Instructions on how to fill out a personal income tax declaration in Vietnam according to form No. 02/KK-TNCN for individuals who directly declare tax?

- Instructions on how to fill out a personal income tax declaration in Vietnam according to form No. 02/KK-TNCN for individuals who directly declare it?

- Instructions on how to fill out a personal income tax declaration in Vietnam according to form No. 02/KK-TNCN for individuals who directly declare it?

- What is the deadline for submission of a PIT statement declaration in 2023?

Instructions on how to fill out a personal income tax declaration in Vietnam according to form No. 02/KK-TNCN for individuals who directly declare it?

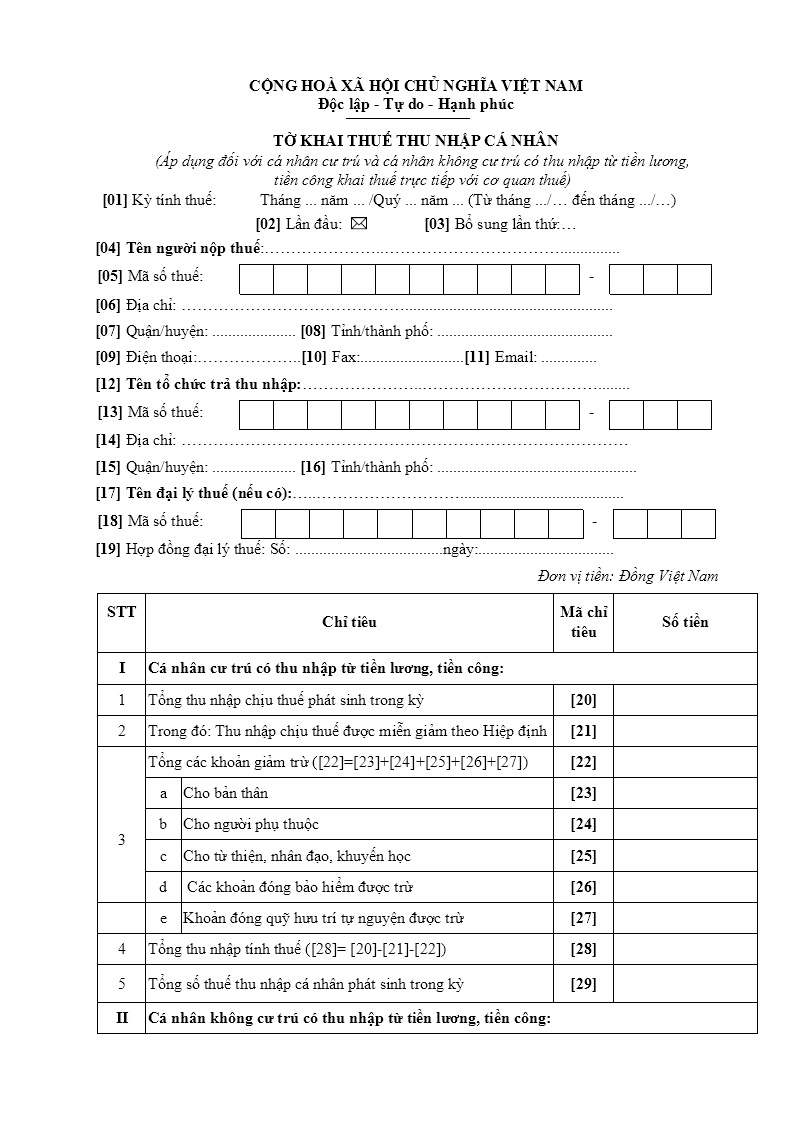

A personal income tax declaration made according to form No. 02/KK-TNCN in Appendix II issued together with Circular No. 80/2021/TT-BTC as follows:

Download the tax declaration form 02/KK-TNCN: Click here.

Instructions on how to fill out a personal income tax declaration in Vietnam according to form No. 02/KK-TNCN for individuals who directly declare tax?

Instructions on how to fill out a personal income tax declaration in Vietnam according to form No. 02/KK-TNCN for individuals who directly declare it?

According to the website of the General Department of Taxation, instructions on how to fill out a personal income tax declaration according to form No. 02/KK-TNCN for individuals who directly declare as follows:

General information section:

[01] Tax period: Enter the month/quarter-year of the tax declaration period. In case an individual declares tax quarterly but not a full quarter, he/she must declare all information from (month) … to (month) … in the quarter of the tax declaration period.

According to the provisions of Points a and b, Clause 2, Article 9 of Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government, individuals may choose between monthly or quarterly declaration throughout the calendar year at each tax authority. Particularly, if an individual has chosen to declare quarterly, he/she can adjust the tax declaration for the month of the year if the individual changes his/her choice.

[02] First time: If you are filing for the first time, put an “x” in the box.

[03] The second addition: If the declaration is made after the first time, it will be determined as an additional declaration and fill in the blank number of additional declarations. The number of additional declarations is recorded by digits in the sequence of natural numbers (1, 2, 3….).

[04] Taxpayer's name: Clearly and completely write the individual's name according to the tax code registration sheet or the individual's identity card/citizen identification/passport.

[05] Tax identification number: Clearly and fully write the individual's tax identification number according to the tax registration certificate for individuals or the notice of personal tax identification number issued by the tax authority or the tax identification card issued by the tax authority.

[06] Address: Clearly and fully write the address of the house, commune, ward where the individual resides.

[07] District: Enter the district in the province/city where the individual resides.

[08] Province/City: Enter the province/city where the individual resides.

[09] Phone: Write clearly and fully about the individual's phone.

[10] Fax: Write clearly and fully the individual's fax number.

[11] Email: Write clearly and fully the individual's email address.

[12] Name of income paying organization: Clearly and fully write the name of the income paying organization (according to the establishment decision or the business registration certificate or the tax registration certificate) where the individual receives the income taxable.

[13] Tax code: Clearly and fully write the tax code of the income paying organization where the individual receives taxable income (if there is a declaration of the target [12]).

[14] Address: Clearly and fully write the address of the income paying organization where the individual receives the taxable income (if the target is declared [12]).

[15] District: Clearly and fully write down the name of the district/district of the income paying organization where the individual receives taxable income (if the target is declared [12]).

[16] Province/city: Clearly and fully write the name of the province/city of the income paying organization where the individual receives the taxable income (if the target is declared [12]).

[17] Name of tax agent (if any): In case an individual authorizes a tax agent to declare tax, the name of the tax agent must be clearly and fully written according to the establishment decision or the business registration certificate or Tax Registration Certificate.

[18] Tax code: Fill in the tax agent's tax identification number (if there is a declaration of quota [17]).

[19] Tax agent contract: Specify clearly, in full, the number and date of the tax agent contract between the individual and the tax agent (ongoing contract) (if there is a declaration of targets [17]).

The declaration of the table's criteria:

I. Resident individuals earning income from wages and salaries

[20] Total taxable income arising in a period: The sum of taxable incomes from salaries, wages and other taxable incomes of salary and wage nature that individuals receive in the period. , including income eligible for tax exemption under the Agreement on the avoidance of double taxation (if any).

[21] In which: Taxable income exempted or reduced under the Agreement: is the total taxable income from salaries, wages and other taxable incomes of the nature of salaries and wages that are eligible fortax exemption under the Agreement for the avoidance of double taxation (if any).

[22] Total deductions: Target [22] = [23] + [24] + [25] + [26] + [27]

[23] For yourself: A deduction for yourself according to the provisions of the tax period.

In case an individual submits tax declarations at many different tax authorities in a tax period, the individual chooses to calculate the deduction for his/her family circumstances at one place.

[24] For dependents: A deduction for dependents according to the provisions of the tax period.

[25] For charity, humanitarian, study promotion: According to the actual number of charitable, humanitarian and study promotion contributions in the tax period.

[26] Deducted premiums: Social insurance, health insurance, unemployment insurance, professional liability insurance for some professions that must participate in compulsory insurance according to regulations in the tax period.

[27] Deductible voluntary retirement fund contribution: is the total amount of contributions to the voluntary retirement fund according to the actual arising, up to a maximum of one (01) million dong/month in the tax period.

[28] Total taxable income: Target [28] = [20]-[21]-[22]

[29] Total personal income tax incurred in the period: Target [29] = [28] x Tax rate according to the partially progressive tax schedule.

II. Non-resident individuals earning income from salaries and wages:

[30] Total taxable income: is the total income from wages, salaries and other taxable incomes of the nature of wages and salaries received by non-residents in the period.

[31] Tax rate: 20%

[32] Total personal income tax payable: Target [32] = [30] x Tax rate 20%

What is the deadline for submission of a PIT statement declaration in 2023?

Pursuant to the provisions of Points a and b, Clause 2, Article 44 of the 2019 Law on Tax Administration in Vietnam, the deadline for declaration and submission of PIT statement documents 2023 is as follows:

- For income-paying organizations: The deadline for submitting tax statement declarations is the last day of the third month from the end of the calendar year.

- For individuals who directly finalize tax: The deadline for submitting tax statement dossiers is the last day of the fourth month from the end of the calendar year. In case an individual has a PIT refund but is late in submitting a tax statement declaration as prescribed, no penalty will be applied for administrative violations in declaring tax statement overtime.

- In case the deadline for submitting tax statement dossiers coincides with a prescribed holiday, the time limit for submitting tax statement dossiers is the next working day of that holiday according to the provisions of the Civil Code.

Thus, the deadline for submitting PIT statement documents for the tax period 2022 for organizations paying income is March 31, 2023, for individuals directly making final settlement with tax authorities is May 4. 2023.

LawNet