How much is the environmental protection tax rate for gasoline, oil, and grease? Who has the authority to decide on environmental protection tax for gasoline in Vietnam?

- What is the environmental protection tax in Vietnam?

- Vietnam: How much is the rate of environmental protection tax for gasoline, oil, grease in 2023?

- Vietnam: Shall the environmental protection tax on gasoline increase to the highest level in 2024?

- Who has the authority to decide on environmental protection tax for gasoline in Vietnam?

What is the environmental protection tax in Vietnam?

According to the provisions of Clause 1, Article 2 of the Law on Environmental Protection Tax 2010, the environmental protection tax is as follows:

Environmental protection tax means indirect-collected tax, collected on products and goods (hereafter referred to as goods) when used to cause negative environmental impacts.

How much is the environmental protection tax rate for gasoline, oil, and grease? Who has the authority to decide on environmental protection tax for gasoline in Vietnam?

Vietnam: How much is the rate of environmental protection tax for gasoline, oil, grease in 2023?

Recently, the National Assembly Standing Committee issued Resolution 30/2022/UBTVQH15 on environmental protection tax rates for gasoline, oil and grease in 2023.

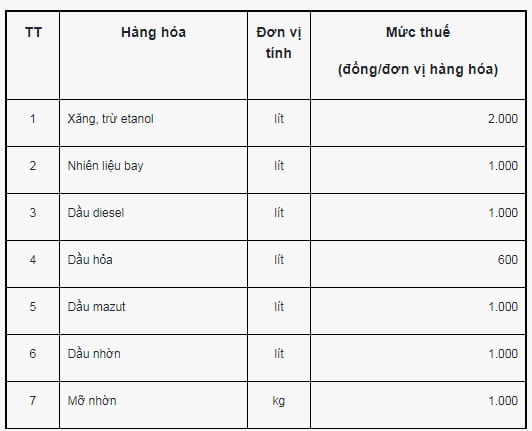

Accordingly, Resolution 30/2022/UBTVQH15 on environmental protection tax rates for gasoline, oil and grease applied in 2023 stipulates the environmental protection tax rates for gasoline, oil and grease as follows:

- Environmental protection tax rates for gasoline, oil and grease from January 1, 2023 to the end of December 31, 2023 specifically:

Vietnam: Shall the environmental protection tax on gasoline increase to the highest level in 2024?

Currently, Clause 1, Article 8 of the Law on Environmental Protection Tax 2010 stipulates the environmental protection tax bracket. In which, the environmental protection tax bracket for petroleum is prescribed as follows:

At the same time, based on the content that the National Assembly Standing Committee approved at the meeting on December 30, 2022 on environmental protection tax on gasoline in 2023.

The time limit for applying the new environmental protection tax is from January 1, 2023 to the end of December 31, 2023.

After that, from the beginning of 2024, the environmental protection tax will return to the prescribed tax rate, ie gasoline 4,000 VND/liter; flight fuel 3,000 VND; diesel, fuel oil, lubricant 2,000 VND/liter; kerosene 1,000 VND; grease 2,000 VND/kg.

However, the National Assembly Standing Committee also considers the increase or decrease of environmental protection tax based on the socio-economic development situation. Therefore, it is expected that the environmental protection tax rate applied in 2024 may also be changed next year.

Who has the authority to decide on environmental protection tax for gasoline in Vietnam?

Pursuant to Clause 2, Article 8 of the Law on Environmental Protection Tax 2010 stipulates:

Tariff table

...

2. On the basis of the tax bracket prescribed in Clause 1 of this Article, the National Assembly Standing Committee provide for specific tax rate to each type of dutiable goods ensuring the following principles:

a) The tax rate on taxable goods in line with socio-economic development policy – social in each period;

b) The tax rate on taxable goods shall be determined under the extent of causing negative environmental impacts of the goods.

Accordingly, unlike other taxes, the Law on Environmental Protection Tax 2010 now stipulates the tax rate of the Environmental Protection tax based on an absolute tax bracket that includes the highest and lowest tax rates for one unit.

In the Law on Environmental Protection Tax 2010, the National Assembly did not specify the tax rates applicable to each type of good. Instead, it replaced it with a tax rate bracket to facilitate the tax collection process and adjust according to socio-economic situation when necessary.

The National Assembly Standing Committee provides for specific tax rate for each type of dutiable goods ensuring the following principles:

(i) The tax rate on taxable goods in line with socio-economic development policy – social in each period;

(ii) The tax rate on taxable goods shall be determined under the extent of causing negative environmental impacts of the goods.

The regulation on the subject to determine the environmental protection tax rate belongs to the Standing Committee of the National Assembly to ensure the flexibility and adaptability of the tax when socio-economic conditions and the changes of state's macro-regulatory policies.

LawNet