Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to Form No. 05/QTT-TNCN?

- What is the latest form of the personal income tax finalization declaration in Vietnam?

- Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to Form No. 05/QTT-TNCN?

- What is included in the dossiers of PIT finalization declaration for organizations and individuals paying salaries and wages?

What is the latest form of the personal income tax finalization declaration in Vietnam?

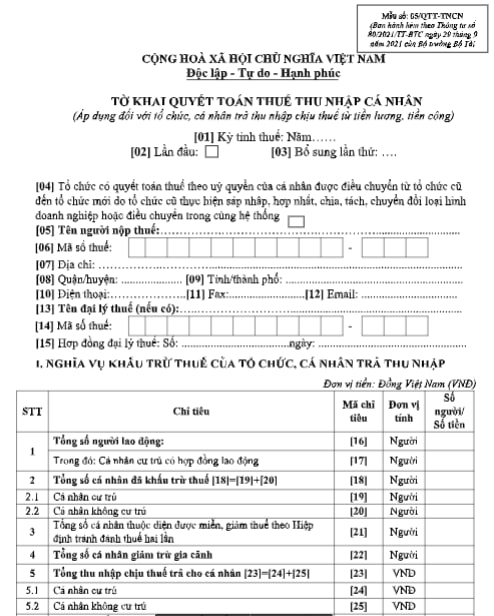

The form of personal income tax finalization declaration in Vietnam according to form No. 05/QTT-TNCN in Appendix II issued with Circular No. 80/2021/TT-BTC is as follows:

Download the form of personal income tax finalization declaration in Vietnam: Click here.

Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to Form No. 05/QTT-TNCN?

Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to Form No. 05/QTT-TNCN?

According to the website of the General Department of Taxation, instructions on how to fill out the PIT finalization declaration form No. 05/QTT-TNCN are as follows:

General part:

[01] Tax period: Enter the year of the tax declaration period. Organizations and individuals that pay incomes for PIT finalization according to the calendar year.

[02] First time: If the first time tax finalization declaration, mark “x” in the box.

[03] The second addition: If the declaration is made after the first time, it will be determined as an additional declaration and fill in the blank number of additional declarations. The number of additional declarations is recorded by digits in the sequence of natural numbers (1, 2, 3….).

[04] Organizations that have tax finalization authorized by individuals are transferred from the old organization to the new organization because the old organization has merged, consolidated, divided, separated, transformed the type of enterprise or transfer in the same system: If yes, then mark “x” in the box.

[05] Taxpayer's name: Clearly and fully write the name of the organization or individual paying income according to the establishment decision or the business registration certificate or the tax registration certificate or the investment certificate.

[06] Tax identification number: Clearly and fully write the tax identification number of the organization or individual paying income according to the Certificate of Tax Registration or the Notice of Tax Identification Number.

[07] Address: Clearly and fully write the address of the head office of the organization, the business location of the individual paying income according to the establishment decision or the business registration certificate or the tax registration certificate or Investment Certificate.

[08] District: Enter the district in the province/city of the organization, the business location of the individual paying income according to the establishment decision or the business registration certificate or the tax registration certificate or Investment Certificate.

[09] Province/city: Enter the province/city of the organization, business location of the individual paying income according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate or Investment Certificate.

[10] Phone: Clearly and fully write the phone number of the organization or individual paying income.

[11] Fax: Clearly and fully write the fax of the organization or individual paying income.

[12] Email: Clearly and fully write the digital email address of the organization or individual paying income.

[13] Tax agent's name (if any): In case an organization or individual that pays income authorizes a tax agent to declare tax finalization, it must clearly and fully write the name of the tax agent according to the establishment decision or Business Registration Certificate or Tax Registration Certificate.

[14] Tax identification number: Clearly and fully write the tax identification number of the tax agent according to the establishment decision or the business registration certificate or the tax registration certificate.

[15] Tax agent contract: Specify clearly, in full, the number and date of the tax agent contract between the organization or individual paying income and the tax agent (the contract is in progress).

Section of declaration of the targets of the table:

[16] Total number of employees: Is the total number of individuals receiving income from wages and salaries at organizations or individuals paying income in the period.

[17] Resident individuals with labor contracts: Means the total number of residents who receive income from wages and salaries under labor contracts for 3 months or more at an organization or individual paying income in a period. The target [17] is equal to the number of individuals declared in the Appendix form No. 05-1/BK-QTT-TNCN.

[18] Total number of individuals withheld tax: Target [18] = [19] + [20].

[19] Resident individuals: is the total number of resident individuals that organizations and individuals pay tax withheld income in the period. The target [19] is equal to the total number of individuals who have declared withholding (the target [22]>0) in the Appendix form No. 05-1/BK-QTT-TNCN and the total number of resident individuals declared deduction (the target [10] is left blank and the target [15] > 0) in the Appendix form No. 05-2/BK-QTT-TNCN.

[20] Non-resident individuals: Is the total number of non-resident individuals whose income has been deducted tax in the period. The target [20] is equal to the total number of non-resident individuals who have declared the deduction (the target [10] marked with an “x” and the target [15] > 0) in the Appendix form No. 05-2/BK -QTT-TNCN.

[21] Total number of individuals eligible for tax exemption or reduction under the Double Taxation Agreement: is the total number of individuals whose taxable income is entitled to PIT exemption or reduction under the Double Taxation Avoidance Agreement. Target [21] is equal to the total number of individuals who have declared with the target [14] > 0 in the Appendix form No. 05-1/BK-QTT-TNCN and the total number of individuals who have declared with the target [13] ] > 0 in Appendix form No. 05-2/BK-QTT-TNCN.

[22] Total number of individuals deducting family circumstances: Is the total number of dependents calculated for family circumstance deduction for individuals who have registered for family circumstance reduction according to regulations. Target [22] is equal to the total number of dependents on the target [16] Appendix form No. 05-1/BK-QTT-TNCN.

[23] Total taxable income (personal income) paid to individuals: Target [23] = [24] + [25].

[24] Resident: Target [24] is equal to the total of personal income at target [12] minus (-) the total taxable income at the organization before the transfer declared at target [13] on the Appendix form 05- 1/BK-QTT-TNCN and total of personal income declared in target [11] corresponding to target [10], which is left blank in Appendix form No. 05-2/BK-QTT-TNCN.

[25] Non-resident individuals: Target [25] is equal to the total of personal income at target [11] corresponding to target [10] marked with an “x” on the Appendix form No. 05-2/BK-QTT-TNCN.

[26] Total taxable income from premiums for life insurance and other optional insurance of an insurance enterprise not established in Vietnam for employees: is an amount of money that an organization or individual pays income to buy life insurance and other optional insurance with accumulated premiums of insurance enterprises not established in Vietnam for employees.

The target [26] is equal to the total income of the target in the target [12] on the Appendix form No. 05-2/BK-QTT-TNCN.

[27] Of which, total taxable income exempted under the provisions of the petroleum contract: is the total taxable income exempted under the provisions of the petroleum contract (if any). Target [27] is equal to the total profit of target at target [14] on the Appendix form No. 05-1/BK-QTT-TNCN and the total profit of target at target [14] on the Appendix form No. 05-2/BK-QTT- TNCN.

[28] Total CIT paid to individuals subject to tax deduction: Target [28] = [29] + [30].

[29] Resident: The target [29] is equal to the total of personal income at target [12] corresponding to the target [22] > 0 in the Appendix form No. 05-1/BK-QTT-TNCN and the total taxable income at The target [11] corresponding to the target [10] is left blank and the target [15] > 0 in the Appendix form No. 05-2/BK-QTT-TNCN.

[30] Non-resident individuals: Target [30] is equal to total of personal income at expenditure [11] corresponding to target [10] marked with an “x” and with target [15] > 0 on the Appendix No. 05-2/BK-QTT-TNCN > 0.

[31] Total personal income tax (PIT) deducted: Target [31] = [32] + [33].

[32] Resident individual: Is the PIT amount that the organization or individual pays the withheld income of the resident in the period. Target [32] is equal to the total profit of the target [22] minus the total profit of the target [23] on the Appendix form No. 05-1/BK-QTT-TNCN and the total profit of the target at target [15] > 0 corresponding to target [10] is left blank in the Appendix form No. 05-2/BK-QTT-TNCN.

[33] Non-resident individuals: Target [33] is equal to the total of personal income at target [15] corresponding to target [10], marked with an “x” on the Appendix form No. 05-2/BK-QTT-TNCN.

[34] Total PIT withheld on premiums for buying life insurance and other optional insurance of insurance enterprises not established in Vietnam for employees: Target [34] is equal to total of personal income at target [16] on Appendix form No. 05-2/BK-QTT-TNCN or equal to [26] on declaration 05/QTT-TNCN multiplied by (x) 10%

[35] Total number of individuals authorizing organizations and individuals to pay settlement income instead: Target [35] is equal to the total number of individuals in Target [10], mark “x” on Appendix form No. 05- 1/BK-QTT-TNCN.

[36] Total PIT withheld: Target [36] is equal to the total tax in Target [22] corresponding to Target [10] marked with an “x” on the Appendix form No. 05-1/BK- QTT-TNCN.

[37] In which: Personal income tax withheld at the organization before the transfer: equals the total tax in target [23] corresponding to target [10] marked with an “x” on the sample Appendix No. 05-1/BK-QTT-TNCN

[38] Total payable personal income tax: equal to the total tax in target [24] corresponding to target [10] marked with an “x” in the Appendix form No. 05-1/BK-QTT-TNCN

[39] The total amount of personal income tax exempted by an individual whose remaining tax payable after authorization for finalization is VND 50,000 or less: equal to the total tax in the target [26] corresponding to the target [27] mark “x” on Appendix form No. 05-1/BK-QTT-TNCN.

[40] Total PIT payable to the State Budget: is the total amount of remaining tax payable by individuals who authorize organizations or individuals to pay the final settlement income on their behalf. Target [40] = ([38] - [36]-[39]) >= 0

[41] Total overpaid PIT: is the total overpaid tax of individuals who authorize organizations or individuals to pay income for tax finalization on behalf of them. Target [41]= ([38] - [36]-[39]) < 0.

What is included in the dossiers of PIT finalization declaration for organizations and individuals paying salaries and wages?

Pursuant to Clause b, subsection 9.9, Section 9 of Appendix I promulgated together with Decree No. 126/2020/ND-CP, the PIT finalization declaration for organizations and individuals paying salaries and wages includes:

- Declaration of PIT calculation according to form 05/QTT-TNCN.

- Appendix of a detailed list of individuals subject to tax calculation according to the partial progressive schedule according to form No. 05-1/BK-QTT-TNCN.

- Appendix of a detailed list of individuals subject to tax at the full tax rate according to form No. 05-2/BK-QTT-TNCN.

- Appendix of detailed list of dependents for family deduction according to Form No. 05-3/BK-QTT-TNCN.

LawNet