Guidelines on How to Fill Out the Additional Personal Income Tax Finalization Form for 2023? What Does the Additional Personal Income Tax Finalization Dossier for 2023 Include?

Supplementary Dossier for Personal Income Tax Finalization Declaration 2023?

According to the guidance in Article 47 of the Law on Tax Administration 2019, the supplementary dossier for personal income tax declaration includes:

- Supplementary declaration form;

- Explanatory document for the supplementary declaration and relevant materials.

Instructions on how to fill out the supplementary personal income tax finalization declaration 2023? What does the supplementary dossier for personal income tax finalization 2023 include?

How to fill out the supplementary personal income tax finalization declaration 2023?

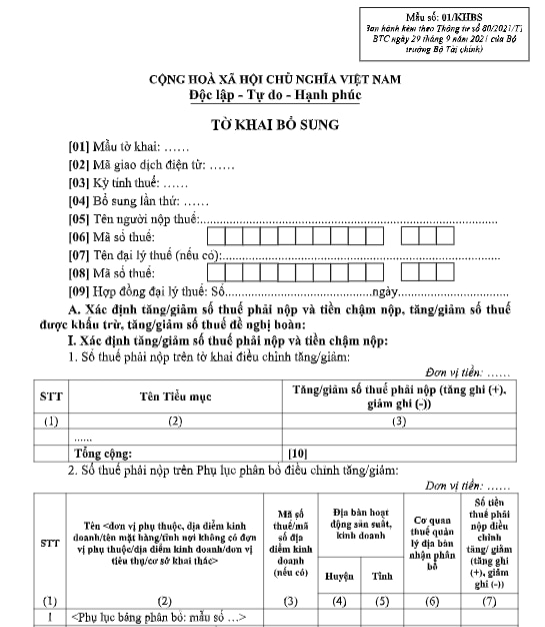

Taxpayers shall supplement their 2023 personal income tax finalization according to Form 01/KHBS issued along with Circular 80/2021/TT-BTC.

Download Form 01/KHBS here.

Taxpayers, when making the supplementary 2023 personal income tax finalization declaration, should follow these instructions:

[1] Fill in the form code of the supplementary declaration form.

[2] Fill in the electronic transaction code of the initial declaration that needs correction or supplementation.

[3] Fill in the tax period of the initial tax declaration that needs correction or supplementation.

[4] Fill in the sequence number of the supplementary declaration compared to the initial declaration accepted by the tax authority.

[5] Fill in the taxpayer's tax identification number.

[6] Fill in the tax agent's tax identification number (if any).

[7] Determine the payable tax amount, late payment interest (if any), deductible tax amount, or the tax refund amount to be adjusted (increase/decrease) based on the supplementary declaration compared to the immediately preceding period's declaration that has been submitted and accepted by the tax authority. For example:

- Supplementary declaration 1: The difference between supplementary declaration 1 and the initial declaration of the tax period;

- Supplementary declaration 2: The difference between supplementary declaration 2 and supplementary declaration 1 of the tax period.

In Section A, the taxpayer must ensure:

- The total payable tax adjustment (increase/decrease) in Items [10] and [11] of Section A of this declaration equals the total payable tax adjustment (increase/decrease) in Item [07] of Section A of the explanatory document (Form 01-1/KHBS). Specifically: Items [10] + [11] of this declaration = Item [07] of Form 01-1/KHBS.

- The deductible tax adjustment (increase/decrease) in Item [12] of this declaration equals Item [08] of Form 01-1/KHBS.

- The refundable tax adjustment (increase/decrease) in Item [13] of this declaration equals Item [09] of Form 01-1/KHBS.

[8] The information in brackets <...> within this table is merely illustrative, so taxpayers need to fill in information according to their supplementary declaration cases.

[9] Taxpayers must declare when they self-identify the reimbursed tax amount that does not conform to be repaid to the state budget.

[10] Fill in the recovered amount difference between the supplementary declaration and the immediately preceding period’s declaration, such as:

- Supplementary declaration 1: The difference between supplementary declaration 1 and the initial declaration of the tax period.

- Supplementary declaration 2: The difference between supplementary declaration 2 and supplementary declaration 1 of the tax period.

[11] Fill in the information of the tax refund decision based on the refunded amount. If there are multiple decisions, enter multiple rows corresponding to each reclaimed amount.

[12] Fill in the information of the tax refund order based on the refunded amount. If there are multiple refund orders, enter multiple rows corresponding to each reclaimed amount.

Is there any late payment fee for supplementary personal income tax finalization declaration 2023?

According to the provisions of Article 59 of the Law on Tax Administration 2019, taxpayers submitting supplementary declarations for personal income tax finalization must pay late payment fees in the following cases:

- Taxpayers submitting supplementary tax declarations that increase the payable tax amount or if the tax authority, competent state authority discovers under-reporting of the payable tax amount, they must pay late payment fees for the additional payable tax from the day following the due date of the tax period of the initial erroneous declaration or from the due date of the original customs declaration.

- Taxpayers submitting supplementary tax declarations that decrease the refunded tax amount or if the tax authority, competent state authority discovers that the refunded tax amount is less than the actual refunded amount, they must pay late payment fees on the reclaimed refunded tax from the date they received the tax refund from the state budget.

Furthermore, taxpayers submitting supplementary tax declarations that reduce the payable tax amount or if the tax authority, competent state authority discovers a reduction in the payable tax amount, they are allowed to adjust the calculated late payment fees corresponding to the reduced amount.

LawNet