How to Fill Out Form 04-1/CNV-TNCN for Declaring the Detailed List of Individuals Transferring Capital Attached with Declaration 04/CNV-TNCN?

When should Form 04-1/CNV-TNCN, listing details of individuals transferring capital, be used?

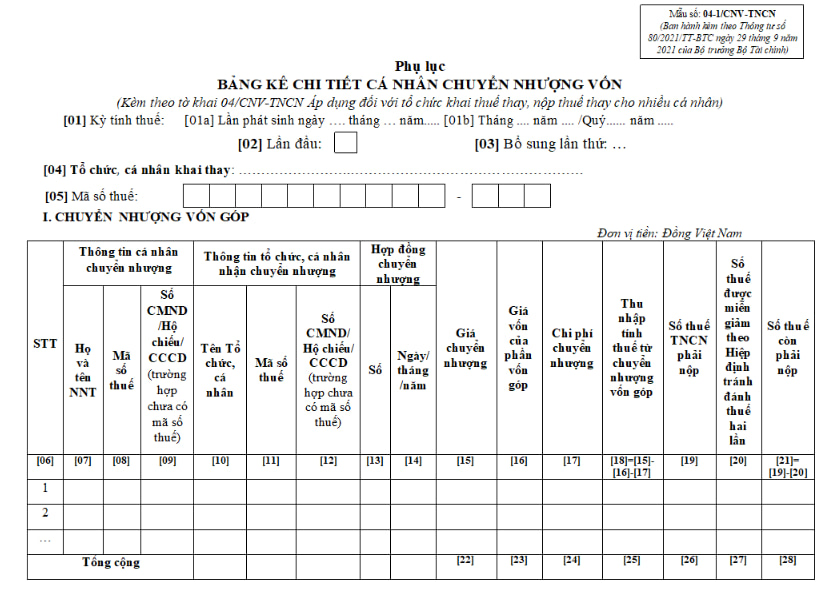

According to guidance from Circular 80/2021/TT-BTC, in cases where an organization files and pays taxes on behalf of multiple individuals who have income from capital transfers, they must declare the detailed list of individuals transferring capital using Form 04-1/CNV-TNCN attached to the declaration 04/CNV-TNCN.

Form 04-1/CNV-TNCN, issued alongside declaration 04/CNV-TNCN, is regulated in Section VII of Appendix II issued with Circular 80/2021/TT-BTC as follows:

Download Form 04-1/CNV-TNCN here: download

How to fill in Form 04-1/CNV-TNCN, listing details of individuals transferring capital attached to declaration 04/CNV-TNCN?

How to fill in Form 04-1/CNV-TNCN, listing details of individuals transferring capital attached to declaration 04/CNV-TNCN?

According to the Electronic Information Portal of the General Department of Taxation, the instructions for filling out the annex 04-1/CNV-TNCN are as follows:

General Information Section:

[01] Tax Calculation Period:

[01a] In case of filing tax for each occurrence, note the day, month, year of the tax declaration occurrence.

[01b] In case of monthly/quarterly – yearly tax declaration, note the month/quarter – year of the tax period.

[02] First Time: If filing for the first time, mark “x” in the square box.

[03] Supplemental Time: If filing after the first time, it is considered a supplemental declaration and note the number of the supplemental filing in the blank space. The number of supplemental filings should be recorded as natural numbers (1, 2, 3, ....).

[04] Name of the organization or individual filing on behalf: Fully and clearly state the name of the organization filing on behalf (according to the Establishment Decision or Business Registration Certificate or Taxpayer Registration) in case the organization where the individual is transferring capital, transferring securities files and pays tax on behalf of the individual. Or fully state the full name of the individual filing and paying tax on behalf according to the Taxpayer Registration or Identity Card/CCCD/Passport.

[05] Tax Identification Number: Fully and clearly state the tax identification number of the organization/individual filing and paying tax on behalf.

Declaration of table indicators:

(I) CAPITAL CONTRIBUTION TRANSFER

[06] Serial Number: Fully and sequentially record the serial numbers from small to large of each individual transferring capital contribution.

[07] Name: Fully and clearly record the full name according to the taxpayer registration form or Identity Card/CCCD/Passport of each individual transferring capital contribution.

[08] Tax Identification Number: Fully and clearly record the tax identification number of each individual transferring capital contribution according to the Taxpayer Registration Certificate or Tax Identification Notification or Taxpayer Identification Card issued by the tax authority.

[09] Identity Card/CCCD/Passport Number: Fully and clearly record the Identity Card/CCCD/Passport number of the individual transferring capital contribution without a tax identification number.

[10] Name of the organization or individual: Fully and clearly record the full name according to the taxpayer registration form or Identity Card/CCCD/Passport of the individual receiving the capital contribution transfer. Or fully state the name of the Organization receiving the capital contribution transfer according to the Establishment Decision or Business Registration Certificate.

[11] Tax Identification Number: Fully and clearly record the tax identification number of the organization or individual receiving the capital contribution transfer according to the Taxpayer Registration Certificate or Tax Identification Notification or Taxpayer Identification Card issued by the tax authority.

[12] Identity Card/CCCD/Passport Number: Fully and clearly record the Identity Card/CCCD/Passport number of the individual receiving the capital transfer without a tax identification number.

[13], [14] Capital Transfer Contract number:....date....month.....year...: Record the number and signing date of the capital transfer contract.

[15] Transfer Price: the transfer price of the capital according to the capital transfer contract.

[16] Capital Value of the transferred capital contribution: the value of the capital contribution at the time of transferring the capital, including: the value of the capital contribution to establish the enterprise, the value of additional contributions, the value of capital acquired, the value of capital from dividends recorded to increase the capital.

[17] Transfer Costs: reasonable actual costs incurred related to generating income from capital transfers, with legitimate invoices, and documents as prescribed.

[18] Taxable Income from Capital Transfer: indicator [18] = [15] - [16] - [17].

[19] Tax Payable: indicator [19] = [18] x 20%.

[20] Tax Exemption or Reduction according to the Double Taxation Avoidance Agreement: In case the individual is entitled to tax exemption or reduction under the Double Taxation Avoidance Agreement, accurately record the tax amount being exempted or reduced.

[21] Tax Payable: indicator [21] =[19]-[20].

[22], [23], [24], [25], [26], [27], [28]: record the total values corresponding to the columns of indicators [15], [16], [17], [18], [19], [20], [21] for all individuals being declared on behalf.

(II) SECURITIES TRANSFER

[29] Serial Number: Fully and sequentially record the serial numbers from small to large of each individual transferring securities.

[30] Name: Fully and clearly record the full name according to the taxpayer registration form or Identity Card/CCCD/Passport of each individual transferring securities.

[31] Tax Identification Number: Fully and clearly record the tax identification number of each individual transferring securities according to the Taxpayer Registration Certificate or Tax Identification Notification or Tax Identification Card issued by the tax authority.

[32] Identity Card/CCCD/Passport Number: Fully and clearly record the Identity Card/CCCD/Passport number of the individual transferring securities without a tax identification number.

[33] Name of the organization or individual: Fully and clearly record the full name according to the taxpayer registration form or Identity Card/CCCD/Passport of the individual receiving the securities transfer. Or fully state the name of the Organization receiving the securities transfer according to the Establishment Decision or Business Registration Certificate.

[34] Tax Identification Number: Fully and clearly record the tax identification number of the organization or individual receiving the securities transfer according to the Taxpayer Registration Certificate or Tax Identification Notification or Taxpayer Identification Card issued by the tax authority.

[35] Identity Card/CCCD/Passport Number: Fully and clearly record the Identity Card/CCCD/Passport number of the individual receiving the transfer without a tax identification number.

[36], [37] Securities Transfer Contract number:...., date....month.....year...: Record the number and the signing date of the securities transfer contract.

[39] Transfer Price: the transfer price of the securities according to the transfer contract.

[40] Tax Payable: indicator [40] = [39] x 0.1%.

[41] Tax Exempt or Reduced according to the Double Taxation Avoidance Agreement: In cases where an individual is entitled to tax exemption or reduction according to the Double Taxation Avoidance Agreement, accurately record the tax amount being exempted or reduced.

[42] Tax Payable: indicator [42] =[40]-[41].

[43], [44], [45], [46]: record the total values corresponding to the columns of indicators [39], [40], [41], [42] for all individuals being declared on behalf.

What tax declaration documents are required for individuals with income from capital transfers directly declaring tax to the tax authorities?

According to Section 9.4 of Appendix I issued with Decree 126/2020/ND-CP, the tax declaration documents required for individuals with income from capital transfers directly declaring tax to the tax authorities include:

- Individual income tax declaration (applicable to individuals with income from capital contributions transfer, individuals transferring securities declaring directly with the tax authorities, and organizations or individuals declaring and paying tax on behalf of individuals) Form 04/CNV-TNCN (issued with Appendix II Circular 80/2021/TT-BTC).

- A copy of the capital transfer contract.

- Copies of documents determining the value of the capital contribution according to accounting records; if the capital contribution was acquired, there must be a transfer contract for the acquisition.

- Copies of invoices and supporting documents proving the costs related to determining income from capital transfer activities as prescribed in Appendix I Decree 126/2020/ND-CP.

LawNet