Vietnam: Instructions on how to fill out the personal income tax finalization declaration according to the latest form No. 02/QTT-TNCN?

- In which case does a resident salary earner directly submit the personal income tax finalization dossier to the tax authority in Vietnam?

- Which form is used in case a resident salary earner directly submits the personal income tax finalization dossier to the tax authority in Vietnam?

- Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to the latest form No. 02/QTT-TNCN?

In which case does a resident salary earner directly submit the personal income tax finalization dossier to the tax authority in Vietnam?

Pursuant to Point d3 Clause 6 Article 8 of Decree No. 126/2020/ND-CP, a resident salary earner shall directly submit the personal income tax finalization dossier to the tax authority in Vietnam in the following cases:

- Tax is underpaid or overpaid and the individual claims a refund or has it carried forward to the next period, unless: the tax arrears is not exceeding 50.000 VND;

- The amount of tax payable is smaller than the amount provisionally paid but the individual does not claim a refund or does not have it carried forward to the next period; the individual has an employment contract with a duration of at least 03 months and earns an average monthly irregular income not exceeding 10 million VND which on which personal income tax has been deducted at 10% and does not wish to have this income included in the tax finalization dossier;

- The individual’s life insurance (except voluntary retirement insurance) or any other voluntary insurance with insurance premium accumulation is purchased by the individual’s employee and 10% personal income tax on the part purchased or contributed by the taxpayer.

- The individual has been present in Vietnam for fewer than 183 days in the first calendar year but more than 183 days in 12 consecutive months from the arrival date.

- An individual that is a foreigner whose employment contract in Vietnam has ended shall submit a tax finalization dossier to the tax authority before exit or authorize the income payer or another organization or individual to prepare and submit the tax finalization dossier as per regulations.

- The income payer or the authorized organization/individual must pay tax arrears if tax is underpaid or will receive a refund in case tax is overpaid.

Resident salary earners who are eligible for tax reduction due to a natural disaster, fire, accident or serious illness shall finalize tax themselves instead of authorizing income payers to perform this task.

Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to the latest form No. 02/QTT-TNCN?

Which form is used in case a resident salary earner directly submits the personal income tax finalization dossier to the tax authority in Vietnam?

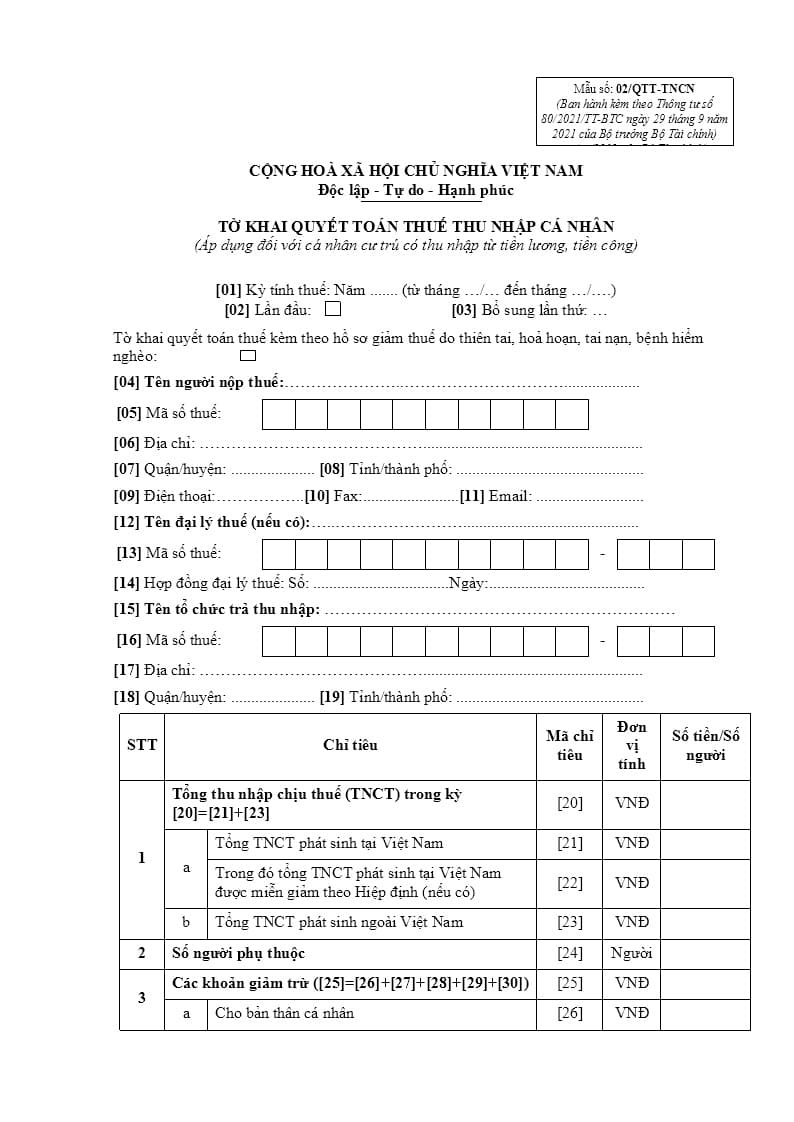

A resident salary earner directly submit the personal income tax finalization dossier to the tax authority in Vietnam according to Form No. 02/QTT-TNCN in Section VII, Appendix II issued together with Circular No. 80/2021/TT-BTC as follows:

Download Form No. 02/QTT-TNCN: Click here.

Instructions on how to fill out the personal income tax finalization declaration in Vietnam according to the latest form No. 02/QTT-TNCN?

According to the website of the General Department of Taxation, the instructions for making a declaration Form No. 02/QTT-TNCN are as follows:

General information section:

[01] Tax period: Enter the year of the tax declaration period. In case the individual does not finalize the tax for the whole calendar year (for example, foreign individuals finalize tax before December 31, individuals finalize the first tax year according to 12 consecutive months from the first day of presence in Vietnam) then write from … (month) to … (month) of the tax finalization declaration period.

[02] First time: If you are filing for the first time, put an “x” in the box.

[03] The second addition: If the declaration is made after the first time, it will be determined as an additional declaration and fill in the blank number of additional declarations. The number of additional declarations is recorded by digits in the sequence of natural numbers (1, 2, 3….).

Tax finalization declarations enclosed with tax reduction dossiers due to natural disasters, fires, accidents or fatal diseases:

If an individual has a request for exemption or reduction due to an accident, fire, accident or fatal disease, together with the personal income tax finalization file from salary and wages, check the box.

[04] Taxpayer's name: Clearly and fully write the individual's name according to the tax identification number registration sheet or identity card/citizen identity card/passport.

[05] Tax identification number: Clearly and fully write the individual's tax identification number according to the tax registration certificate for individuals or the notice of personal tax identification number issued by the tax authority or the tax identification number card issued by the tax authority.

[06] Address: Clearly and fully write the address of the house, commune, ward where the individual resides.

[07] District: Enter the district in the province/city where the individual resides.

[08] Province/City: Enter the province/city where the individual resides.

[09] Phone: Write clearly and fully about the individual's phone.

[10] Fax: Write clearly and fully the individual's fax number.

[11] Email: Write clearly and fully the individual's email address.

[12] Name of tax agent (if any): In case an individual authorizes a tax agent to declare tax, the name of the tax agent must be clearly written in accordance with the establishment decision or the business registration certificate or the tax registration certificate.

[13] Tax identification number: Fill in the tax agent's tax identification number (if there is a declaration of target [12]).

[14] Tax agency contract: Specify clearly, in full, the number and date of the tax agent contract between the individual and the tax agent (the contract is in progress) (if any target is declared [12]).

[15] Name of income-paying organization: In case, according to current regulations, the place where the finalization file is submitted is the tax agency managing the income-paying organization, clearly and fully write the name of the income-paying organization (according to Decision No. establishment certificate or business registration certificate or tax registration certificate). If according to current regulations, the place of submission of finalization dossier is the place of residence, the individual shall not fill in this target.

[16] Tax identification number: Clearly and fully write the tax identification number of the income paying organization where the individual receives taxable income (if there is a declaration of target [15]).

[17] Address: Clearly and fully write the address of the income paying organization where the individual receives the taxable income (if the target is declared [15]).

[18] District: Clearly and completely write the name of the district/district of the income paying organization where the individual receives taxable income (if there is a declaration of the target [15]).

[19] Province/city: Clearly and fully write the name of the province/city of the income paying organization where the individual receives taxable income (if there is a declaration [15]).

Section of declaration of the targets of the table:

[20] Total taxable income (PIT) arising in the period: Target [20]=[21]+[23]

[21] Total taxable income arising in Vietnam: Is the sum of taxable incomes from salaries, wages and other taxable incomes of the nature of wages and salaries arising in Vietnam, including taxable income exempted under the Agreement for the avoidance of double taxation (if any).

[22] In which the total taxable income in Vietnam is exempted or reduced under the Agreement: Is the sum of taxable incomes from wages, salaries and other taxable incomes of the nature of wages and salaries received by an individual who is exempt from tax under the Agreement on avoidance of double taxation (if any).

[23] Total taxable income arising outside Vietnam: is the sum of taxable incomes from salaries, wages and other taxable incomes of the nature of wages and salaries arising outside Vietnam.

[24] Number of dependents: Is the number of registered dependents of an individual whose family circumstances are deducted during the tax year.

[25] Deductions: Target [25] = [26] + [27] + [28] + [29] + [30]

[26] For the individual himself: A deduction for himself according to the provisions of the tax period.

[27] For dependents to be deducted: A deduction for dependents according to the provisions of the tax period.

[28] Charity, humanitarian, study promotion: are charitable, humanitarian and study promotion contributions of the tax period.

[29] Deducted premiums: Social insurance, health insurance, unemployment insurance, professional liability insurance for a number of professions that must participate in compulsory insurance of the tax period.

[30] Deductible voluntary retirement fund contribution: The total amount of contributions to the voluntary retirement fund according to the actual arising, not exceeding twelve (12) million VND/year of the tax period.

[31] Total taxable income: Target [31] = [20] - [22] - [25]

[32] Total personal income tax (PIT) incurred in the period: [32] = [31] x Tax rate according to the partially progressive tax rate.

[33] Total tax paid in the period: [33] = [34] + [35] + [36] - [37] - [38]

[34] The tax withheld at the income paying organization: Is the total tax amount that the organization or individual paying income has withheld from the individual's salary or wages, based on the tax withholding voucher issued by the organization or individual paying the income.

[35] Tax paid in the year not through an income paying organization: Is the individual tax amount directly declared to the tax authority and paid in Vietnam, based on the individual's payment slip into the state budget.

[36] Deductible tax paid abroad (if any): Is the amount of tax paid abroad determined up to the amount of tax payable corresponding to the ratio of income received from abroad to total income but not exceeding the tax amount of [32] x {[23]/([20] –[22])}x 100%.

[37] The tax amount deducted and paid abroad coincides with the annual finalization: The tax amount paid abroad coincides with the annual finalization. The tax amount paid abroad coincides with the annual finalization, which is determined by the individual himself if he/she has declared and paid overseas in the first tax year. In case it is not determined that the tax amount paid abroad coincides with the annual finalization, it is not required to declare in this entry.

[38] The tax amount paid in the year is not through the organization paying the duplicate income due to the annual finalization: Individuals determine by themselves the amount of tax paid in the year without going through the same income paying organization due to the year-over-year finalization if they have declared it in the first tax year. In case an individual determines that there is no tax paid in the year that has not been paid by an income-paying organization due to the year-over-year finalization, this indicator is not required.

[39] Total PIT reduction in the period: [39]=[40]+[41]

[40] The same amount of tax payable due to the annual finalization: Individuals determine the same tax amount due to the annual finalization at the organization to deduct from this target.

[41] Other reduced total PIT amount: Individuals who declare tax reductions as prescribed by law, excluding cases of reduction due to natural disasters, fires, accidents, fatal diseases affecting their ability to pay tax.

[42] Total tax payable in the period [42]=([32]-[33]-[39])>0: [42]=[32]-[33]-[39] in case [ 42]=([32]-[33]-[39])>0

[43] Tax exempted by individuals whose tax payable after finalization is 50,000 VND or less: Individuals only write the exempted tax amount after finalization using the target [42] in case 0<[42] <=50,000 VND.

[44] Total overpaid tax in the period: [44]=([32]-[33]-[39])<0, individuals with overpaid tax amounts shall be recorded in this entry as positive numbers.

[45] Total tax to be refunded: [45]=[46]+[47]

[46] Tax refunded to taxpayers: Individuals with overpaid tax amounts and requesting refunds shall record this in this entry.

[47] Offsetting tax for other payables to the state budget: Individuals with overpaid tax amounts and requesting offsets for other payables to the State budget (including budget debts, payables of other taxes such as value added, license, special consumption..) shall be recorded in this target (not exceeding the target [45]).

[48] Total offset tax for the following period: Target [48]=[44]-[45]

LawNet