the taxpayer shall make supplementary declarations in the monthly and quarterly tax declaration dossiers with errors or omissions, and concurrently synthesize supplementary declaration data into the annual tax statement declaration dossier.

If the annual tax statement declaration has been submitted, only the annual tax statement declaration shall be supplementarily declared; especially in case of supplementary declaration of personal income tax statement declaration for organizations and individuals paying incomes from salaries and wages, they must also make supplementary declarations of monthly and quarterly declarations with corresponding errors and omissions.

2. The amount of tax payable on the Allocation Annex is adjusted to increase/decrease:

Column (2): Declare the name of the subsection of the budget catalog system of the tax with adjustments or additions that increase or decrease the payable tax amount compared with the allocation appendix with errors and omissions and the name of the sub-unit The business location or location has errors that need to be adjusted in terms of tax obligations allocated to localities.

Column (3): Declare the tax identification number of the dependent unit, the business location that has been granted the tax code or the business location code if only the business location code corresponding to the name of the subsidiary is granted Depending on the location, the business location has errors that need to be adjusted in terms of tax obligations allocated to localities in column (2).

Column (4): Declare information about the district and province level where the tax liability is allocated in the same way as the declaration in the allocation appendix.

Column (5): Declare information about the tax authority in charge of the area receiving the allocation similar to the declaration in the allocation appendix.

Column (6): Declare the amount of tax payable adjusted to increase or decrease corresponding to each subsection in column (2).

Target [11]: Declare the total payable tax amount, which is adjusted to increase or decrease after supplementary declaration compared to the amount declared in the appendix of the allocation table.

Target [10] + Target [11] = Target [07] of the Explanatory Note No. 01-1/KHBS.

Note: This section only declares information related to the increase or decrease in tax payable on the Allocation Table.

In case the annual tax statement declaration has not been submitted, the taxpayer shall make supplementary declarations in the monthly and quarterly tax declaration dossiers with errors or omissions, and concurrently synthesize supplementary declaration data into the annual tax statement declaration dossier.

If the annual tax statement declaration has been submitted, only the annual tax statement declaration shall be supplementarily declared; especially in case of supplementary declaration of personal income tax statement declaration for organizations and individuals paying incomes from salaries and wages, they must also make supplementary declarations of monthly and quarterly declarations with corresponding errors and omissions.

3. Determining the amount of late payment increased/decreased:

Declare information about the number of days of late payment up to the date of supplementary declaration and the increase or decrease in the amount of late payment after supplementary declaration, which increases or decreases the payable tax amount in the respective criteria.

Note: Taxpayers who make supplementary declarations leading to an increase in the payable tax amount must fully pay the supplementary payable tax amount and late payment interest to the state budget (if any).

II. Amount of tax deductible increased/decreased:

Column (2): Declare the name of the subsection of the budget index system of the tax with adjustments or additions that increase or decrease the tax deductible compared to the tax declaration with errors or omissions.

Column (3): Declare information on the increase or decrease in the amount of tax deducted. The data to be recorded in this column is taken from the corresponding data in column (7) of the explanation form No. 01-1/KHBS (data for increasing and decreasing the deductible tax).

Target [12] = Target [08] of the explanation form No. 01-1/KHBS.

Note: In case the supplementary declaration only increases or decreases the amount of value-added tax that is still deductible in the following period, in addition to the supplementary declaration in this section, it is also required to declare in the targets for adjusting the increase/decrease the deductible tax amount of previous periods on the tax declaration for the current tax period (the period when errors were discovered).

III. Tax amount to be refunded for increase/decrease:

Column (2): Declare information about the name of the subsection of the budget catalog system of the tax with adjustments or additions that increase or decrease the tax amount requested for refund compared to the tax declaration with errors or omissions.

Column (3): Declare information about tax amount to be increased or decreased. The data to be recorded in this column is taken from the corresponding data in column (7) of the explanation form No. 01-1/KHBS (data for increasing or decreasing the tax amount requested for refund).

Target [13] = Target [09] of the explanation form No. 01-1/KHBS.

Note: Taxpayers are only allowed to make a supplementary declaration to increase the amount of value added tax requested for refund when they have not yet submitted the tax declaration of the next tax period and have not submitted the application for tax refund.

B. Tax refund and late payment interest (if any): Declare information in this section when taxpayers themselves discover that the refunded tax amount is not in compliance with regulations and must be paid to the state budget.

I. Tax amount to be refunded:

1. Amount of money recovered: Declare the difference between the supplementary declaration and the declaration of the same period in the preceding period, for example:

- The first supplementary declaration: The difference between the first supplementary declaration and the first declaration of the tax period;

- Second supplementary declaration: The difference between the second supplementary declaration and the first supplementary declaration of the tax period.

2. Information on the refund decision, refund order according to the tax refunded amount. In case there are many decisions, refund orders, declare multiple lines corresponding to each amount of refund.

II. Late payment interest:

1. Number of days to receive tax refund: Declare information on the number of days to receive a tax refund, which is determined from the date the refund is paid by the State Treasury or the date the State Treasury clears the tax refund with the state budget revenue according to the decision on tax refund recovery of the tax authority or the decision or document of the competent state agency until the date the taxpayer makes supplementary declaration.

2. Amount of late payment: Declare the amount of late payment which is determined by the refunded amount payable to the state budget multiplied by (x) the number of days of receiving the tax refund multiplied by (x) the rate of late payment.

Note: Taxpayers who make supplementary declarations leading to a reduction in the tax refunded by the state budget must fully pay the overpaid tax amount and late payment interest to the state budget (if any).

Signed and stamped part:

The legal representative of the taxpayer or the legal representative of the taxpayer shall sign, seal or electronically sign the declaration to submit the declaration to the tax office and take responsibility before law for the declared data. In case the tax agent declares on behalf of the taxpayer, the legal representative of the tax agent shall sign, seal or digitally sign on behalf of the taxpayer and add the full name of the tax agent employee directly performing the tax declaration and the employee's practice certificate number in the corresponding information.

LawNet